Event #3 - It might be time to get into Forward Logistics (FWRD)

Blackstone and Apollo might be the final chapter to this turvy story

I returned, and saw under the sun, that the race is not to the swift, nor the battle to the strong, neither yet bread to the wise, nor yet riches to men of understanding, nor yet favour to men of skill; but time and chance happeneth to them all

Ecclesiastes 9:11

The market has been throwing a bunch of fascinating opportunities out lately - so expect me to be writing a fair bit - though some I have refused to write about (but have discussed with some friends) for reasons pertaining to our geopolitical climate/tensions but of which I have discussed privately with a few individuals. I was criticized by a buddy of mine w.r.t ethics on embellishing certain stocks which profit from the demise of “keep the peace” that has governed us so well in recent history.

With that said, the idea I’d like to highlight today is Forward Logistics (FWRD). This is a very simple idea that I feel is ripe now for the taking, with huge upside potential, given the amount of leverage through the capital structure.

I will not be fleshing out the business in full detail but would rather highlight the setup as is, right now. Essentially, FWRD was historically a pretty good business trading >$100 per share, before a a terrible acquisition was made, erasing significant equity value. Over the last year or so, there has been repeated agitation for change but to no avail, at least up till recently, whence green shoots appear to be springing forth - not only on the strategic side of things but on the technicals as well, with the stock busting through all the short-term moving averages today (can already hear guttural sounds)..

Anyway, how the entire corporation got so bombed out is as follows:

In August 2023, FWRD in gross negligence and classical capital cycle mistake, paid a fat premium to acquire Omni Logistics at the peak of the freight cycle, literally at the tail end of the freight boom, right before the industry turned down. The deal was a disastrous one in that not only was the deal done at a multiple that was overvalued on peak earnings, and at a premium to the acquirer’s, it was done via a highly dilutive equity issuance, which resulted in the proforma entity saddled with a fat debt burden, and vulnerable to the impending freight downturn.

The deal was so bad that FWRD’s stock collapsed significantly, >50%, between deal announcement and deal close. The worst part of the whole thing? Shareholders could not say a damn thing and this was structured in a way to avoid a shareholder vote - in simple terms, FWRD conducted the deal via a reverse merger of sorts and a share-asset swap.

Shortly after, come end 2023, FWRD, in the face of the sharp freight downcycle, realized they blew it and attempted to terminate the Omni deal but was forced to close the deal at a modest price cut to the original terms.

Shareholder lawsuits ensued but futile nonetheless.

Come May 2024, Irenic Capital files a 13D, disclosing a ~5% stake and begins a private engagement with management, pushing for strategic review. A few months after, in August, Clearlake Capital bumps up its stake by more than 50% up to a 14% stake and flipped from passive to active, calling the company to review strategic options. Within the same month, Ancora joins in as an activist, publishing a scathing open letter criticizing the company’s share price performance over multiple time periods and demanded a sale of the company. Fast forward to October and Alta Fox enters the fold with another scathing letter - caustically sardonic - “Do not confuse our stake as a vote of confidence in the Company's Board and leadership. On the contrary, we view your disastrous track record of ignoring shareholders’ views as abhorrent.”

In any case, Alta Fox does not seem to be involved any longer but Clearlake, Ancora and Irenic still own non-trivial stakes.

In fact, there were many event-playas involved in the FWRD circa 2024 at prices much higher from here ~mid 30s, and I think most have abandoned ship as the process dragged on without much fruition, the board of directors not doing much at all until the lapsing of 2024. It was only on 6 January this year, when a formal announcement of strategic alternatives was made. Sheesh…

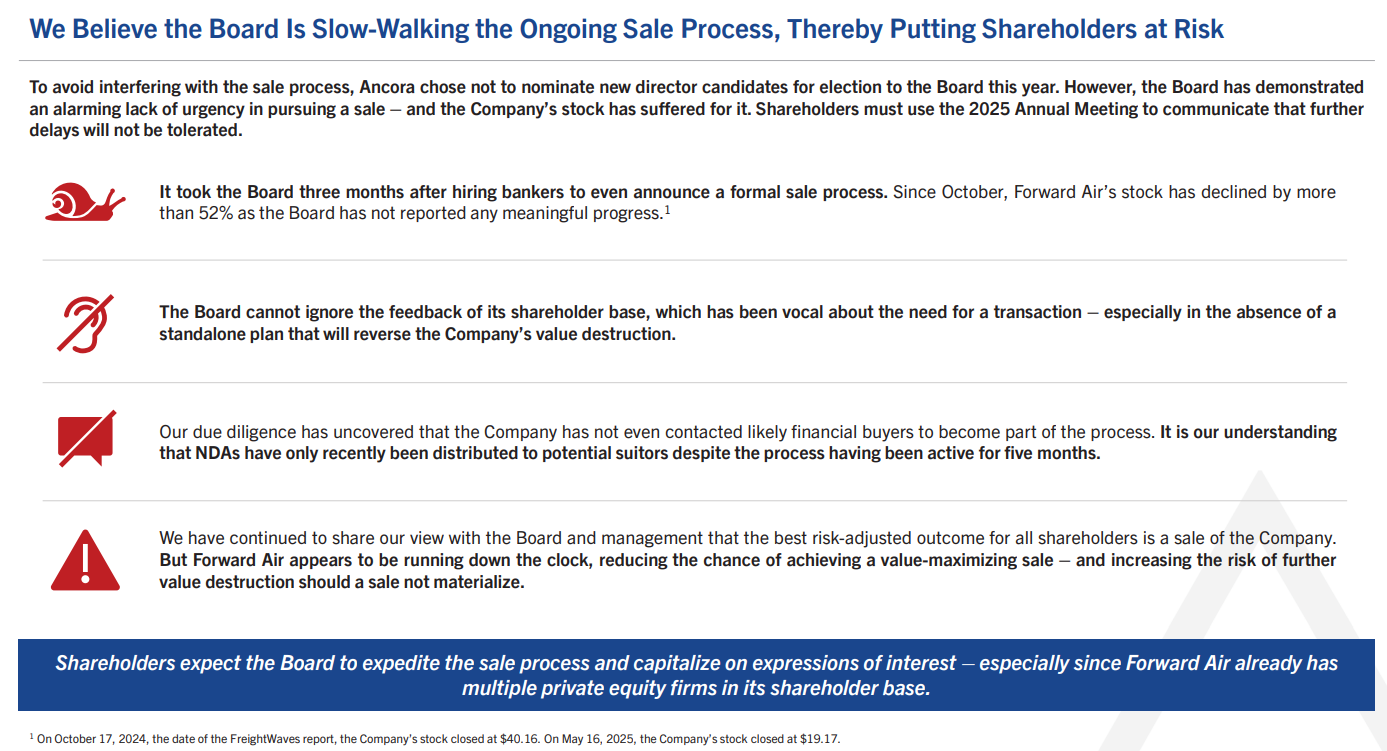

Fast forward into May and Ancora issues yet another scathing letter leading a successful campaign in removing three long-serving directors in the 2025 AGM. The presentation prepared by Ancora, captured basically the background and the strategy going forward (:p).

The governance and merger issues of times past:

The sequence of activists involvements:

As of May, the issue purported by Ancora was that the board had not even contacted financial buyers then and had been purposely delaying the strategic process which has resulted in equity value erosion.

Later on in the presentation, after Ancora sort of cooled down a little, they began to meticulously highlight why FWRD is a compelling business to own which essentially boils down to FWRD’s core business. Prior to the acquisition of Omni, FWRD was an asset-light transportation and logistics company with its expedited LTL division, a crown jewel. As one can see, prior the disastrous acquisition in FY23, FWRD consistently generated mid teens and higher returns on capital with low to mid-teens EBITDA margins.

Profit margins have taken a dump in FY24 and beyond resulting from prolonged negligence and gross mismanagement - FWRD’s LTL division had underpriced its services relative to peers, as well as underutilized its network, leading to an inefficient cost structure and thus, inferior margins, relative to peers.

FWRD in their latest Q1 25 presentation exhibit the margin differences:

In any case, whatever improvement can be made would be ultimately the rewards reaped by an intrepid private buyer of this company, and it is unlikely (I hope) that I’d have to wait to see the improvements as purported.

The main crux of the presentation to me is what is obtainable in a sale and it appears that even a transaction at the low end i.e. 12x EBITDA, would yield a stock price double from where we are trading today. Even at 10-11x, assuming buyers attempt to extract their pound of flesh from an over-levered entity operating on a ticking-time clock, would yield a stock price in the 30s easily. Given the amount of leverage through the EV, every turn of multiple yields a ~$7 stock price up/down.

The stock rallied significantly today to ~23 and change. This is because the best part of the set-up was reported over the weekends - that FWRD has not one, not two, but a quartet of major PE players including Blackstone and Apollo, eyeing a potential takeover, on top of Platinum Equity, as well as Clearlake (FWRD’s largest shareholder). Initial bids are due for submission in the first week of July. Moreover, the article also hints that “there is a possibility other suitors may emerge.”

Given the multiple, credible players involved e.g. Apollo is known to diligence fast, move fast; Blackstone, we all know too well off; and Clearlake has a ~13% toe-hold on the register; it is likely that a resolution, a resolution that should be amenable to shareholders (less-likely a pound of flesh extraction by one singular, powerful buyer) should come to form soon.

Thanks for sharing.