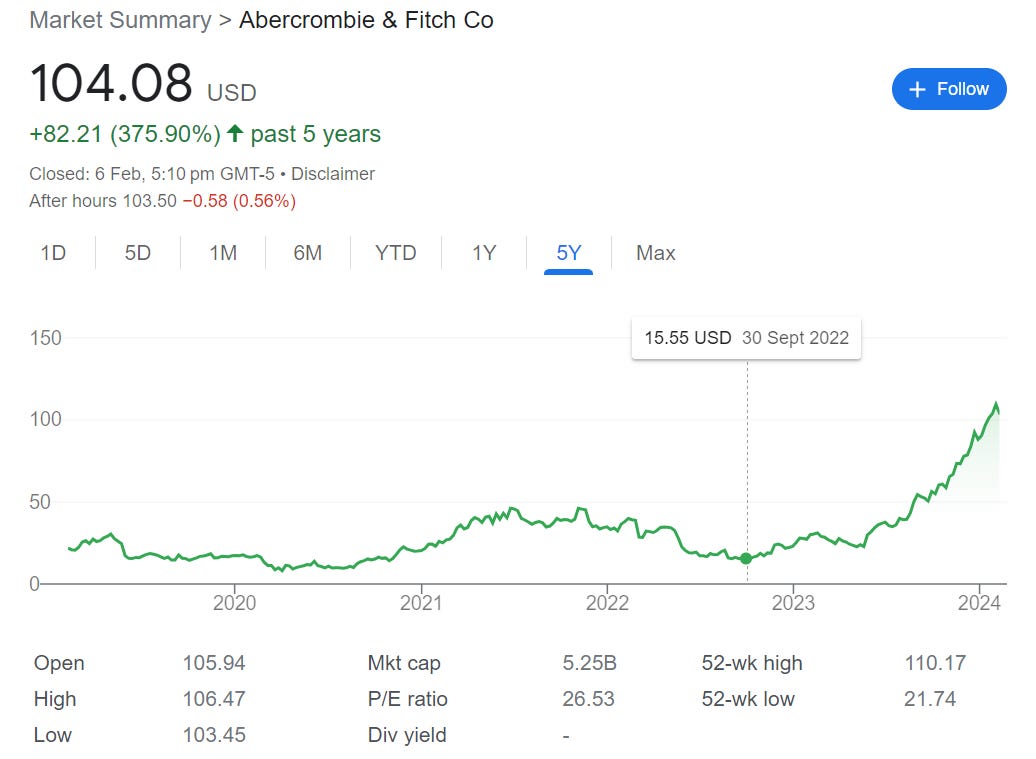

Recently, I’ve been spending a fair amount of time cogitating about extremely painful sins of omission (broadly) - basically, ideas that I included in the watchlist in the past but for some reason, may have dismissed it or sold too early, resulting in huge gains foregone; two prime examples being ANF and TAYD, both shared on COBF in late 2022 - here’s how both stocks have performed since.

Of course, to an extent, I blurt out a lot of trashy deep value companies and am cherry picking the winners - there were many “duds” too - but a common theme seemed to emerge from the successes - what I call, “cash boxes with a business attached”. Of course, many deep value investors would react repugnantly to that gross phrase; global stock markets are littered with such opportunities and most end up as value traps, I’ve been trapped by a number of them in the UK especially which explains why scarred value investors in general have adopted a value with a catalyst approach.

However, based on my observation, the US stock market feels quite different - much more liquid, many more eyeballs, better corporate governance in aggregate and a lot more shareholder friendly than any other jurisdiction. Whilst in Japan for e.g. most deep value names, of which there is an abundance, tend to remain as such (at least prior to 2023), a true net-net (not a biotech but one with an actual business attached) in the US (very rare), seems to more or less re-rate to its value at some point (or so it appears to me), and when it happens, it happens rather quickly and aggressively.

Below I will outline the simple thesis I had for both ANF and TAYD back in the deep 2022 selloff, just to demonstrate how simple it was.

ANF

Say a stock price of ~$15, ANF had about 50m shares and thus a market cap of around 750m. Back then, ANF sported ~300m of debt against ~620m of cash equating to a net cash position of 320m and an EV of 430m.

ANF was going through a difficult year in 2022, net income dipped to ~3m but the firm still generated ~240m of EBITDA and even throughout its life, consistently generated positive FCF. Normalizing operations to around ~300m of EBITDA and maybe ~150m of FCF (assume 100-150m of normalized CAPEX) would get us around a 1x EBITDA and ~35% FCF yield; moreover the company was revitalizing its clothing line - I purchased the ANF basic-t set in late 2022 and am absolutely in love with them. At such multiples, the train of thought in mind was that if one were to offer a comparable business at such prices in a private setting, one would’ve been laughed out of the deal room - unfortunately, it’s really difficult to cut through the noise of public market - “it’s a bad business”, “look at the stock chart” etc. In addition, there was no rapacious controlling shareholder here, the register was completely open; what made this even more fascinating was that nobody “smart” was really pitching this and thus, no opportunity for hand-holding.

What a layup.

Of course, the business could’ve deteriorated further but the with a net cash balance sheet and a history of paying out said cash - prior to COVID, ANF was paying an annual ~60m of dividends (not including share repurchases) - around 8% of the market cap then - there was 1) no risk of insolvency (time for the business to turn) and 2) this wasn’t a locked cash box (like many other value traps).

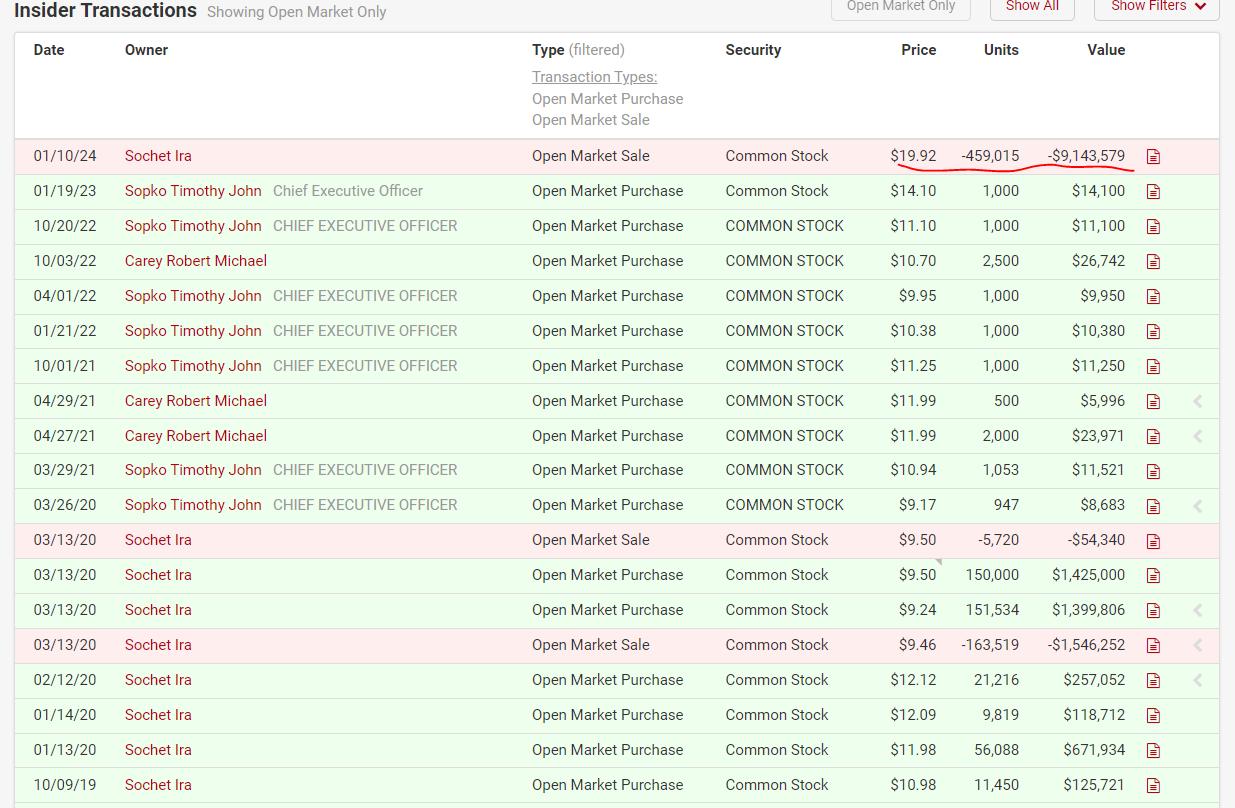

Unfortunately, in this case, there was no insider buying - which just goes to show that it isn’t always a necessity especially if other alignment metrics are met i.e. history of dividends etc.

TAYD

Taylor Devices was an interesting set-up - dealing with quirky machinery (who wants to deep dive into this) with involvement in the aerospace and defense industry (a potential tailwind given global unrest). The stock had traded side ways for a long time but with value accruing subtly - an increasing net cash balance (here’s the model from 2022) as Uncle Sam had deposited ~9m of cash via PPP loans i.e. $2.50 of found value. Hence, net of the burgeoning cash (which was ~60-70% of the market cap then), TAYD went from trading at a rich multiple to a mere 5-6x EPS, completely unnoticed by the market as per the price action. Moreover, TAYD was not overearning as well - GMs came in at 28%, ~ average of historical GMs. Again, while TAYD was not laughably cheap (like ANF), it was still very cheap and given the net cash balance, one didn’t have to worry about the investment blowing up anytime soon.

In TAYD’s case, there wasn’t a history of capital returns but a private investor involved in the sale of Otelco had acquired a meaningful stake late 2019 up till 2020 and owned >10% of the company; I speculated that he would have wanted access to the found value at some point and would probably shop the company given it would be the most efficient way to cash out his large stake without any slippage. I was wrong on that front:

Conclusion

With the two examples above, I hope you can see how simple many of these ideas were and what a large margin of safety they had - one would’ve done very well even if say ANF and TAYD were 2 in a basket of 5. Around that time, I was looking at HURC as well, a net-net stock with no debt on its balance sheet - operations have remained pretty gnarly but one ding for HURC was that the stock wasn’t as cheap on a normalized earnings basis. Regardless, from late 2022 till now, HURC has been range bound (no capital loss) and one would’ve done excellent overall, owning the 3 aforementioned stocks.

In light of what I’ve written so far, here’s the criteria for what I term - cash boxes with a business attached

Large cash box (preferably >50% of market cap)

Is it a locked cash box or an open cash box - either a history of capital returns or a large investor to ensure alignment

Sound business attached (consistent profitability with a long operational history)

No overearning - preferably company going through a temporal trough

Cheap on normalized FCF

As usual, I’m open to feedback especially from more experienced investors given the small sample of experience I’m gleaning from.

In the next post, I’ll share a few interesting ideas that fit this criteria.. stay tuned.

Gamestop pre the meme madness would have qualified for the above ! It was / is a worse business than the others, but had net cash = market cap