“Life is like a cup of coffee, it is best made with love…”

I’ve loosely followed Farmer Bros (FARM) for quite some time but a series of events triggered me to revisit the situation.

Part of my New Year’s resolution was to go cold turkey on my addiction of the highly acidic blend of roasted Robusta and Liberica black coffee one would find all over Singapore, typically consumed sugarless and without milk for the true aficionados - their presence never going unnoticed as every sip leaves an unmistakable yellow taint on the crooked canvas assembled right behind those lips.

This turkey survived for quite a bit until two weeks ago … I took a short trip to Shanghai to visit some buddies (will be flying to Bangkok in a week - drop me an email if you’d like to grab a drink) and in the spirit of “whatever happens on vacation, stays on vacation” decided to steal a couple cups of freshly brewed black coffee to tide through the day, especially after a number of late drunken nights. Now that the gates are unlocked, I still sneak a cup of coffee here and there, despite no longer being on vacation!

Touch my heart, did it help sustain the life in me? Absolutely. Was I plagued by guilt for messing my resolution? Absolutely … not

In any case, sipping some black coffee reminded me to visit the FARM again. Note, this is a microcap and quite speculative so readers ought to take caution and as always, consult their financial advisor.

Background

FARM has endured over a century and bears an interesting and tarried history - marked by themes of disruption, deceit, nepotism, family-feuds and plain-old capitalism.

The company, in their own words, “is a leading coffee roaster, wholesaler, equipment servicer and distributor of coffee, tea, and other allied products.” The business previously consisted of two segments - the direct-store-delivery (DSD) and direct ship (DS). Think about the time you were morning-greeted with a warm cup of coffee at the hotel buffet, you may have consumed a FARM coffee - that coffee was probably delivered in the morning via a truck, backed by a contract and brewed by a FARM coffee brewing machine - that’s the DSD business. For the DS business, third party carriers are employed to deliver coffee bulks to wholesalers e.g. grocery chains and convenience stores, sometimes in the form of private label.

As noted in the slide below, 2/3 of coffee production is essentially DS though DSD despite being the smaller business, is more profitable i.e. higher margin and more diversified - sells tea, spices as well (second slide maps out the DSD business).

FARM has been riddled with problems and the stock price has taken the dumps. There’s quite a fair bit of history one can glean on the company from 1 and 2; the focus of my writeup will be on recent key issues, resolutions and the set up, as I see today.

Set Up

The set up is simple. As mentioned, FARM operates a high margin DSD business and low margin DS business. The DS business was a drag on the firm’s profitability. To put into perspective, the DSD business generated 36.6%, 42.5% and 33.7% gross margins for fy21, 22 and 23 respectively whilst the DS business did 4%, 2% for fy21, 22 and sported a negative gross margin for fy23. The DS business thus became a drag on overall profitability; consolidated, the business generated a mere 25.4% and 29.2% gross profits for fy21 and 22 and ~23% for fy23.

As seen in the margin figures above, fy23 was an especially tough year and FARM was was deeply unprofitable, netting ~(-10m) EBITDA losses and facing bankruptcy risk as it was close to tripping its debt covenants. The stock traded to as low as $1.80 for a market cap of around 36m against a net debt load of ~105m and pension liabilities of ~30m, i.e. shareholder equity made up a mere ~20% of FARM’s enterprise value (EV).

Lo and behold, in the final hours, management pulled a rabbit out of the hat and sold its low margin DS business along with the underutilized Northlake facility for a cool ~100m with ~92m of net proceeds used to restructure its balance sheet. Post sale, gross debt was brought down to 27m consisting of a 23m revolver and 4m letters of credit. The stock, as expected, reacted strongly to the news, surging and drifting past $3, even briefly touching the 4s, before settling back at where we are now ~$2.57.

Where we are today

The stock has retraced a majority of its gains since the cleansing of the balance sheet, in fact, trading much lower despite the company being on stronger footing today.

By way of example, back in 17 Feb 2023 (arbitrary day),

FARM sported atrocious margins and was deeply unprofitable

Saddled with a large debt load with an imminent covenant trip

yet the market deemed the equity worth a cool ~90m.

Today, as reported in Q3, FARM has

Divested its low margin DS business

Returned to EBITDA profitability ( ~0.3m for this quarter and ~2m over the last 3 quarters) and guiding to be FCF positive in early FY25 (sometime later this year).

note ~6.5m of annual interest saved

Has minimal debt - 23m revolver and 3m letters of credit with ~6m of unrestricted cash

yet the market has accorded this dying stock, a mere ~50m market cap.

Profitability

As bankruptcy risk is off the table in the medium term, my view is that the market has dinged the stock due to sheer unbelief that FARM can achieve a solid level of profitability, enough to warrant a proper multiple.

However, there is adequate proof that the income statement is indeed inflecting.

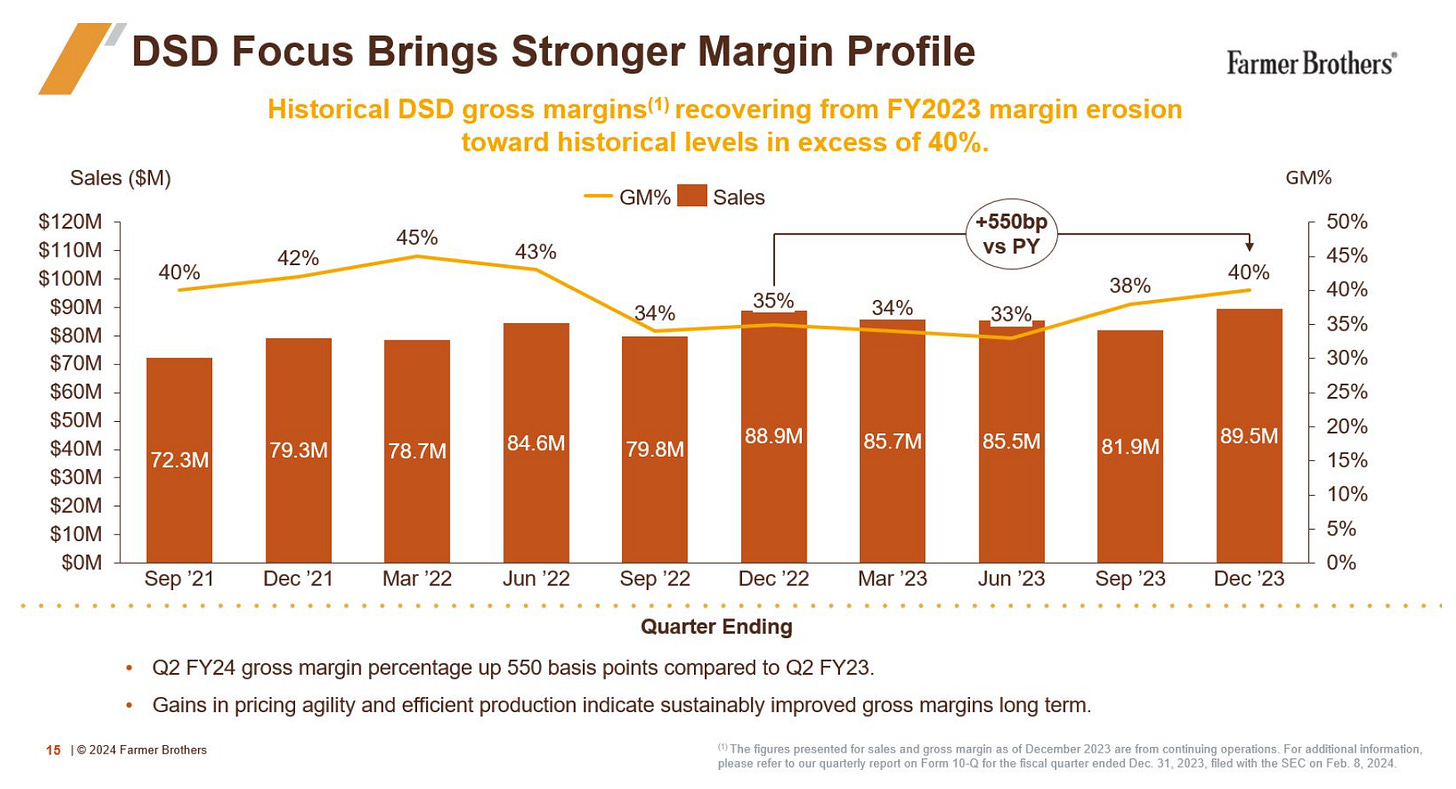

As seen in the slide above, the DSD business, prior to fy23, generated as high as 45% gross margins in the Mar 22 quarter.

The DSD business has recovered from the fy23 lows and sits nicely at ~40%. Further upside in gross margins would come from:

Inventory/portfolio rationalization

inventory accounted via FIFO method

FARM in the process of clearing old high cost inventory/SKU and rationalizing their portfolio/product line for more efficient pricing (aided by A.I according to management)

There remains some old SKU left but once the process is complete, the COGS flow through would provide an additional boost to gross margins

added benefit of working capital release i.e. more cash flow

Tailing off transitional costs

transition costs from DS sale

transition costs as FARM is consolidating manufacturing in its Portland, Oregon facility.

Adjusted EBITDA is trending positively despite a slight dip in Q3 24 and management has reiterated positive FCF in early fy 2025 (next few quarters). Note that FARM has 134m and 173m of federal and state NOLs so cash taxes wouldn’t be an issue in the near term.

Valuation

My assumptions are as follows:

Adopt management guidance of 350m of revenue

Assume 5% EBITDA margin (the DSD business generated 5.3% and 5.2% EBITDA margins for fy21 and 22 respectively so this is not a stretch)

Assume additional 10m of revolver drawn to cover any cash needs en-route FCF breakeven

A month back, FARM sold its last major property - 142k SQF equipment repair center in Oklahoma for ~$5.8m (i.e. 10% of the extant market cap) which may have gone unnoticed by the market (no press release).

Modest 8x EBITDA multiple

Historically FARM traded at 8-10x EBITDA

Food products typically go for NTM 8-9x EBITDA (i.e. KHC, SJM, THS, BGS)

Top operators like Nestle may go for mid teens EBITDA

FARM acquired BOYD’s clientele (no roasting facilities involved) for ~5-6x EBITDA

A scaled portfolio like FARM with similarly no owned facilities, would probably garner an additional turn or 2 of EBITDA

Delta’s failed acquisition of Coffee Holdings was done originally at 0.6x EV/Revenue

A similar multiple on FARM implies a 210m EV and a ~$7 stock price

Assume further share dilution a year out

Without much heroic assumptions, it’s easy to triangulate FARM being worth north of $4.

Incentives

Early this year, John Moore replaced Deveri Maserang as CEO with a sized down base salary from ~700k to ~450k and a 3 year 450k PBRSU (performance-based RSU) tied to the company’s stock price, contingent on FARM reaching $6 per share or for FARM to be sold for at least $6 per share.

For what it’s worth, this is not the first time John Moore has managed a coffee company, this man lives and breathes coffee.

The newly installed CFO also has a chunk of PBRSU tied to obtaining a $6 stock price.

I’ve followed Bradley Radoff’s investments for quite a bit and that’s how I initially chanced upon FARM (just to reminisce history a little - Mr Radoff was an activist investor for one of my first investments (which got me hooked on the game), Newpark Resources (NR), purchased at ~$0.85 in late 2020 when it was a certified net-net; the stock peaked at $8.65 a couple weeks back, a cool 10-bagger (p.s. I did not capture all 10 bags, but got a few bags for myself); Mr Radoff still holds a sizeable ownership).

But NR is a thing of the past. With FARM now, Mr Radoff, through his firm JCP, and 22NW went joint-activist in late 2022 which saw Mr Radoff become an independent director. The activists purchased shares at an initial cost basis oodles higher than now and Mr Radoff was still buying shares late last year around current prices.

Risks

High coffee prices

Coffee prices have been running up bigly with a short temporary respite late last year. However, the World Bank is forecasting the easing of coffee prices in 2025 and for Arabica, which is of key relevance to FARM’s premium brands, nearly 7m bags will be added to annual production from Brazil and Colombia which should aid the easing of Arabica prices going forward.

Competitively speaking, lower tier competitors that utilize Robusta beans will face more inflationary pressures as the Robusta market remains tight particularly due to gnarly weather in Vietnam which should provide Arabica-coffee brands some additional ground in price wars.

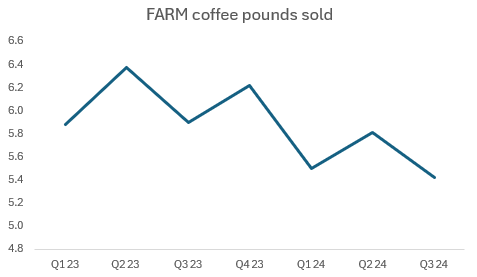

Flat to negative volumes for coffee pounds sold.

Note that this is not an idiosyncratic issue to FARM and is prevalent across the coffee space.

Nestle for e.g. has seen flat real internal growth (RIG) for the last 2 years.

RIG is measured as “organic growth - pricing growth” i.e. a 5% growth in organic sales coupled with a 5% increase in prices would indicate zero real internal growth implying flat sales volumes. In other words, Nestle hasn’t seen much coffee volume growth but as indicated above, there is an innate resilience to coffee consumption.

JM Smucker provided solid commentary on the space - namely that 1) they will continue seeing soft volumes and 2) while the coffee space remains a little stifled, things should normalize over time as always.

Obviously, FARM is seeing volumes decline a lot worst (especially factoring in the drop from fy22 to fy23 which is not in the chart above) so this is not a risk to dismiss and the onus is on management to find a balance between price-taking and volumes sold; but the fact of the matter is that it’s low-tide season for the entire industry and as the tide turns, it should lift all boats.

Should FARM be able to re-attain gross margins comfortably north of 40%, I could see EBITDA returning to low single digit % and the stock should rerate accordingly.