Quick musing on proforma Dollar Tree (DLTR) - Nasty divorce but free to fly now

Divorcing Family Dollar at 10c on the $ yikes

This will be a quick note. The news came out after my work so I’ve had to chuck my dinner down and spend the rest of my evening doing up the numbers. I’ve thrown in a quick trade at ~$66 and threw in some tweets right at market open.

The stock is up LSD % right now as I’m writing, so the initial dollars have more or less been snapped at the open. But you never know, in this market, there might be opportunities to jump in, especially prior to April 2 :p.

So we all know Dollar Tree (DLTR), or at least anyone who’s been in the game long enough should know. It’s like Advanced AutoParts (AAP)… the kind of “one day it’ll work” story…. “one day, we’d have our Autozone (AZO) moment or whatever”.

Background

Anyway, DLTR made a horrendous $9b acquisition of fellow retailer, Family Dollar (FD) a decade ago.

I won’t be going into detail here but turns out, integration of two retailers has been a rather difficult endeavor. Apart from FD just being able to barely eke out profits, these businesses are very different in what they offer. FD is a lot more like DG, with ~80% of sales from consumables whilst DLTR is more balanced, half consumables and half discretionary. Apparently, these two retailers are separately managed under the DLTR brand and apart from corporate synergies, shouldn’t really be operating under the same roof.

In the end, management raised the white flag and decided to put FD up for sale, the process lurking for a year or so.

There were some activist pushbacks back in the day, on how FD really should really belong more to DG, given that >70% of DG’s sales are consumables as well. So it’s really a case of FD marrying the wrong girl… or the other way round.

Where we are now

Moving on, as mentioned, just a few hours back, DLTR released their 4Q24 results and finally announced the sale of FD… but for a sum way below expectations.

FD was sold to a PE consortium consisting of Brigade Cap and Macellum, for a gross ~$1b with $800m of net proceeds. In other words, the sale was done at ~10c on the dollar. I don’t think this was in any analysts’ bingo card. FD does around 13-14b of sales so we’re talking a sale at around 0.07x EV/Rev. Absolute bonkers.

Why was this priced so poorly? Apart from the the process being quite a prolonged one, ~9-10 months (this is not a complex company), indicating a probable bid/ask spread, Brigade and Macellum have been eyeing valuable retail footprints - Macy’s and Kohls respectively, and might really’ve been the only bidders for FD. FWIW, in the bankruptcy docket (first declaration) of the now defunct dollar chain OG, 99 Cents, which had most of its footprint in California, out of 32 prospective buyers, only 4 came with an indication of interest.

The market greets this sale with a yawn, or maybe initially.

As mentioned, DLTR’s operations have been masked by the ailing FD.

When you peel back the onion, you sort of realize you have a business better than DG (crazy to say, I know) and maybe should trade at a premium to DG.

At ~$69 where it’s trading now, DLTR is being offered for ~7.3x FY25 EBITDA, and ~13x FY25 P/E. DG at ~$85 is being offered at 8.1x FY25 EBITDA and 15.4x FY25 P/E.

Lame spread I know, it was juicier when DLTR was at $65 right at the open. In any case, DLTR really should be $80 minimum, and that’s merely accounting for closing of the spread. If dollar stores return to favor again, further upside is to be made.

FWIW, DLTR traded in line with DG through Jan and Feb, before the spread diverged as DLTR traded down. One could argue that it’s due to tariff risks (DG ~3% exposure to China vs DLTR ~20%) but hasn’t that always been known?

In any case, stretching the outlook a bit, here’s why I think DLTR might deserve a premium over DG, at least based on how they’ve performed of late.

Comparisons

First off, let’s appreciate a little how well DLTR has done over the last two fiscal years. Their consumables segment has proven to be a consistent market share taker, which cannot be said of FD - clearly struggling in both sales volumes and unit volumes.

Margins

Over the last two years, DLTR has generated superior EBIT margins to DG. And it’s not like DLTR is earning peak margins. They too, like DG have seen margins erode over the recent years. Both saw a ~2% hit to EBIT margins between FY23 and FY24, but given that DLTR is a higher margin business, it took less of a hit on earnings than DG.

Stretching it out further, DLTR has shown to consistently generate superior EBIT margins as well as obtain higher EBIT peaks, ~15% in FY22, indicating a higher margin potential ceiling compared to DG.

Of course, this is a factor of the merchandise mix as consumables tend to be more stable relative to discretionary. It’s why Five Below (FIVE), which a few of us made good money on, has been generally (apart from its tiny consumables segment) struggling over the last fiscal year, given its main proposition is trendy discretionary products.

Superior same store sales growth

Whilst you would expect DLTR’s discretionary mix to affect its same store sales growth (SSSG) - huge issue at FIVE - DLTR has actually done incredibly well and relatively better than DG, despite the latter having a more favorable sales mix tilting towards consumables.

Through FY24, DLTR’s SSSG has been relatively stronger than DG, despite lapping difficult FY23 comps, which DG did not have to lap.

Really, when you observe DLTR’s comps through 2021, they’re actually quite incredible. It’s noticeable that customer traffic began picking up somewhere in FY23 and FY24, when inflation started rearing its head and the consumer started feeling the pinch.

Store productivity (Sales per square foot)

This is where DG takes the lead. DG has exhibited superior sales/sqf, taking it up from ~$230 per sqf pre COVID to around ~$260 per sqf in FY24. That’s a markedly, 13% increase.

DLTR has seen improvements as well, doing ~$200 per sqf in 2019 and hitting the mid 230s per sqf in FY24, a ~15% increase.

Notably, DG’s sales per sqf hit a peak of ~$273/sqf in FY22 and has trended down since. DLTR on the other hand appears to have “peaked” in FY23 but whether it deteriorates further from here remains to be seen.

Whilst DG has better sales productivity, on a profitability per sqf metrics, given that DLTR earns twice the operating margin of DG, DLTR generated ~$18 of EBIT/sqf compared to DG’s $10 EBIT/sqf.

Future prospects

DG grew its store base faster through the initial years out of the pandemic but DLTR has recently picked up its growth and outpaced DG. DG is forecasting a 2% unit growth for FY25 whilst DLTR is guiding to an additional 400 stores on the current 8881 store footprint. This would imply a ~4.5% unit growth in FY25, twice that of DG.

DG’s is also forecasting operating margins returning to ~6-7% but that’s only in FY28/29, and still below its pre-COVID margins, as well as still inferior to DLTR, which is likely to see margins climb back up as well, with time.

Notably, DG is guiding to a weak ~2-3% SSSG for FY25.

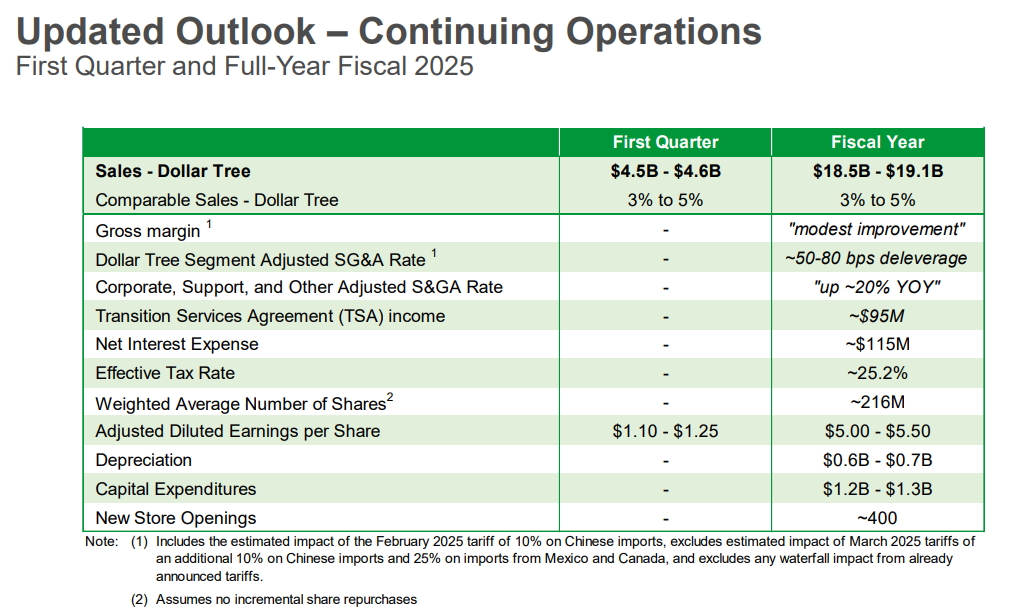

Comparing DG’s outlook to DLTR, DLTR is guiding to ~3-5% of SSSG growth, i.e. almost twice the SSSG growth of DG. They are also guiding to some modest gross margin expansion, factoring in the the current level of tariffs.

It is worth mentioning that now, DLTR will have full management focus. DLTR is currently experimenting with multi-price points, which has reported to generate sales uplift in legacy stores that have converted to the new multi-store price format. The efficacy thereof remains to be seen.

There will be some SG&A bloating in FY25 but kick-in of the TSA income from sale of FD will kick in to offset the bloat.

Past Valuations

Between 2010 and 2015, prior to the acquisition of FD, DLTR traded either in line or at a modest premium to DG. Now with DLTR back to its roots, it’s unclear to me why this shouldn’t happen again.

Other peers

Amongst its peers, DLTR has some of the best stacked comps of the gang. I used this table for my post on FIVE, it’s been money’s worth to say the least :p.

FIVE has been facing trouble of late and brought in a new CEO which previously led Forever 21 into bankruptcy, yikes.

At ~$77, FIVE is trading at ~7.3x FY25 EBITDA and ~15-17x FY25 P/E (a slight premium to DLTR) depending on whether you net out its cash or not. Its EBIT margins have likewise deteriorated down from ~11% in FY22 to a mere ~8.4% in FY24, on par with DLTR’s FY24 numbers. It also has large exposure risk to China. Notably, FIVE’s store base has been in total mud, with SSS just trending poorly over the last three years. The CEO is guiding to a midpoint 1.5% SSS for FY25, below that of DLTR’s.

TGT, another one at $106, this time with terrible EBIT margins (MSD), trades at ~7x EBITDA and ~12.7x P/E. Pretty close to that of DLTR. But again, this business has inferior margins and really has done terribly on a SSS basis; the company is guiding to a flat SSS for FY25.

BBY, $75 stock, trades at 6x FY25 EBIT and ~12x P/E. Margins? 4% kind of thin. Comps? Absolutely abysmal with no light in sight so far though management sees a 1% midpoint SSS this FY25.

Anyway, what I’d like to highlight is how DLTR is sort of trading like a doghouse retailer when really, it’s been performing relatively well in the tough environment. FD was a key overhang on the stock but that is now clearly gone.

There is probably a share price overhang through April 2, the market doesn’t exactly want to get long right before Trump’s tariff announcements. This trade could be paired with a short on potential tariff names i.e. FIVE etc., based on what has been discussed in this post.