Finding a bargain in Five Below (FIVE)

Is a dollar of profit at Five Below worth the same as at Best Buy?

Introduction (If you hate my story-telling, please scroll to the Background section)

A lady once asked me a thought provoking question, “why have children?”

Redirecting my gentle gaze to the ceiling and stressfully clasping a chunk of hair on the back of my head, I pondered and dug deep, with the intent of conjuring an impressive answer.

The testosterone in me blurted, “to pass down the huge wealth I would amass some day, my children are my legacy!” and my traditional Eastern roots interrupted, “so someone would take care of me when I’m old and decrepit!”

Unsatisfied with my answer, she gracefully responded, “Here’s what I think… children provide you access to a world of emotions you would never have had access to… say your child was ostracized at the playground, the hurt you’d feel is only exclusively accessible to you as a parent.”

I thought the answer was quite perfect and soothing to my ego. I would never have been able to answer that in short notice unless I were a parent. But notice I used the word “quite”. Because deep down the answer still wasn’t perfect…

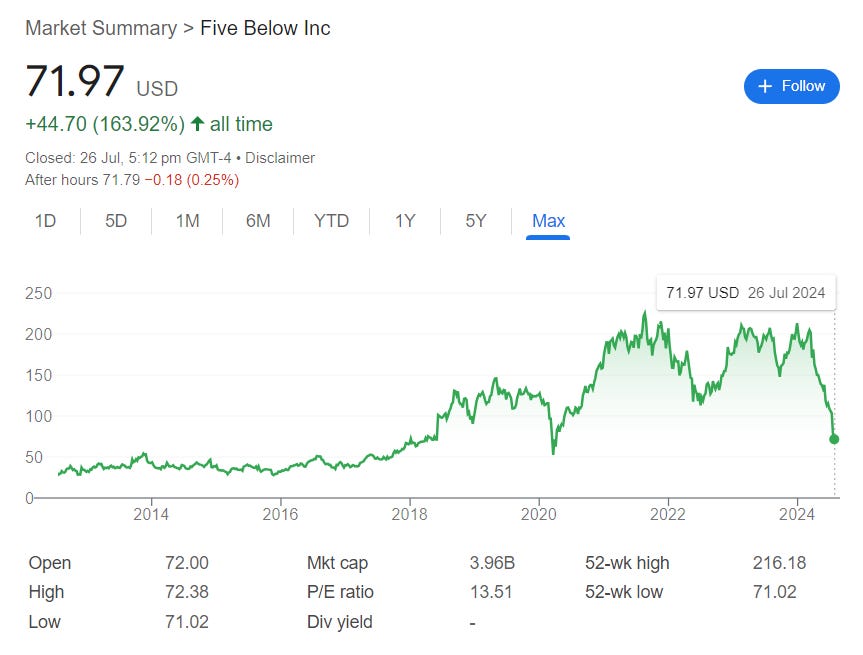

Until I saw the price chart of FIVE - a popular specialty, discretionary retailer catered for children and teenagers. The stock in free-fall since the start of the year, I telepathically hear the painful cries of stuckvestors who disregarded valuation, the feeling not dissimilar to busting your knee in a scrappy leg entanglement exchange on a Wednesday jiujitsu night class, because you were negligent of your knee line and refused to tap … such tends to provide interesting investing opportunities.

I opened up my notes, triangulating key questions to answer for this stock and like a voice from heaven, I found the perfect answer to why one should have children.

Children provide you access to a world of stocks you would never have understood until your 8 year old daughter begs you to take her treasure hunting at the local Five Below…

*satire by the way

Background

Five Below is a value-based specialty retailer selling trendy items catered for children and teenagers; think Dollar General but larger stores, wider range of prices, urban/suburban communities, more vibrant and catered for juveniles.

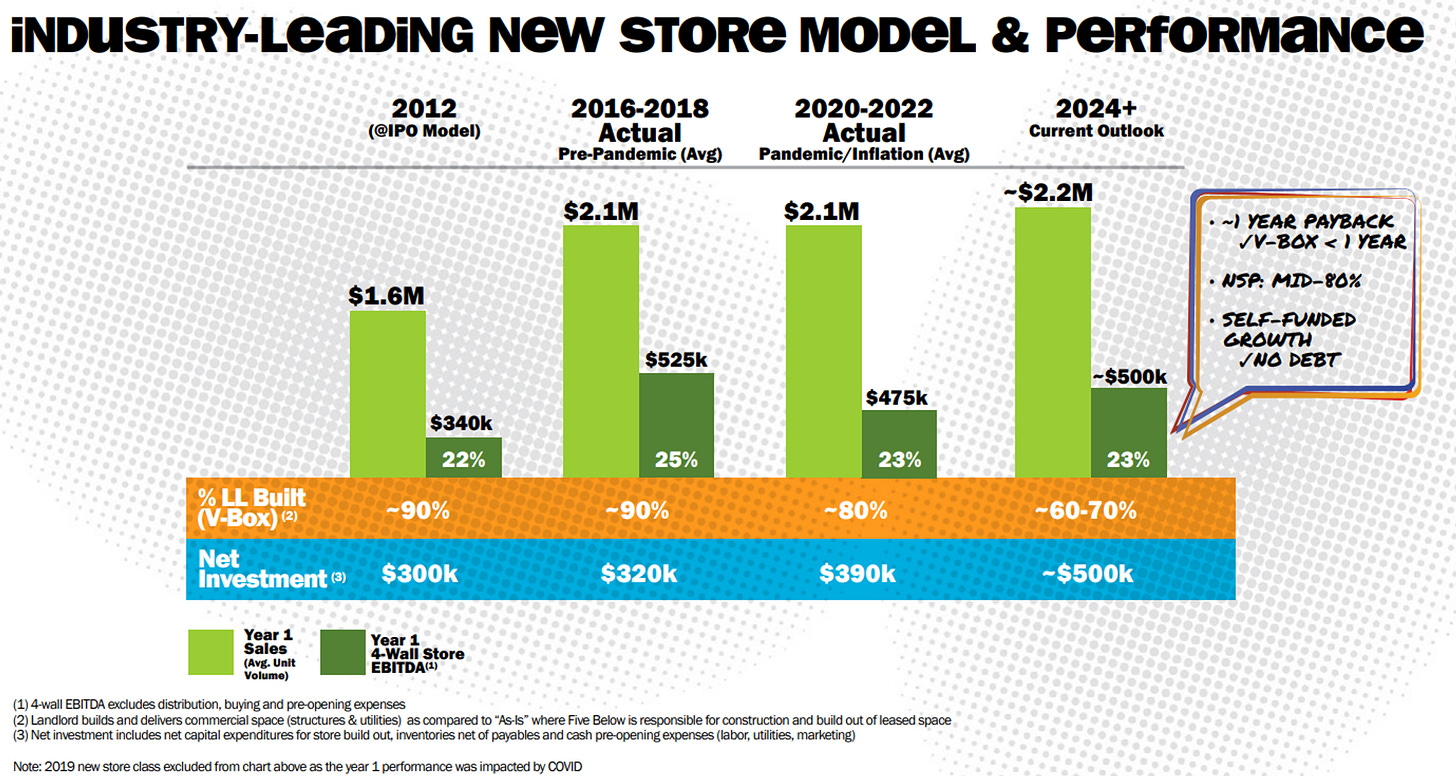

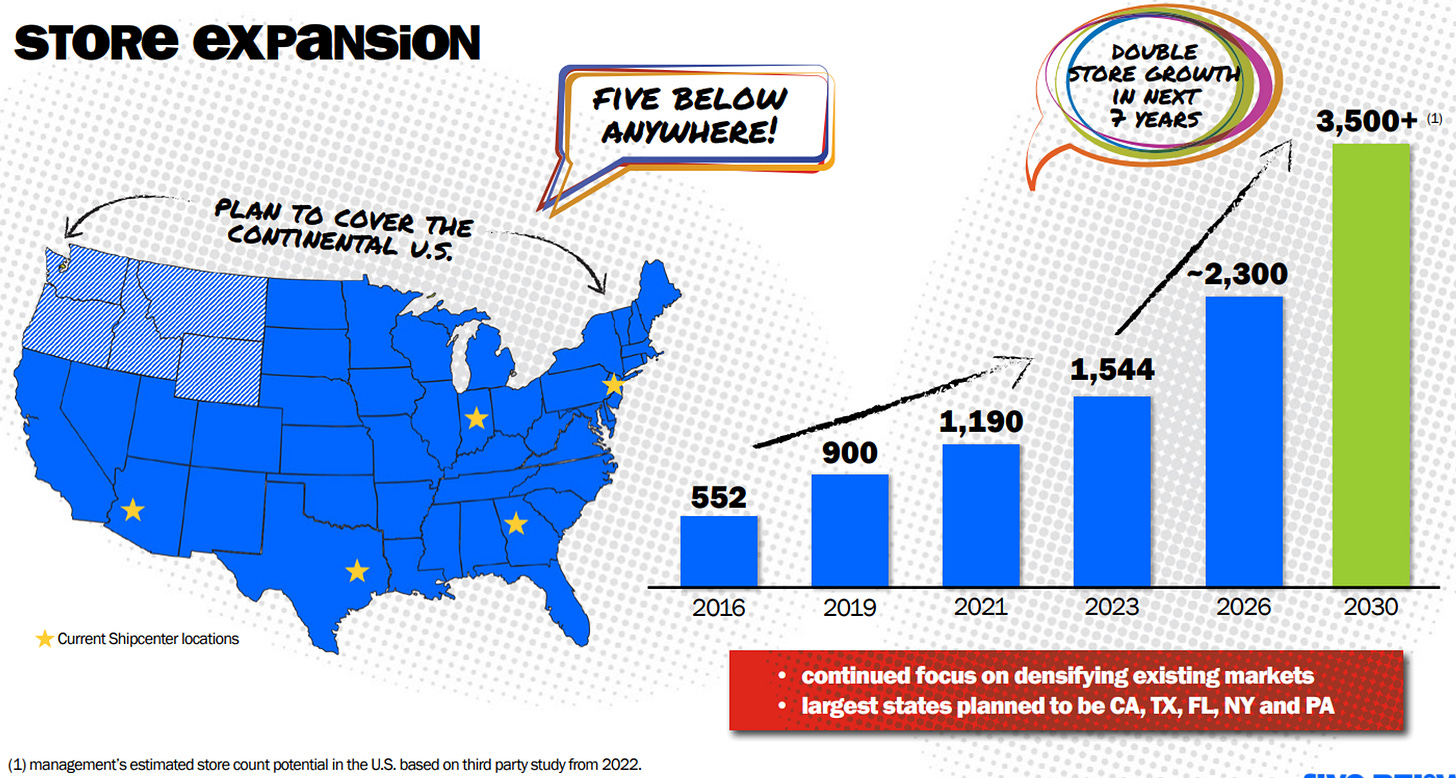

Due to its excellent unit economics (1-year payback) and long runway for growth, FIVE was a market beloved, trading at ridiculous multiples - the market according extremely high expectations for the business.

That lasted until recently… as we’ve all been accustomed to - existing entails death.

The key issues plaguing the stock are as follows:

At the end of fy23, management guided to comparable sales of flat to 2% for Q1 24 and flat to 3% for fy24.

Q1 comes along and the company nets a -2.3% comp (missing the guidance) followed with a -5% guide for Q2 24 and a revised -3% to -5% comp decline for fy24.

2 weeks ago, as if management couldn’t destroy credibility further, the CEO resigned abruptly and FIVE again, revised guidance downwards to -6% to -7% comp decline for Q2.

In other words, the market has synthesized these recent actions and concluded that the business concept is impaired and management has no darn clue what is going on. Ex CEO (Mr Anderson), perhaps as some speculate - expecting results to deteriorate further - decided to jump ship to another dumpster fire Petco (WOOF), for not much a base salary increase and an equal salary bonus. In fact, the hurried exit of Mr Anderson was responsible for the recent 30% leg down from ~$100 to ~$70 per share i.e. ~1.7bn of market capitalization erased.

This is not to say that FIVE is not experiencing problems but fundamentally I believe

Headwinds may prove to be temporary

Valuation is way too cheap

There are easy fixes to create value here

Headwinds may prove to be temporary

With elevated inflation and a tapped out consumer, retail has been facing headwinds in recent years; the implication thereof being discretionary goods retailers catered to lower income demographics are swimming against the tide as they are not of first importance in wallet share.

Headwinds in discretionary goods were an issue since the last fiscal year and to the credit of FIVE, analysts were praising management for navigating the swamp and comping positive growth despite competitors drowning. For example, DLTR discloses discretionary comps and its retail brand - Family Dollar - is and was seeing huge declines in discretionary comps since last year.

The headwinds are persisting still and some resilient retailers are starting to succumb to the tide - i.e. this recent quarter was Dollar Tree’s first discretionary comp decline since the onset of COVID. DG is not so transparent but has indicated softness in discretionary comps and looking to layer promotional activity to boost sales. In other words, this is an industry-wide headwind and not unique to FIVE.

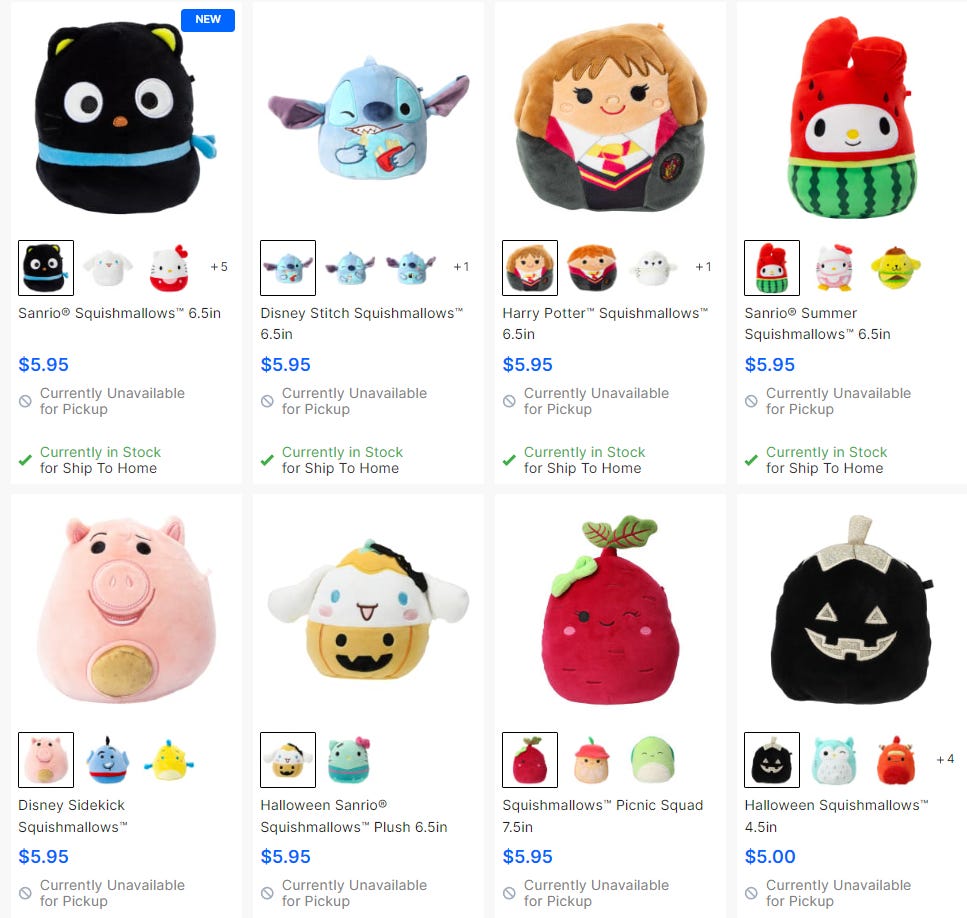

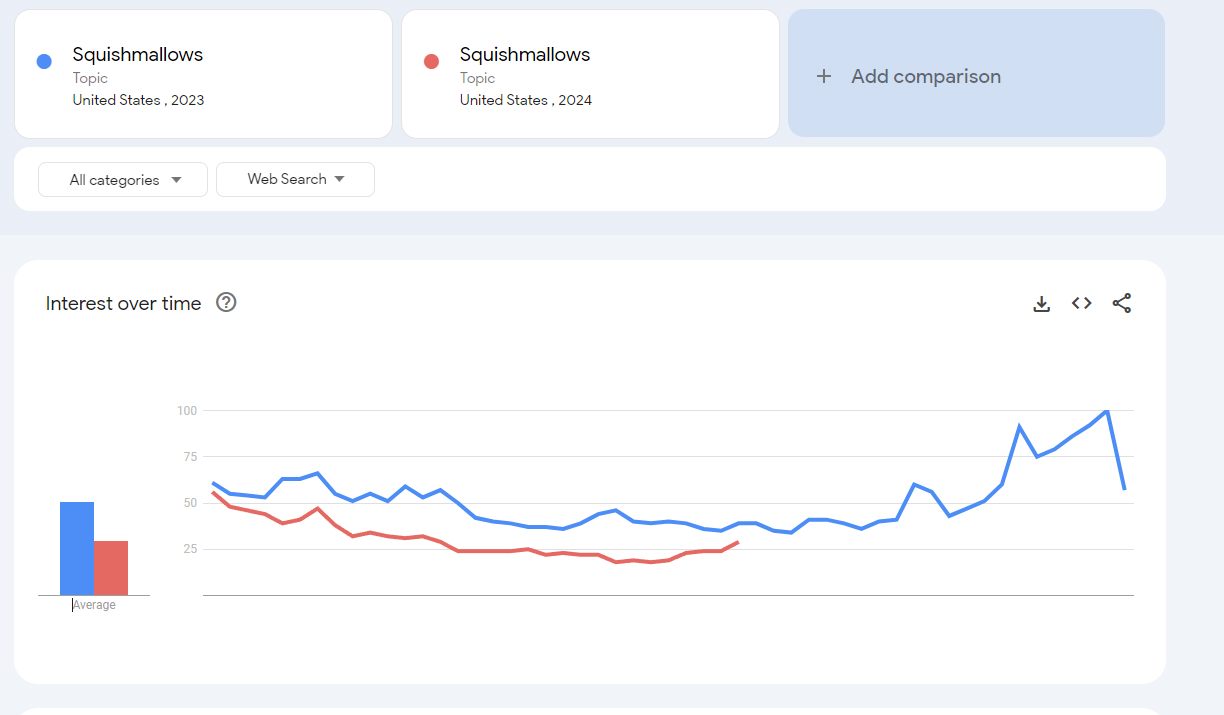

FIVE indicated in their recent quarter that consumables (i.e. candy, food, beverages) have comped positively (in-line with peers) but discretionary faced difficulties due to issues lapping squishmallows, which were extremely popular and “cult-like” last year - explaining why FIVE managed to comp positive whilst competitors were drowning.

This makes sense when reconciling the recent quarter comps decline of ~2.3% resulting from a 2.8% decline in transactions offset by a 0.5% increase in transaction value i.e. people have been shopping less (not as much as when squishmallow was all the rage last year) but buying more.

Moreover, management stated they were caught afoot given that comps really dropped off around Easter and into May which jives with Dollar Tree’s commentary on Easter being challenging this year. For such retailers that rely on holidays to really drive sales, any weakness during specific holiday seasons can really distort earnings.

Last but not least, 50% of FIVE’s customer demographics is in the 0 to 50k annual income range and though higher income cohorts have traded down, it isn’t enough to offset the squeeze out in the lower income bucket.

Another fear that seems to pervade investor sentiment is Temu risk. I’ve been studying PDD on the side lately so the rapid ascent of Temu and the fact Amazon is addressing them validifies said risk. However, I do think FIVE value proposition is different and that ties us into the introduction satire. Speaking to regular FIVE customers, the prevailing sentiment seems to be, “yes Temu is cheaper but delivery time sucks and my kid loves the treasure hunt experience which is why I bring them to our local Five Below every week!”

Analyzing comps

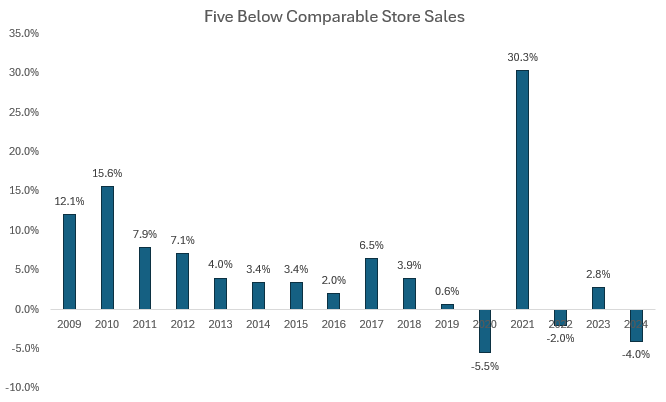

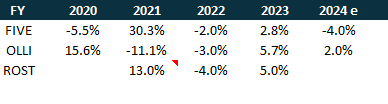

As seen in the diagram above, retail is a lumpy business; FIVE comped -5.5% in 2020 due to COVID, before resurging 30.3% in 2021, and then having staggered years subsequently. This is not unusual as demonstrated by Olli and ROST.

ROST doesn’t provide 2020 figures given the pandemic-induced abnormality, so 2021 comps against 2019 figures.

Let’s iron out the figures a little bit:

Not apples to apples but Olli’s stacked comp (multiplying the percentages across the years) rate from end of 2019 to end of 2024 will be a mere 7.47% growth whereas FIVE notches at 19.09%.

Starting from end of 2020 instead, Olli’s sales will be down 7.03% by end of this year whilst FIVE is up 26.02%.

As mentioned, ROST comps 2021 figures against 2019 figures. Regardless, 13% is barely impressive when FIVE’s 2 year stacked growth (I comp 2021 against 2019 instead of 2020) is 23.13%.

ROST, despite being a undisputed top tier retailer, also saw a comp decline of -4% in 2022 before rebounding 5% in 2023 - great business do see comp declines too.

To distill the figures above simply, FIVE’s numbers remain best-in-class and minor aberrations in comp are completely normal. For the market to freak out over a -4% estimated comp decline for FIVE this year, illustrates the high expectations the market had for FIVE but also a disregard for the ebb and flow dynamics of business in a chaotic world.

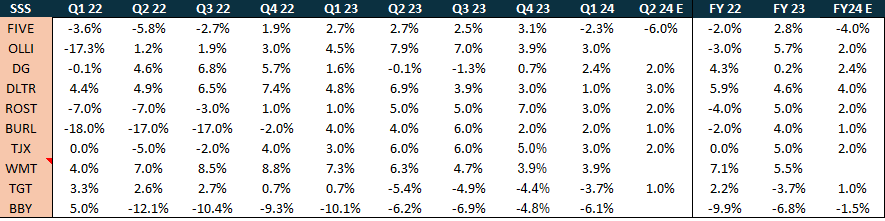

Below is another table showing the ebb and flow of comps for other similar retailers:

Valuation

This brings me to my next point. Valuation at current prices is ridiculous.

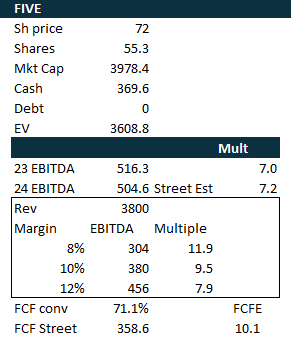

FIVE currently trades for 7x 2023 EBITDA and 7.2x 2024e EBITDA. Using management revenue midpoint guidance and provisioning for margin deterioration, even at the worst 8% margin, not seen since 2009/10, lends us a ~12x multiple which isn’t that expensive though such a scenario is unwelcoming.

Consider that during 2020, i.e. COVID year, FIVE comps declined -5.5% (refer to table above), yet EBITDA margins came in at ~11.5%. Of course, the seasonality of results helped in that most of FIVE’s earnings come in Q4 during the holiday season and by then, COVID had tempered down a lot.

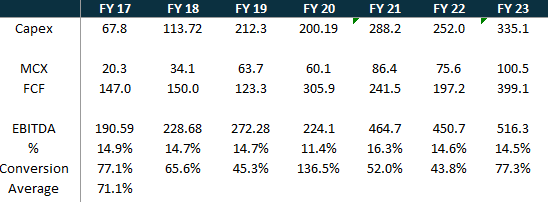

Management doesn’t reveal maintenance capex (MCX) but this can be implied from some simple analysis and examining other retailers.

First up in the 2022 10k (pg 43), FIVE guided to spending 145m to open 200 new stores (actual figure was 204 new stores). Total CAPEX for 2023 came in at 335m with 252m allocated for stores indicating ~100m for MCX. In 2022, the guide was 85m for 160 stores (actual was 150) against 169m of store capex, equating to MCX of ~84m. The figures bounce around a fair bit but they can be ridiculously low. For e.g. in 2021, FIVE spent 120m on stores with 95m for store growth equating to a mere 25m of MCX for ~1100 stores. I believe the figures in subsequent years climbed higher due to incorporating Five Beyond into legacy stores.

Analyzing peers, convenience store peers like Casey and Murpheys - MCX ranges from 10-25% of capex. ROST in 2018, for e.g., had ~1700 stores and indicated that 30% of their 475m capex budget will be allocated for MCX which irons out to around ~143m.

In 2023, FIVE ended the year with ~1500 stores and considering each box is ~9k SQF vs ROST’s ~20k SQF, factoring inflation, we could easily triangulate around ~80-100m of MCX which is exactly 25-30% of the total CAPEX spent in 2023.

Mathing it out, this gives us an average EBITDA to FCF conversion rate of ~70% across the last half a decade (note true FCF could be a lot higher as explained above). Again, this is not exact science but I don’t think maintenance of retail boxes are that capital intensive anyway.

Converting our street est EBITDA into FCF, gives us ~10x FCFe (excluding net cash from market cap), a very reasonable valuation.

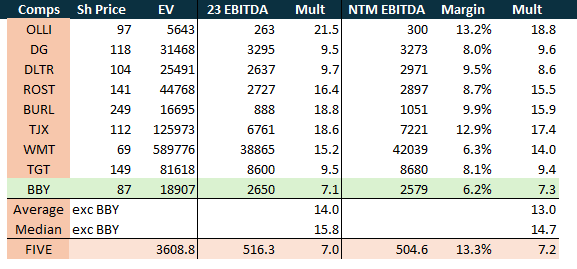

This is where it gets bonkers. Have a look at where peers trade. Despite sporting top tier margins and a debt-free balance sheet, FIVE trades at the lowest of its peer group, and ~half the median and average multiple.

At this point, FIVE trades close to BBY, which I wouldn’t consider a peer but was included to illustrate the next point.

The Best Buy Comparison

So Best Buy (BBY) is also a discretionary retailer except its products are on the opposite end of the spectrum v FIVE. Unlike FIVE’s low ticket, high frequency products, BBY sells high ticket, low frequency items i.e. electronics and hasn’t been that great of a business; the market valuing FIVE at BBY’s multiple despite BBY margins being less than half of FIVE’s, seems to tell me that the market thinks FIVE is a weaker business than BBY.

Here’s why that’s bonkers.

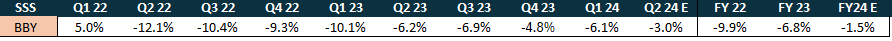

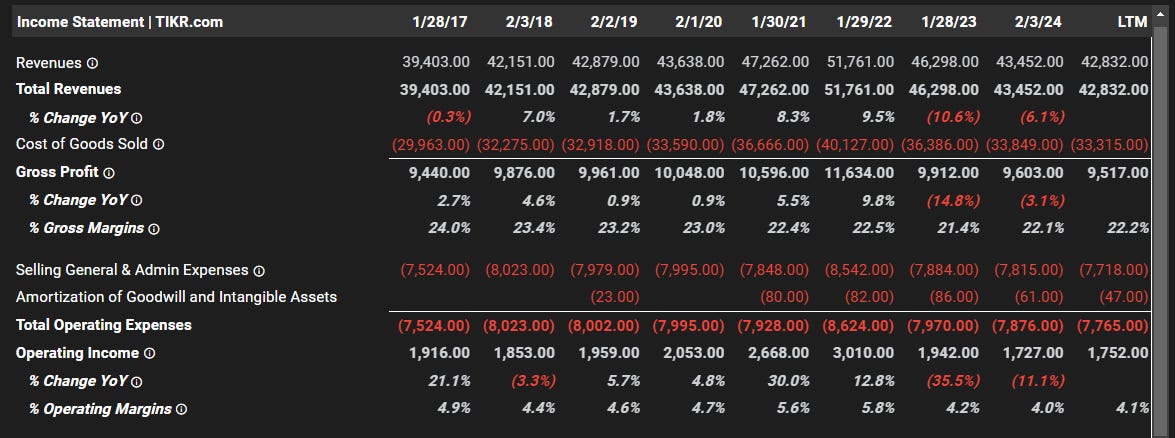

BBY’s comps have been deeply negative since 2022 though management believes it will moderate this year. There’s always light at the end of the tunnel!

Revenues hasn’t grown much since 2018 and operating income is lower than 2017.

Interestingly, despite SSS turning deeply negative in fy22 onwards, operating margins declined not more than 2% which really questions my bear margin assumption of 8% for FIVE.

With BBY margins substantially lower than FIVE’s, BBY has substantially less cushion to deal with any forthcoming headwinds.

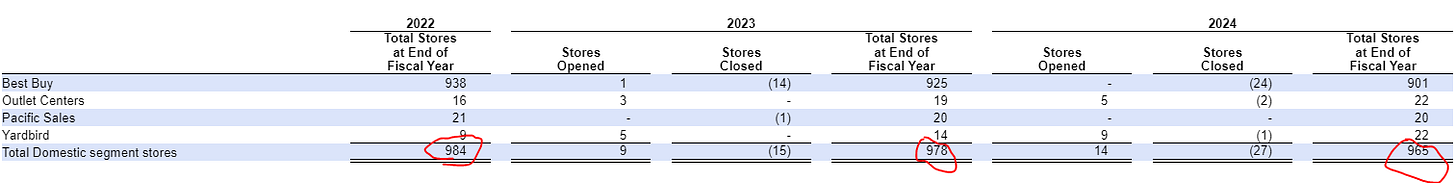

Whilst FIVE has been growing its store footprint, BBY has been actively shrinking.

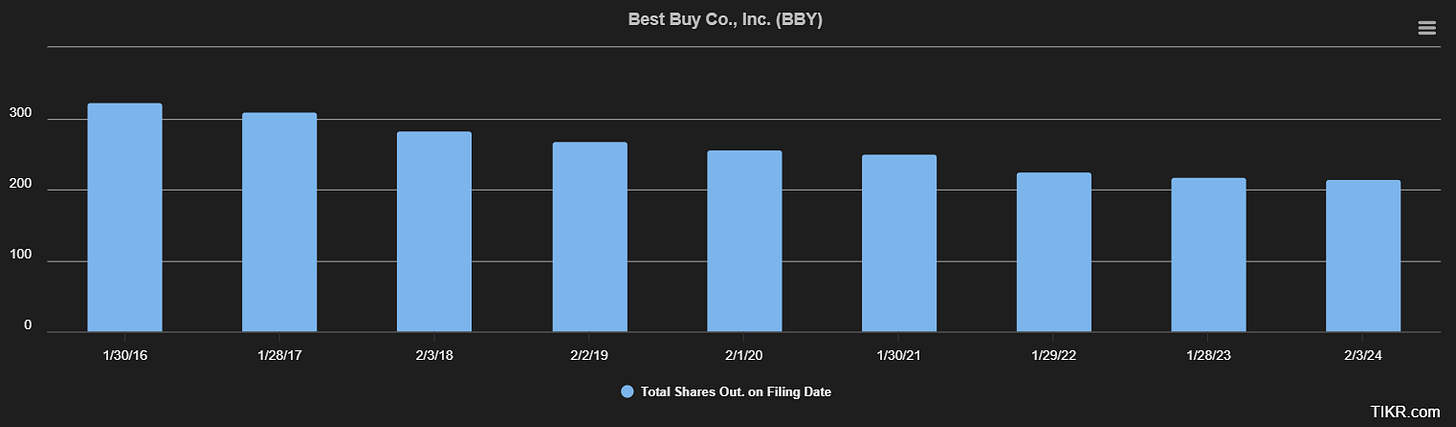

The key reason why BBY has been able to grow its share price comes from hammering its share count (something FIVE should begin doing with its spare cash at these prices).

In sum, BBY is a vastly inferior business and yet the market is saying FIVE should trade at the same multiple as BBY - an undifferentiated, no growth, low margin retailer - insane. This is my key variant view of this stock and why I find the opportunity at FIVE here compelling especially if one considers the current issues to be transitory.

By the way, you would think BBY trades nasty but despite revenues going nowhere since 2017, the stock is up a cool ~70% since or flat, depending on your start point. Not a great return but could be a lot worst given how horrible the P&L has been.

Potential value resolutions

Considering the three-legged stool of value creation in retail:

New store growth

Comps growth

Capital allocation

Right now the market is saying, yes 1) is intact but 2) and 3) are in the dumps.

With ~370m of net cash on the balance sheet, not including the additional cash flow generated by year end, FIVE, like BBY, should take the opportunity to hammer its share count down, potentially retiring 10% of its market cap even if in the expense of new stores growth, whilst keeping the balance sheet untethered. This fixes 3).

For 2), FIVE should, again, slow down new store growth and focus on improving merchandise, discovering trends and converting legacy stores to incorporate Five Beyond (higher price point tier - $6 - $25). Currently ~60% of store base has been converted with a goal of 80% by year end. Notably, post-converted stores outperform non-converted stores by MSD % not so much due to the higher ticket items but due to more transactions i.e. customers return more often given the larger catalogue.

The best time to buy retail is when comps turn sour and the market can’t look past a few quarters. With a clean balance sheet, management has breathing room to fix operations and make good decisions. Next year, comps should be much easier to lap given the negative growth this year and the market will be ebullient again, whence FIVE can continue its store expansion plans.

Thomas Vellios, co-founder of FIVE has stepped back in as Executive Chairman to aid the interim CEO and help source for a new CEO. Thomas was the visionary of this concept and currently owns ~24m worth of stock so it’s great to have him back, active.

Risks

Economic recession

I’m not too worried given the clean balance sheet. FIVE actually managed to comp positive during the GFC and eked its first EBITDA profit in the depths of 2008.

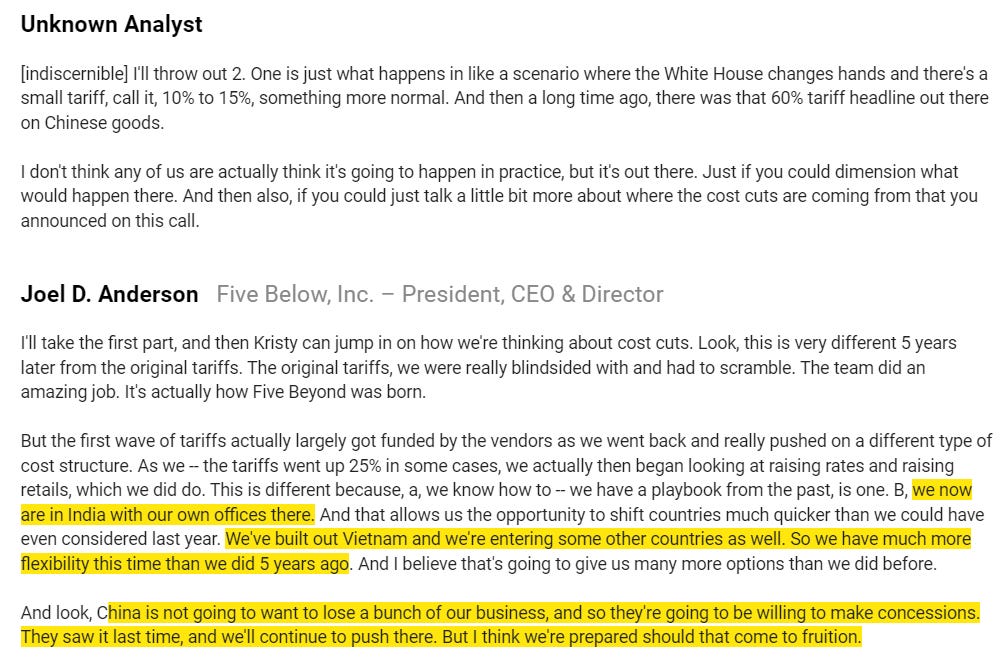

Tariffs

Management addressed this in the recent Oppenheimer Conference (transcript below)

FIVE has a more diversified sourcing base than in the past which should help alleviate tariff pressures should they come. It’s also worth noting that other competitors will be affected similarly.

Retail concept falters/competition

As is the risk with specialty retailers, there’s a potential that the concept of FIVE just loses its place going forward perhaps as Temu continues to grow and demonstrably proves to be a threat.

Not a perfect comparison at all but retail is scary and what astounded me was Shein/Temu swift assassination of UK darlings i.e. ASOS and Boohoo; not too many years back, ASOS was the thing. I’d see stacks of ASOS parcels piled up at the parcel collection area and I’d take the time to notice who were the fashionable girls living in my college dorm.

This is less surrpising but the last few years has seen a whole slew of retail bankruptcies in the US.

Management reassured that comps weakness was across all geographies so it wasn’t due to competition from left-field.

The upside of deceased retailers would be of course, lesser competition and perhaps cheap discarded stores for FIVE to pick up - e.g. FIVE picked up some TUEM stores when TUEM went insolvent.

Conclusion

I think the market has priced a lot of pessimism into FIVE given the slew of events lately on the backdrop of a nasty market tape. Nevertheless, I think this is another case of over-extrapolation of recent events which should correct itself in times past.

Thanks for the post and I enjoyed reading it. Have you looked at Savers Value Village? Any thoughts or comments?

Really enjoyed this piece. Nice work! Looks like others include the lease obligations in the EV as debt. Any thought on this approach?