Another quick trade at Silk Laser (SLA.AX)

Another quick trade from down-under; this idea is a little “punty” and perhaps those with more experience would be able to quantify the upside/downside a lot better. Nevertheless, I think the dynamics of this situation is interesting and worth flagging.

Silk Laser is an Australian laser, skin, injectables and body clinic; the company was formed in 2009 and was listed on the ASX in 2020. The stock traded up into the 4s before languishing through 2022, trading below $2 before recovering some ground, up till a few weeks ago when Wesfarmers (Wes) proposed a $3.15 bid, sending the stock spiking. This was shortly topped, 2 days ago by a Hong Kong rival, EC Healthcare, raising the bid up to $3.35, initiating a bidding war. The stock at time of writing, trades around $3.41, a slight premium to EC’s bid, indicating that the market believes Wes will counter-propose, deadline 30 May.

The trade is binary and as follows - 1) Wes bumps it up, accepting a bidding war which in my view, could potentially take the stock up to the high 3s and maybe low 4s, 2) Wes walks, ceding the entity to EC whose proposal is “non-binding” and subject to a slew of conditions including regulatory approvals; while a faux-bid might be a concern, I think the risk is rather low, as we shall see in a bit.

Before addressing the points above, let’s backtrack a little and discuss the business. As mentioned, Silk Laser is in the non-invasive medical aesthetics business. Non-invasive medical aesthetics enjoy secular tailwinds as seen in this slide by Cutera.

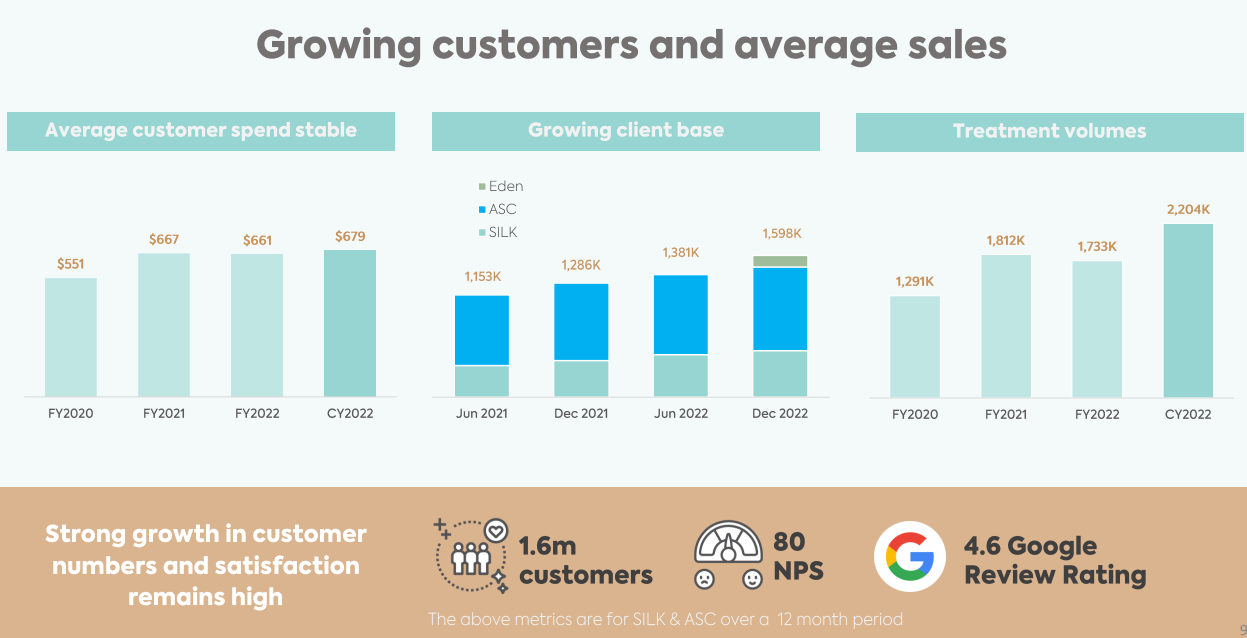

Aesthetics is generally non-discretionary; treatments entail high gross margins and are not one-off services i.e. repeated service is necessary for aesthetic maintenance. This is illustrated by the flat to positive LFL sales exhibited by SLA even in 2022 as other parts of the economy suffered negative comps. Also, H2 2023 is already running 10% LFL growth in the first 7 weeks.

Metrics have been trending well in general. This isn’t a high organic growth business per se; network growth is limited, client demography is limited to affluence - only those who can afford to commit long term to said treatments. Given the high-ticket and nature of service, I surmise clientele is rather sticky as the “don’t fix what isn’t broken” adage holds very strongly for facial aesthetics. Thus, revenue is pretty close to “recurring” i.e. high quality.

Given the limited network and client growth, growth strategies employed by incumbents include cross-selling of services, taking prices up and extracting cost efficiencies. In a mature steady-state industry, scaled players win and hence, rolling-up of the industry becomes an attractive proposition.

A few months post H1 (ends Dec 2022), on 1 March 2023, SLA acquired Eden Laser Clinics for a total consideration of ~10m, taking on 7.5m of additional debt with 2.5m of net cash on Eden’s balance sheet. Eden is expected to earn 1.4m of pre-synergies EBITDA in the year post acquisition.

EBITDA net of cash rents is ~82% of adj EBITDA and thus, accounting for rents and acquisition of Eden (half a year of EBITDA), along with incorporating sell-side estimates of 25m adjusted EBITDA, I estimate SLA to earn ~21m of EBITDA in 2023. Moreover, EBITDA in 2022 surpassed street estimates and so there’s a chance that SLA beats again this year.

With the background out the way, let’s have a look at the valuation implied by the current stock price.

At $3.41, the valuation implied is 9.1x EBITDA which is not drastically cheap but within the range of precedent transactions which we shall see in a bit.

Why Wes might bid higher?

Market Dynamics

The specialist clinic market is highly fragmented with 30% of the market controlled by a few large operators followed by a tail of mom and pops. SLA controls about ~10% of the market (my estimate pf acquisition of Eden), whilst Wes, through ClearSkincare owns 6% of the market; KKR through Laser Clinics (LCA), owns 12% of the market.

There is a scarcity premium that should be accorded to SLA as it is the only public listed entity of its sort (to my knowledge), left floating in the Australian stock exchange and the winning bidder would immediately snap up an additional 10% market share, which is a lot easier than going door to door, rolling up multiple mom and pops and integrating systems etc.

SLA has a well developed franchise which should warrant a higher multiple

We have two precedent transactions to glean from. First, KKR acquired LCA in 2017 for 650m with LCA earning a reported 50m in annual EBITDA, a ~13x multiple. Second, Wes through API.AX, acquired ClearSkincare at ~8-9x EBITDA.

So we have a range of multiples here - on one hand, a private equity firm with no expertise nor synergies to realize (hence the recent poor business practices)*, pays a fat 13x and on the other end, a strategic operator pays 8-9x.

*Just a note on the poor business practices at LCA - surely that should lead to some level of customer attrition which will benefit other players in the industry such as SLA. Moreover, since KKR is repurchasing franchisee operations, opex is shifted onto the corporate P&L which means the ludicrous discounting of times past may cease going forward.

SLA owns an extensive franchise network

Bill Ackman states it perfectly in his presentation on Wendy’s eons ago: “The Franchise business is a stable, high-margin business that can grow with minimal capital required. Highly stable, royalty-like businesses of this nature typically trade in the range of 10x – 12x EBITDA, depending on growth.”

When Wes acquired ClearSkincare, it did not come with a developed franchise operation and hence the lower multiple, in my view. SLA on the other hand has an established franchise network.

Additionally, SLA’s model is also peculiar in that rather than soliciting indiscriminate franchisee potentials, it prefers to partner with its cosmetic nurses, turning them into business owners, as the injection of personal equity ensures quality of service.

In sum, I don’t see why Wes couldn’t lob a bid at say 10-11x EBITDA, not accounting for synergies. Even a 11x on 20m of EBITDA is a $3.89 share price.

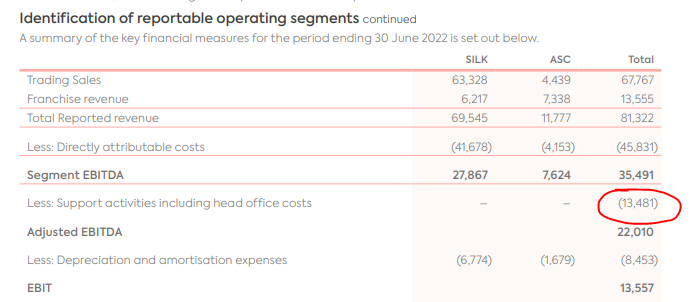

With regards to synergies, for fy22, head office costs sat around 13.5m; I don’t think Wes would have issues wringing out a few million entailing an immediate accretion to EBITDA.

Would Wes cede to EC?

First, both players are strategic and aren’t subject to the whims of a financial buyer. These aren’t guys that will retreat just because the RBA raises rates by 50 bps rather than an expected 25 bps.

Second, as mentioned, Wes already owns ClearSkin and in their old acquisition presentation, outlined the synergies to be obtained, which I reckon is not dissimilar to what can be achieved with SLA.

Third, with regards to the validity of EC’s bid, EC has a track record of conducting M&A and indicated intentions to build a diverse mix of synergistic assets to develop a one-stop shop serving all medical and healthcare needs. Moreover, EC didn’t lob a topping bid right after Wes but rather, waited a month or so which seems to signal a calculated strategic intent rather than pure aggression. They would probably have diligenced the requisite regulatory hurdles and found low odds of disapproval - these assets don’t threaten national security and even post acquisition, EC doesn’t end up with a giant slice of the Australian market as they have zero presence currently.

It is worth noting that the market cap disparities here are quite astounding. Wes sports a market cap of A$56b whilst EC sports A$1b market cap; EC is currently more or less net cash and is majority owned by founder Eddy Tang who seems rather ambitious and determined to realize his vision.

In any case, Wes has a lot more chips on its side of the table and to fold and cede a network of clinics, clientele data and 10% of the market to a foreign player doesn’t seem too palatable an idea. Wes sports $600+ m of cash on the balance sheet; since a bid has already been lobbed, what’s an extra 50m to push past the finish line?

Additional Thoughts

Harvest Lane, a pure merger arb shop, has been acquiring stock in SLA, though at much lower prices. Just last year, Harvest had a bitter run with Wes over the acquisition of API, of which Harvest felt was too stinky a bid. Unfortunately, given the toehold that Wes had (19%+), rival bidders - Sigma and Woolworths - pulled out as securing a scheme vote majority of 75% would be difficult.

In this case, the register is rather neutral with Wes owning only ~9.5% of shares outstanding. Perhaps, this time, Harvest will finally be able to extract their pound of flesh.