“One must imagine Sisyphus happy…”

This year is an incredibly exciting year for markets. Whilst this is not a macro prognostication blog, I want to digress a little and state my view that underappreciated sectors over the past year or two will see their renaissance this year, even if due to simple plain old reversion to the mean. And I hate to say this, but China for example, the IPO performance of recent listings e.g. Bloks (6000 times oversubscribed) seem to point to renewed ebullience on the Hong Kong stock exchange. Again, when it comes to Chinese equities, we could only really hold our noses..

For today, I have two interesting ideas I’d like to flag to readers, so here goes..

#Idea 1: PG&E Corp (PCG) - Baby thrown out with the bathwater

Disclaimer: Purchased June calls in the 80c range early market open yesterday which have now appreciated a fair bit.

As we’ve all sadly heard, last week, Los Angeles saw one of its worst fires since 2013. Affecting both the Palisade and Eaton regions, the fire burned 23.7k acres in the former and another 14.1k acres in the latter. Cumulatively, more than 12,000 structures have been burned and this could be the most costly fire in American history, estimates falling between $50 and $150 billion.

Regardless, investigations for the cause of ignition can be congealed into three points:

Power line issues

Rekindled embers from previous small fire

Arson

The main thing we’d have to be concerned about is power line issues as this directs the blame squarely on utilities which will then be liable for billions of dollars of damages to victims.

Essentially, this is what’s going on at Hawaiian Electric (HE) at the moment (awaiting approval of its $4b settlement regarding the 2023 Maui wildfires) and what happened to PCG a number of years back when they filed for bankruptcy in 2019. Whilst PCG was liable for a number of wild fires between 2015 and 2018, the Camp Fire of 2018 in the Butte County, Northern California, pushed the firm’s potential liabilities to an ~30bn, forcing PCG to file for bankruptcy in early 2019.

Coming back to the present, Edison International (EIX), a Southern California utility is already facing lawsuits for its faulty equipment, igniting the fire.

Accordingly, the stock lost ~$19 of per share value equating to ~7.4b of equity value erased (on a 390m diluted share count basis).

Whilst this panic is understandable at EIX given the LA fires were within its coverage area, PCG also saw its stock killed, falling ~4pts and an ~8b of equity value erased (as per a 2.143b diluted share count).

In other words, whilst EIX fell more in % than PCG, the market has actually penalized PCG more in absolute terms than the former.

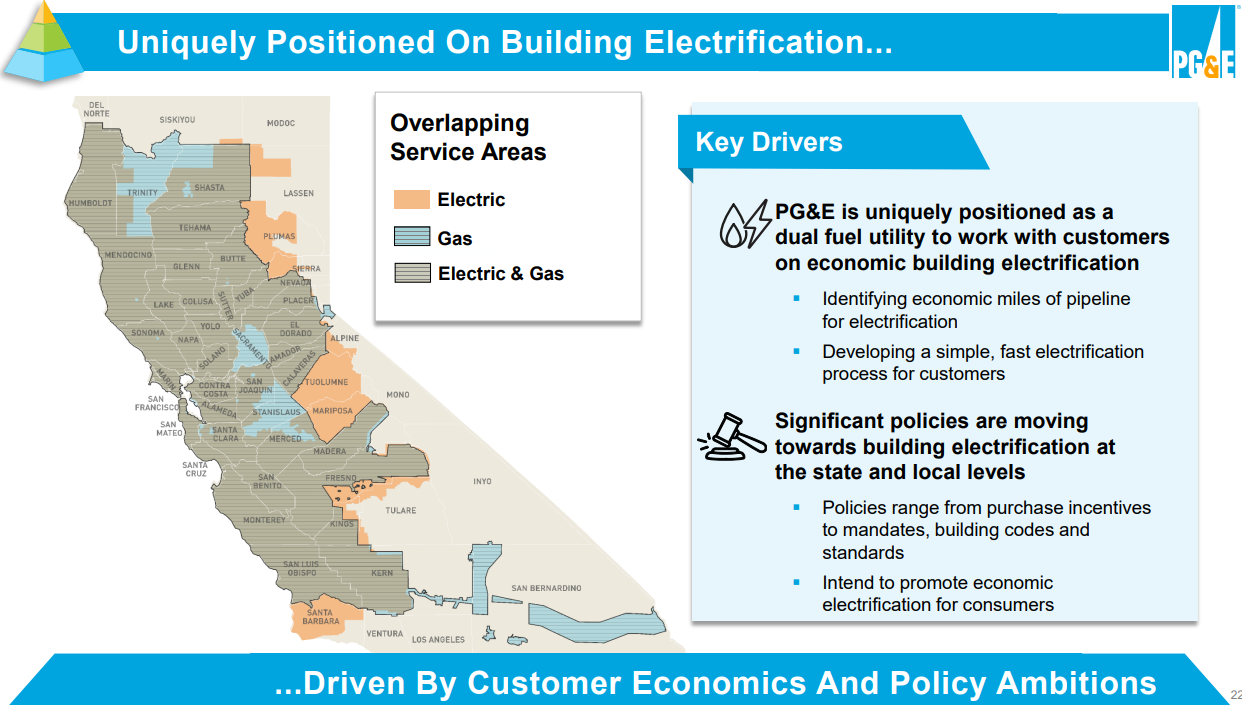

Analyzing PCG’s coverage area, neither Palisade nor Eaton fall within or near the shaded areas. In fact, Palisade and Eaton are way out south (see Figure 2) - see Ventura as reference.

With the assumption that PCG should be penalized, one could argue that PCG pre crash market cap of ~43b was ~40% higher than EIX’s ~30b market cap (on the assumption that market capitalization does affect to a minor extent the liability accrued to a firm i.e. a larger firm would have better ability to compensate than a smaller firm). One could also argue that PCG sports a higher credit rating (BB+) than EIX (BBB) and therefore has better ability to seek necessary funding for compensation.

Regardless of the aforementioned reasons, the point stands that the fires were way outside of PCG’s coverage area and it is very unlikely that they will be penalized for the fires, if at all.

Risks

Another concern is that we are in a “new era of erratic weather” of sorts. A purported cause of the LA fires was due “weather whiplash” whereby the monthly precipitation in LA went from extremely wet to extremely dry, in both cases way outside the norm.

As a result, this January wildfire was a massive anomaly.

In other words, some may argue that utilities deserve a lower multiple going forward due to a higher “risk premium” i.e. erratic weather is a risk to future profits.

However, the S&P utility index has barely barged through this period.

Another risk to highlight is that investigations tend to be drawn out and triangulating the cause of the wild fire could take as long as a year to finalize. In other words, if you are betting on PCG via short-term call options, you might risk being “too early”. On the flipside, I expect PCG to provide reassurance and the market to carry the baby back into the bathtub soon, maybe with some cajoling as well.

PCG is guiding to $1.50 per share in EPS for 2025 and projecting a 10% EPS growth p.a. in the medium term, which they more or less accomplished over the last few years (see core EPS).

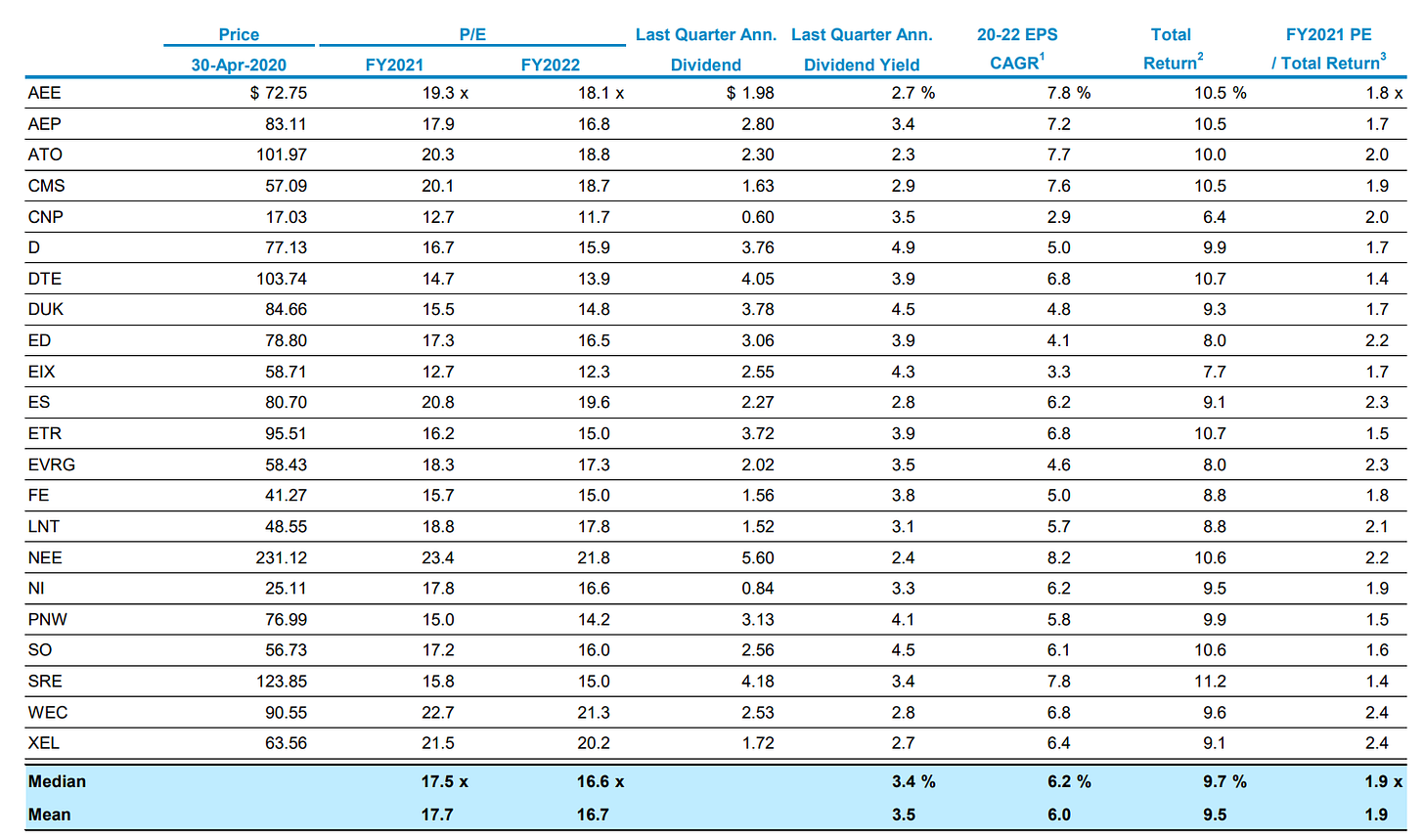

10% growers seem to be few and far in between for utilities, as per my knowledge. For comparison, handpicking a few utilities - EIX is projecting 5-7% growth going forward; DUK is projecting 5-7% growth; AEE is projecting 6-8% growth; AEP is projecting 6-8% growth.

Pulling out PCG’s bankruptcy plan presentation from 2020, the median EPS CAGR for utilities sit around ~6% and the median multiple was ~17.5x P/E. Of course, this was 5 years back, and interest rates are higher now too, but even assuming ~13-15x multiple, it’s not hard to envision PCG return back to its $20 pre-fire stock price and more.

#Idea 2: Honeywell (HON) - capturing the aerospace division

As the saying goes… “no money, no honey”… Honeywell is here to the rescue.

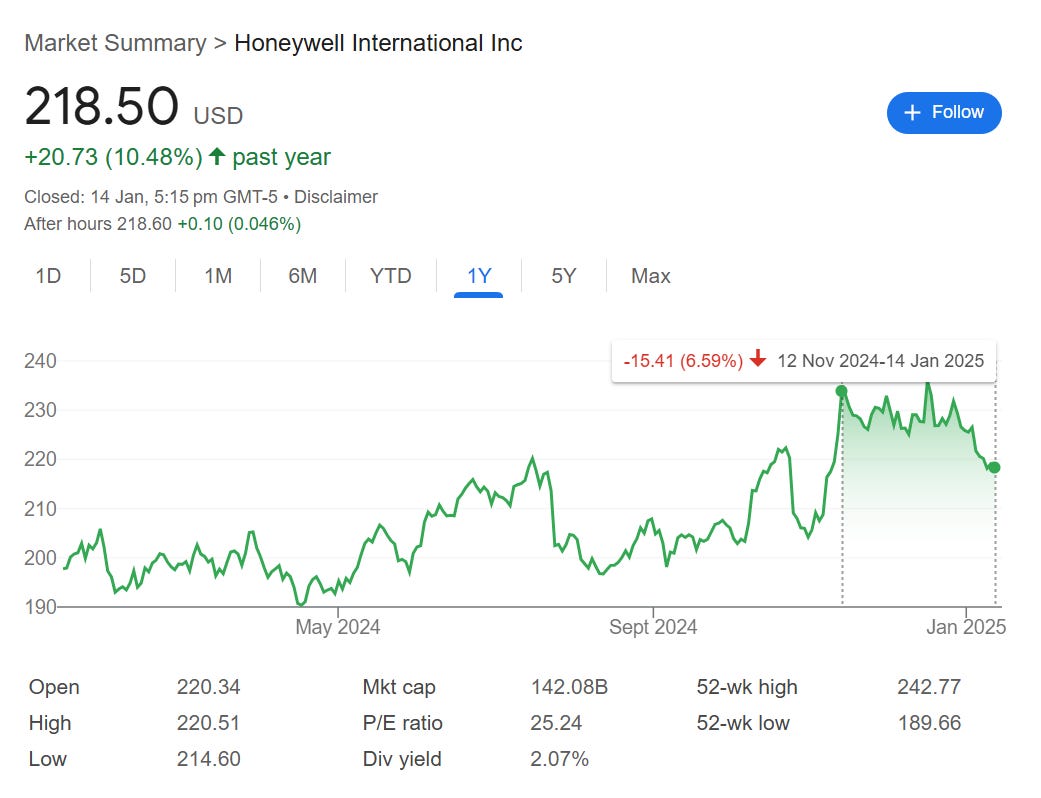

I’ve been following Elliott for awhile now and found their recent pitch on HON, incredibly compelling. Aerospace related companies are worth an incredible amount of money and I’ve already missed two in my rather short investing career - GE (General Electric) and RR (Rolls Royce) - both have been absolute homeruns so I don’t intend to miss this one.

Elliott has not been too approving of HON’s quantum computing unit, Quantinuum: “while we make no judgment on Quantinuum itself, it is reasonable to question whether Honeywell’s investing in quantum computing is a distraction…”. I totally understand their stance as this was written before the quantum computing bubble went rocketing in December. Another way to view Quantinuum now is that it is potentially a “call option”. In fact, HON had entertained the idea of spinning out Quantinuum via an IPO at a ~10b valuation last July, way before the advent of the quantum computing bubble. Peers such as RGTI, DWAVE, IONQ are all up a few fold from their market cap in July, even after Jensen’s recent party-pooping bubble-popping comments on quantum computing being 2-3 decades away.

“pfft, you must be totally fun at parties Jensen…”

For what it’s worth, HON is Elliott’s largest position in any single stock ever and has traded down since Elliott announced its position on 12 November last year.

Just yesterday, rumors has it that HON could formally announce plans to split the company in early Feb during its Q4 earnings. I’ll be eagerly waiting for that.

Analysis on PCG ignored the huge default risk on the company's $57billion of debt.

Great call on PCG, just added 500 shares