When I look at the scars on my back, invariably most of them have come from complex, levered, busted shitcos that have nice upsides when they work (though with a scorpion stinging downside if they don’t) with an additional ego boost for being clever. The whole experience feels a little like this movie clip from Skyfall.

I’ve been considering avoiding situations as such, except on days I feel like James Bond of course.

Generally though, it’s always been healthier to find low hurdles to clear.

Typically, huge returns could be generated via cutting through the fog of uncertainty to find the signal - calling or raising the pot behind the “river”; but there are times as well where I do find that pushing the stack in at the “river” may be a much better r/r than prior that.

The situation laid out below is as such and the series of events preceding where we trade today has pushed the stock to the foregone conclusion of an imminent catalyst, at the very least, in my view.

Anyway, I’ve noticed a fair amount of intriguing situations out there so I’m pulling out the first one here. There’s no guarantee I’ll continue writing about other fascinating situations (time constraints..) but we’ll save that for another time.

Let’s dig in..

Background

The current market appears to have a very weird dispersion of equities - a frothy market on one end and on the other end, a bunch of relatively cheap names, a real head scratcher. This sets up an interesting scenario where financial and strategic investors come in and swoop things up for the cheap - we’ve already seen a few instances within the sneaker industry. A few articles indicating deal making is hot again - here, here.

Enter Trimas (TRS), the ticker a blessed one in that just last month, The Reject Shop (TRS.AX) in Australia was taken out by Dollarama on the cheap, in spite of the YUGE premium paid. So we are on good momentum here and fingers crossed, Trimas is next.

The situation is simple - TRS has been a sleepy stock - trading flat for the most part of the last year until recently when it broke past its 200 day MA, and has proceeded to climb since, especially on news that its largest shareholder has been incessantly buying up shares bigly.

At a cursory view, this dormant chart activity could be attributed to a modest headline revenue growth exacerbated by EBITDA deterioration between FY22-24.

However, the headline numbers obscure a fundamental shift within the business portfolio toward a higher quality earnings stream i.e. profits that command a higher multiple in markets - that is in this case, away from specialties and into aerospace. Essentially, the business has transformed itself into a packaging and aerospace business which in itself is also a ridiculous pairing with no definite synergies, wherein lies the opportunity.

Typically, these sort of situations are accretive when you slice the steak knife right through. Barington Capital has been at it for awhile now, incessantly slicing on that rare A5 wagyu, and notably, Irenic Capital and Alta Fox Capital has also joined the table (as per the latest 13f) - Irenic famously involved with a few aerospace transactions i.e. Barnes Group and Triumph Group.

Barington’s initial letter in Dec 2023, highlighted the travails of the packaging business, the sub-scale size of the aerospace division and specialty products segment. Barington agitated for change via 1) downsizing its specialty products business via sale of small residual oil and gas division i.e. Arrow Engine, 2) improving aerospace margins and selling it at some point in the future, and lastly, 3) fixing packaging business margins.

This did not fall entirely on deaf ears as 1) was executed pronto, with TRS selling the Arrow Engine division for $22m in H1 24 last year.

However, given the miniscule scale of Arrow Engine relative to the entire firm, this was not a needle-moving transaction and Barington came forward again with a second letter in July 2024, urging the company to put an up for sale sign for either the aerospace division or the entire company.

Sometime in Q4 24, on the heels of a rumor of a potential takeout by American Industrial Partners (probably looking to snag the aerospace division IMO), a mystery buyer appeared - an investment firm, Trend International, loading up a ~10% position overnight.

Coming into 2025, we’ve had a few executive shuffles with Mr Amato stepping down as CEO on Jan 6 (looking for a replacement) and TRS’ CFO, Mr Mell leaving as well, to be replaced with an interim CFO.

On Jan 10, Barington, again, stepped out from the woodwork and lamented - nooo we don’t need another CEO, just sell the whole damn company - quoting Barnes (B) (bear in mind) as an example of another multi-segment peer that unlocked huge value via selling of the entire firm.

Moreover, come February, a new director joined the BoD, Shawn Sedaghat… who turns out to be the chairman of Trend International, himself sporting a flavored background in specialty packaging, founding/co-founding two packaging businesses across the last two decades.

Again Shawn Sedaghat has been purchasing more shares, this time under his own name, effectively owning ~1.9m shares or ~5% of the company as of the writing. His purchases have been rather aggressive recently as well, with stacked buying over the last week or two.

Somewhere in mid-February, TRS, in the spirit of replacing a girlfriend, purchased GMT Aerospace for EUR 22m (Arrow Engine was sold for US$22m :p), enlarging its manufacturing footprint into Europe and exposure to Airbus.

To lay the final capstone, in the recent Q4 24 earnings call, Mr Amato has finally, blatantly, acknowledged the undervaluation of TRS relative to the stock price, something not said in any of the transcripts I’ve perused over the last year or two.

“First, the point I'd like to make is, as we presented last quarter and again this quarter, we have 2 business platforms that, in my opinion, are extremely valuable. The intrinsic value of those platforms are fantastic, certainly relative to our market cap, and the Board is well aware of that. And the Board is looking at, with advisers they have brought on, what is the best assessment to unlock the highest value for all of our shareholders, as we move forward.”

Business Overview

Just to backtrack a little, with images taken out of the BoFA leveraged finance conference in 2023, TRS could historically be thought of as three disparate businesses which frankly are so different from each other that there’s no reason for them to be bundled together.

The typical playbook for companies like that would be portfolio simplification followed by an eventual takeout.

TRS appears to be on the right path so far. Over the years, the firm has divested businesses tied to cyclical commodity end markets i.e. specialty and energy divisions, whilst making bolt-ons in packaging and aerospace.

As of Q1 25, the business could be thought of as a two-segment firm - packaging and aerospace.

Nevertheless, whilst the aerospace division has been on an upward recovery mode from aircraft OEM production issues through COVID, the packaging business was a victim of the bullwhip effect in recent years.

Post COVID, smacked by the confluence of consumer revenge spending and supply chain problems, suppliers upstream began to overstock, with TRS’ customers ordering excess packaging goods in fear of shortage, only to end up having to destock in 2023 when the variables reverted to the mean. TRS then took capacity out in response to that, only to see its order book balloon again in 2024, forcing capacity to be brought back in again but this time, with a lag, resulting in overloading of existing capacity and expedited freight resulting in a tax on packaging profit margins.

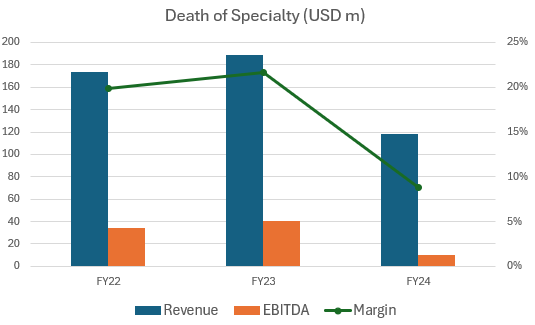

Business on the specialty chemicals front was absolutely abysmal in FY24 as well with revenue declining 37% and EBITDA margins falling from 21.6% to 8.8%. As a result, with the packaging business unable to hold its weight given the 2.5pt deterioration in margins, consolidated EBITDA declined from ~156m in FY23 to ~146m in FY24, despite revenue going up.

FY25 estimates

As mentioned, there has been multiple transactions - sale of Arrow Engine, acquisition of GMT Aerospace etc, but net net, let’s make some forecasts on how EBITDA will shape up in FY25.

Management provided revenue guidance of around 4 to 6% revenue growth and EBITDA of around 150-165m as specialty chemicals bounce back and the acquisition of GMT Aerospace, more than offsetting Arrow Engine.

*Note, guidance was given prior to the April tariff escalation (?).. I have no clue where we are now with tariffs FWIW, I kinda got lost halfway through…

For segment margins, management guided to 1 - 1.5% margin growth for packaging and 1.5% - 2% margin growth for aerospace.

Scenario 1:

Using very conservative assumptions.

Assume Packaging sees a 1% margin growth with a topline GDP 3% organic growth, as guided by management

Aerospace sees 1.5% margin growth and a GDP 3% organic growth as well, followed by GMT Aerospace adding ~$25m of revenue

Specialty business flattish, net of Arrow Engine, with 10% margins.

Corp overheads of ~3% of revenue

This gets me to a total revenue of $955m (i.e. 3.3% growth - below management guidance) and ~$162m of EBITDA.

Scenario 2:

More generous assumptions.

Assume packaging sees a midpoint 1.25% growth and topline growth at 3%

Aerospace margins grow midpoint 1.5% with 10% organic growth, followed by GMT Aerospace adding ~$25m of revenue

Specialty business the same

Corp overheads of ~3% of revenue

Results in a total revenue of $976m, (5.5% growth) and $167m of EBITDA, slightly overshooting the top end of the guidance re EBITDA.

Valuation

Packaging

As per the firm’s 10K, TRS publicly traded packaging competitors include Aptar, trading at ~13x NTM EBITDA and Berry, recently acquired by Amcor for an all-stock transaction of ~$8.3b and all-in EV of ~$15b against ~$1.7b of EBITDA i.e. ~9x EBITDA. Other packaging peer multiples can be found in the snippet below - typically trading between 7-13x EBITDA (also verified in the Berry merger proxy).

TRS would likely trade at the upper end of its packaging peers as it’s more “specialty” packaging - dispensers and dabbling in the pharmaceutical space e.g. supporting customers up till midscale before they go to a CDMO (high multiple business) - rather than volume-based commoditized packaging i.e. Berry. The difference in end-markets is also illustrated by the margin difference (>20% at TRS vs 17% at BERY) between both companies.

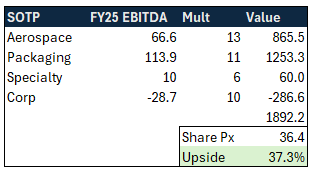

TRS shares some similarities with Aptar but Aptar is a bigger entity, has much larger exposure to pharma, well-managed, growing and boasts slightly higher margins so a slight discount to Aptar, i.e. ~11x EBITDA should be fair.

Aerospace

Pulling out figures from the Barnes merger proxy, past transactions in this space have gone for a median multiple of ~12.4x and average multiple of 13.4x, midpoint ~13x. There are likely divergences between the businesses - more defense focused or more aftermarket exposure vs OEM will command a higher multiple etc. But for simplicity sake, we can slap a 13x multiple on this.

Others

I assume a 6x multiple on trough specialty earnings and an average blended multiple on corporate overheads.

$26.50 share price

Scenario 1

With scenario 1’s conservative assumptions, we get ~$36/share or a nifty 37% upside.

Scenario 2

With more generous assumptions, we get ~$38/share or a nifty 44% upside from here.

Before discussing a potential wholeco valuation, let’s examine a case study of another takeout done recently - Barnes (B).

Between 2021 to 2024, Barnes went from being a predominantly industrial player to an aerospace player, with the help of a major bolt on in 2024.

Despite the portfolio transition, its stock price was more or less flat, and even down since FY21, likely on the back of a struggling industrials division.

Nevertheless, Barnes was eventually acquired by Apollo at $47.50, a nice upside for anyone who bought shares during the year or two prior.

The merger proxy provides ample detail on the merger background:

TLDR:

Barnes began soliciting interests given it was disregarded by public markets despite rebalancing its portfolio towards Aerospace. This attracted more than 10 parties (both strategic and financial) with initial offers as high as $60, at first glance. However, and my guess is, given the overhang of the anemic industrial segment, the offers were eventually revised down to an invisible ceiling of ~$50.

As if finding the right acquirer isn’t tricky enough - does the acquirer have committed financing? Is it a consortium or singular buyer? Is the buyer strategic or financial? Does the buyer require CFIUS approval, shareholder votes? - given the two disparate divisions, management also had to deal with whether to sell the company piece by piece or the entire thing in one singular transaction.

This is where Apollo shines and possibly why they seemingly snap up every damn deal. Apollo was quick with the due diligence, entering the advanced stages way ahead of other parties; moreover they had no issues obtaining financing, did not require shareholder votes and had no regulatory hurdles to cross.

Barnes results were relatively poor through FY24 due to exogenous factors i.e. supply chain issues, and management was reluctant to extend the process past the Q3 24 earnings date in fear that the stock price reaction post hoc might derail the entire strategic process. On top of that, given that the rumors of Apollo looking to acquire the firm were already leaked, killing the deal may further immolate the stock.

In other words, Barnes was sort of at the mercy of Apollo, notwithstanding they had activist pressure from funds such as Irenic Capital. In the end, Apollo snagged Barnes for a cool $47.50 per share or a value of ~11x FY24 EBITDA - 3.6bn against a projected 325m of FY24 EBITDA (as per management Sept 2024 projections) - which was a good deal for Apollo relative to the implied equity range of values provided by the investment banks.

Assuming ~162-167m of EBITDA for FY25 and a Barnes takeout multiple of ~11x (conservative given TRS’ packaging business is likely more valuable than Barnes’ struggling industrial business) , this gets us to $33 - $35 per share which is a just a smidge lower than our SOTP calculations.

What could happen

The outcome should be rather predictable from here though the timeline is still up in the air.

Given Mr Sedaghat has been able to purchase shares in the open market up till last week, it’s probable that strategic talks are in their infancy and there is no concrete deal out there just yet.

Given his background, it’s not wild to presume that he’s eyeing TRS’ packaging business and so a full-on sale of the entire company seems unlikely. What appears to be a probable outcome is highlighted in this quirky incentive package shown below, issued upon the departure of the CEO:

Notably, the head of TRS’ packaging business (not aerospace) and a few other executives were granted retention RSUs (not exactly huge packages but worth highlighting) which vest across two years but accelerate in the event of a change in control.

Conclusion

Upside may not be the juiciest but and I will be accumulating more shares on weakness, as I think whoever is reading this should, if they come to same conclusion as I do - that within a year or so, it’s unlikely for Trimas to be in the current form it is.

The relevant players have all aligned at the table: the CEO has stepped down, Barington is still at it (even increasing its position in Q1), activist funds such as Irenic Capital and Alta Fox Capital have arrived onto the scene, and Mr Sedaghat - aggressively hoovering shares in the open market.

The business has streamlined itself over the last few years and appears ripe for a deal. Regardless, TRS’ subdivisions still lack scale relative to counterparts and given the huge interest from both financial and strategic buyers for Barnes, I can’t help but see multiple bidders coming in for TRS’ aerospace division (especially with deal-making appetite back).

Just on stock price path - there might be a retracement if Mr Sedaghat stops purchasing shares, while it may be a good thing from a strategic review perspective, it may take out that “price support” seen over last few weeks; the company also has a knack for putting up surprising quarters and so a miss might send this lower in the near term.

Disclosure: Long

Thanks for this post

I was just randomly checking the new purchases for Alta Fox in Q1 25 and was digging a bit further into this one. You provided a nice overview and then some of all the info I was able to find for now.

Looks interesting!