Innovative Solutions & Support (ISSC) - Market ignoring accretive acquisition?

Price : $7.77

Average Volume: 27.8k

Brief Overview

ISSC operates in the aerospace sector, has been growing organically ~20% p.a. over the last few years, generates high incremental margins and stratospheric post-tax ROIC. A few months back, the company made an accretive acquisition of Honeywell’s product line with the potential to augment revenues and earnings bigly. The market has decidedly paid zero attention, with the stock trading -3.7% ytd and the proforma entity trading at a 10x to a low teens multiple (depending on one’s estimates) for what should be worth a lot more, reasonably valued.

The stock trades around ~$200-300k per day and ideal for small funds and personal accounts.

Background

ISSC designs, manufactures and sells avionic solutions in the air transport, business aviation and military markets with customers ranging from Boeing, Pilatus, FedEx and the DoD. The firm focuses on modern cockpit solutions through the integration of measurement systems and display systems. Notable innovations/products include the proprietary autothrottle - ThrustSense, Utilities Management System (UMS), Flat Panel Display (FPD). The UMS for e.g., replaces 22 traditional subsystems in the aircraft, whilst the FPD ensures every subsystem is displayed clearly; as per management, the combination of ISSC’s avionic solutions provide the most advanced cockpit system developed globally.

The quality and importance of said products is demonstrated in the firm’s gross margins. Apart from the period 2012-2015, which saw gross margins hovering in the 30s, GM has generally been around 50-60%. The reason for the period of low GMs was a result of engineering development contracts (EDCs) comprising >20% of revenues which are basically OEM-financed R&D i.e. reimbursements and basically entail thin margins, meaning that inclusive of internal R&D, ISSC was spending 35-40% of revenues on R&D.

With GMs in the 50-60s range (similar to that of Transdigm), this attests to the scarce competition facing ISSC’s avionic products as new entrants would typically suffer long lead time for product development, followed by the uphill attainment of FAA approval and building relationships with the end-market.

For brief background, ISSC grew rapidly in the early 2000s as RVSM standards aimed to fit more traffic into heavily traveled air routes, spacing planes at altitudes within 1000 feet rather than 2000 feet, thus requiring more precise RVSM-compliant altimeters, forcing airlines to upgrade their equipment. In 2006, the FAA mandate for RVSM installation passed, depleting ISSC’s order-book, sending revenues plummeting from north of $60m in 2005 to a mere $17m a year later, with the bottom line entering bleeding territory. In the following years, ISSC revamped their product line, plowing gobs of cash into R&D, developing flat panels for e.g., with the mission of modernizing and making efficient, aircraft cockpits.

In 2013, Delta contracted ISSC to retrofit their MD-88/90 fleet cockpit, adding >60m to their backlog, before reneging on the contract in late 2014, sending ISSC’s revenues and shares plummeting. From then, management began to alter their approach, focusing on a few key internal innovations, sole-source with price advantage - a prime e.g. being their autothrottle, providing up to 10% fuel savings, and marketed in both the OEM and aftermarket.

Revenues bottomed in 2018 and has been growing organically at ~20% CAGR p.a. ever since with the firm pulling in more revenues from the OEMs - more predictable but lower in margins - to provide better income visibility; OEM revenues are estimated to comprise 40% of revenues with the remainder 40% coming from aftermarket and 20% from repairs.

Acquisition

Just prior to the acquisition, ISSC’s production facility was only 30% utilized. Given incremental utilization would not lead to a commensurate increase in cost, every incremental dollar of revenue falls straight to the bottom line and thus, ISSC kickstarted an acquisition game plan, hunting for 15-20m revenue bolt-ons.

In Q3 this year, ISSC got what it wanted with a $36m acquisition (comprised of cash and a term loan) of several product lines (in the picture above) from Honeywell, with said products found in thousands of aircrafts, complementary to ISSC’s existing offerings* and sporting GMs in the 50-60% range. Moreover, for certain products, there is the optionality of selling into the military market and further iteration thereof.

*previously, ISSC would have to go and purchase idiosyncratic products from Honeywell (at a markup) when presenting their solutions to a customer.

Apart from IP, tooling and test equipment, no labor or facilities were acquired in the transaction.

A few points worth considering then.

What was the multiple paid?

Honeywell generated around $9.5m of net income in 2022 from this product line i.e. ISSC paid a mere ~4x earnings, ridiculously cheap.

Why was it sold so cheaply?

Management mentioned that Honeywell was moving towards next generation avionics and so these products were no longer core to operations. My view is that given the relatively small % of profits these products contributed to Honeywell*, the seller was price insensitive and looking for a good fit (ensuring OEMs e.g. Boeing, won’t be affected by the transition) rather than the best price. What’s another $30m to a monolithic conglomerate spewing $5b per annum?

Moreover, since there were ~7 bidders at the table, it is unlikely that ISSC stumbled into a pit latrine.

Post acquisition, management guides to an increase in revenues and EBITDA by at least** 40% and 75% respectively - before synergies - which I believe to be sandbagged, to be explained in the next section.

Proforma Earnings

Abbreviated financial statements exhibit that said product lines acquired, generated $21.5m of revenues and 9.5m of EBIT in 2022, and poised to generate ~20m of revenues and ~10m of EBIT in 2023. ISSC generated ~27m of revenues and ~7m of EBIT in 2022 and will likely, generate ~29-30m of revenues and ~7-8m of adjusted EBIT (net of one-time expenses) in 2023. In other words, if the abbreviated statements can be taken at face value, this would increase revenues by ~60% and EBIT by ~100% (post transaction accounting adjustments).

My estimates are laid out below:

I make a few assumptions

Annualize the 2023 9m revenues for ISSC’s current operations and assume zero organic growth into 2024

Acquired product revenues are 80% of historical revenues (16m rather than ~20m) - assume some revenue attrition

<60% gross margins (lower than 2022 GMs)

13% R&D (guided by management prior to the acquisition), compared to the historical 9-10%

28% SG&A, cancelling out exceptional costs (e.g. SBC) in 2023 but accounting for slight labor expansion resulting from acquisition (note this SG&A still runs a few % higher than prior years)

1.6m interest expense

21% tax rate

In sum, I estimate ~45m of sales, ~13.5m of EBIT (30% margins) and EPS of $0.54 for fy24. Management has previously estimated that revenues of $50m should generate ~30% EBITDA margins so we’re right around that ballpark. From a different angle, the acquired products, integrated into the current cost structure generates around 40% EBITDA, which assuming reattribution of 1.4m SG&A from the 8.14m of SG&A, gets us to around ~40% EBIT margins ((7.78m - 1.4m)/16.03m). D&A typically runs 1- 1.5% at ISSC so we’re right around there.

One key question (and a key risk) worth pondering on is → will actual financials resemble abbreviated financials?

Perhaps, as mentioned, there is a risk of revenue attrition due to change in vendor, or the lack of an adequate salesforce means ISSC doesn’t generate the same amount of sales as Honeywell did. I have buffered for this possibility by haircutting revenues 20% (from 20m to 16m). However, there are a few mitigants -

i) while the acquired avionics is entirely aftermarket (more volatile), there remains 15-20 years of sales cycle and they are still bound by contracts:

“we had unique capability at IS&S that made us a very attractive buyer for Honeywell. Because at the end of the day, what they don't want is for this transaction not to be -- not to go well. And they get a lot of grief from Boeing and Airbus and Embraer and Gulfstream and all of those large OEMs, ranging from business aviation to air transport because the people that acquired this product line didn't have the knowledge or the capabilities to perform on these contracts.”

(7/13/23 M&A call)

ii) certain products are critical to operations (inertial reference units for e.g. known as the heart of an aircraft), and so switching to a different product may be too much a risk.

Moreover, Honeywell will be assisting in the initial integration (ongoing now) and ISSC has hired experienced people from Honeywell to aid in this process.

On the upside however, there might be cross-selling revenue synergies as ISSC will be able to cross-sell their proprietary suite of products given that they will be on the approved vendor-list for OEMs operating the acquired products.

Another way of thinking about management’s guidance versus the abbreviated financials is through the revenue to capacity ratio. At ~30m of revenues, management cited ~30% of capacity utilization; post acquisition, management cited ~50% capacity utilization. On a 1:1 revenue to capacity ratio, this equates to a >60% increase in revenues, in line with the abbreviated financials.

Valuation

To an acquirer

Transdigm (TDG) in their recent presentation guided to current acquisition multiples of 12-15x EBITDA - the actual valuation dependent on i) sole source, ii) market mix (preferably commercial) iii) OEM or aftermarket (preferable). On these three fronts, ISSC has quite the attractive profile. 5 years ago, in their 2018 analyst day, TDG guided to acquisition multiples of 9-12x EBITDA so valuation has etched up a fair bit since.

Another example would be UTC taking out Rockwell Collins at 16x EBITDA in 2017 - again when multiples were lower.

Historical and peers:

Historically, ISSC traded at a high teens to 20x EBIT, sporting a P/E in the 20s. Note, peers (albeit larger and diversified), Honeywell, Howmet Aerospace, Garmin, TDG - trade for high teens EBITDA and between 20-30x P/E with some being roll-ups and “arguably” sporting precarious balance sheets.

In any case, should 2024 earnings come in at my estimates (which I believe to be conservative), one can easily envision > $11 per share, which should easily unfold as the combined company proves its earnings over the next few quarters.

Moreover, for what it’s worth, ISSC also currently sports a backlog multiples of what was, a couple years back.

Other points

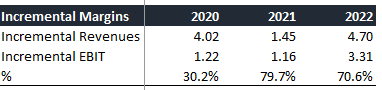

Inorganic growth and incremental margins

Just to highlight what growth does to the bottom line, further capacity utilization should continue to lift margins higher - incremental EBIT has notched in at ~70% over the last couple of years.

ROIC

Over the last number of quarters, ROIC has climbed into the 30s to 40s range. ROE sits around mid-teens, depressed due to a lazy balance sheet.

FCF

The business is FCF gushing as capex runs <1% of revenues and so the term loan used to aid the acquisition should be paid off rather rapidly - guesstimating within 2 years - another minor boost to the equity value.

Potential to be sold

Founder Geoff Hendrick passed away last year and the estate liquidated a bunch of stock over the last number of months though the estate still owns ~9.5% of share capital. I won’t be surprised if this business gets sold eventually. TDG generates similar ~60% GMs but 50% EBITDA margins due to efficiencies and so a large player could easily bolt this on and pay say 15x EBITDA for 30% margins and roll it into their SG&A → pf acquisition multiple will be 9x EBITDA.

Why is this mispriced?

I think this ties in with the risks; you have a stodgy sounding company, with 1 analyst covering, scant liquidity and operating in the rather niche aerospace sector; the acquisition is entirely aftermarket which yes, entails higher margins but could be unpredictable as investors who took a bath on this stock a decade ago would remember, when Delta reneged on its contract. There are also zero tweets on this stock.

This also doesn’t tick the “microcap” checklist of high insider ownership as CEO Shahram only owns 1.3% of shares; all executive officers and directors as a group own slightly north of 2% of shares.

In addition, Christopher Harborne of Klear Kite, is the largest shareholder - not much is known about him other than the fact he has a Thai name and citizenship, and has been involved in some shady dealings with Boris Johnson - no, not just a cup of tea.