Flight Update

Volaris (VLRS)

General numbers for the quarter trended alright.

TRASM fell to 7.92c (from 8.3c in Q2 22 and 8.2c in Q2 21) though still significantly better than pre-COVID numbers - this was partially due to base fares plunging to $47 pp (vs $56 the prior year) for load factor stimulation as a result of domestic overcapacity and a partial cost-savings pass-on as fuel costs came in at a nifty $2.70 per gallon. This was offset by ancillary revenues jumping to $46 pp (vs $37 the prior year).

CASM-X shot up to 4.82c, slightly overshooting management’s range of 4.7 - 4.8c due to currency headwinds, grounded aircrafts and aircraft delivery delays. EBITDAR came in at 27% of revenues and guidance was reaffirmed - 3.3b of revenue and 29-31% EBITDAR margins.

A few key points worth highlighting.

Capacity overhang. ASM growth has now been revised up to 13% from 10%. The quarter suffered some domestic overcapacity and the crux of it is that until CAT 1 is reinstated, overcapacity prevails as excess can’t be easily redistributed. CAT 1 remains the key catalyst going forward - looks to be very soon, in a matter of weeks. In this case, one can be very bullish on RASMs given that once capacity eases, there exists upside potential as load factor stimulation discounts are obviated.

Lack of transparency re domestic and international profitability; this question was raised by an analyst from Deutsche Bank but was more or less ignored by management - and perhaps intelligently, so to conceal route margins. In the recent quarter, it seems that the bulk of profits came from international routes especially on the backdrop of fare weakness domestically.

Guidance presumes fuel costs between $2.55 to $2.65. Economic jet fuel prices are already inching near $3 per gallon ($2.60 + 40c = economic fuel cost as per Q4 22 transcript).

I’ve made some adjustments to my model, using assumptions of 380m of fuel gallons consumed in fy2023, with fuel costs at $3 per gallon and CASM-X of 4.8c, generating ~900m of EBITDAR, on 3.3b of revenues - a 27% margin (undershooting the low end of guidance by 2%). The average fuel cost/gallon consumed in H1 2023 was ~$3.07 and so H2 fuel cost/gallon has to come in quite a fair bit <$3 which seems a fairly tough bet; in other words, a key risk would be escalation of fuel prices - a 20c jump to say $3.20 would take EBITDAR down to 830m (below the Street’s 865m).

To sum it all up, my numbers from the initial write up may have been a little too bullish and the Q2 numbers have provided me more clarity on what to expect for the current year.

Nevertheless, I do think we see a CAT 1 resolution very soon and the stock should react nicely to that - a de-risk for those playing the LT and a good exit point for those playing the event, fingers crossed.

As always, open to feedback.

Pacific Current (PAC.AX)

Every month or so, a simple riffling of the Australian Financial Review (AFR) leads to some interesting ideas - lately, bidding wars (we just had Silk Laser), quite simply due to the relative undervaluation of the Australian stock market.

So here’s one. Pacific Current Group (PAC) on July 26, received a non-binding joint bid from Regal Partners and River Capital, consisting of $7.50 in cash and 2.2 GQG shares (of which Regal will spin-off post-acquisition since PAC owns 4% of GQG) per PAC share, equating to $11.06 (GQG closed today at $1.62) per share. As per the wordings of the document - PAC established an Independent Board Committee… “reflected inbound interest in PAC”, indicating that there was quite possibly, multiple interested bidders.

Sure enough, the next day, GQG announced intent to counter-bid preluding a potential bidding war.

PAC closed today at $10.22, a 7.6% gross spread from the current extant bid by Regal.

PAC’s business model

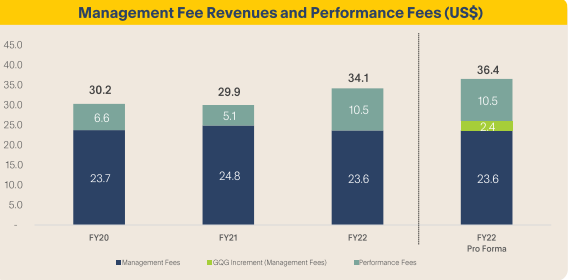

Essentially, PAC invests in disparate funds and earns a slice of management and performance fees which, after netting out corporate expenses, is either distributed as dividends or reinvested into new stakes in other funds.

Management fees tend to be valued at premium to performance fees due to 1) visibility (capital duration lockup requirements) 2) stability/no volatility (fixed % regardless of performance/economic environment - can’t be said about performance fees).

A simple valuation methodology is to decipher how much a stream of management fees is worth. By way of example, PAC, just 3 months back, invested in Cordillera at ~13.3x FY 24 management fees (30 / 2.25). I am comfortable ascribing 0 value to Cordillera’s performance fees as the wording of the document - “PAC also expects Cordillera to generate performance fees in most years” - seems to indicate the unreliability thereof.

One could quibble over whether that’s fair but it’s worth noting that the 13.3x multiple was imputed on 2024 numbers and for a singular private equity fund investing in quirky assets (aging whiskey, spectrum licenses, boat marinas); PAC on the other hand boasts a more diversified portfolio of assets that lends to more verifiable valuation.

Accordingly, in H1 23, PAC earned $22.3m in management fees, or an estimated annualized ~$40m for FY 23 (assuming $10m of performance fees against management’s guided $50m of total fee revenue). A 13.3x multiple would equate to ~$10.40 per share (already higher than the latest closing price) and doesn’t account for demonstrated performance fees, poised to be “sustainably higher” in FY 24. Ascribing 50c to a buck for performance fees would get us close to $11 in total, close to Regal’s bid. It’s also worth noting that PAC’s portfolio beta is just slightly north of 0.5 and the lowest compared to ASX peers and thus, each buck of performance fee may be worth an anti-volatility premium.

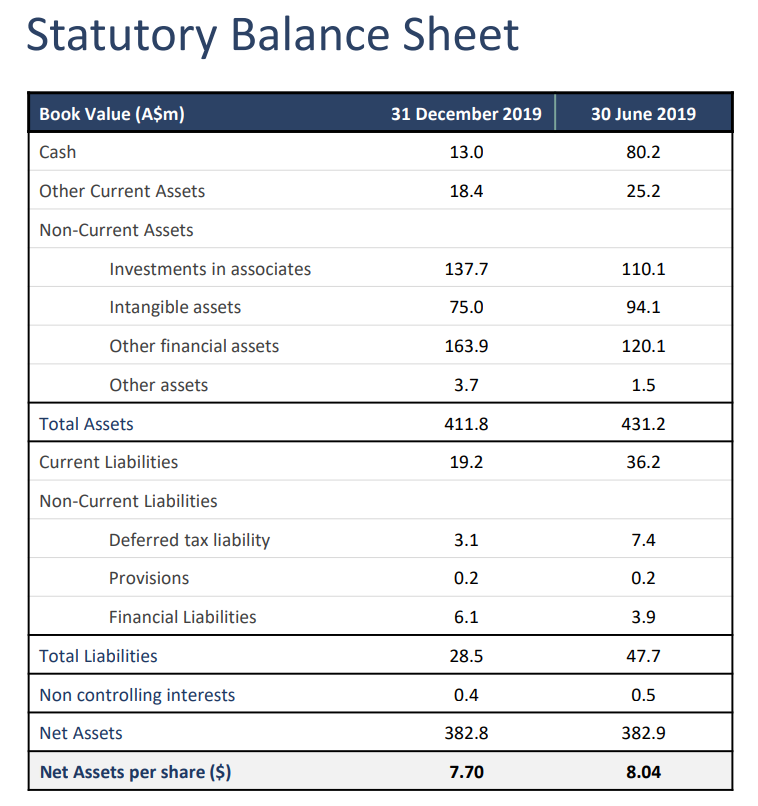

Another way to look at the valuation (and perhaps even more reliably) of PAC is on a price to NAV basis.

PAC closed H1 23 (Dec 2022) with an NAV of $9.93. Results for FY23 aren’t out yet but at the bottom of the proposal doc regarding Regal’s bid, management estimates true NAV to be between $11.50 - $12 due to accounting standards preventing PAC from writing up a number of investments within its portfolio. Moreover, PAC’s 4% GQG stake (~27% of its total FUM portfolio) has risen >15% since the start of 2022 and should tally up to to an extra ~40c of NAV .

In sum, it’s not difficult to envision a higher bid here - maybe ~1x NAV, not forgetting potential synergies which could perhaps demand a slight premium even; when accounting for the GQG stock component, Regal’s bid of $11 really ain’t cut it.

Regal and River own ~28% of total stock and so a bid from GQG (or any other potential bidders) would ultimately require the votes of the former parties. But on top of that, management has to approve of the offers. For what it’s worth, CEO of PAC, Paul Greenwood owns 1.3% of PAC and sits on GQG’s board. Tony Robinson, a PAC board member, is a non-exec director at River.

Odds and Ends

One key risk is that GQG is a faux-bidder - the market doesn’t seem to believe an over-bid will happen and hence the gross spread to the extant bid. Unlike Regal, GQG’s strategy isn’t to acquire a portfolio of funds; moreover, the sheer amount of private investments as a % of the portfolio brings a huge “?” to where this fits into GQG - how exactly does GQG implement “strategic vision for unlocking value for PAC’s shareholders and portfolio companies”?

Another risk includes NAV not being worth the full dollar. PAC’s NAV has over-time trended towards private investments, leaving GQG carrying the bulk of its public equity exposure. This is a +ve factor given that there are tons of empirical studies that demonstrate private returns outstripping public returns - as always, up for debate.

One of the recent investments sold at a loss was Seizert, a public market investment vehicle - understandable given Seizert’s chronic underperformance.

Apart from GQG, most of FUM is in private real estate in the US (Banner Oak) and private equity in Asia (ROC Partners)

The Regal proposal indicates that PAC’s stake in Victory Park is worth $4 per share (clearly Regal wants this specific asset). Victory Park is a private credit fund, making up ~10.5% of PAC’s total ownership adjusted FUM, whilst being valued at >35% of the total acquisition value. GQG publicly floats at ~A$4.6b and PAC’s 4% stake is worth ~$180-190m another ~$3.70 - essentially valuing the remaining ~63% of FUM at ~$3.30.

In late 2019, management rejected an unsolicited bid - $7.425 per share in straight cash at a slight discount (~3.5%) to reported NAV.

Prior to 2018, PAC traded at a slight premium to NAV and it’s unlikely that management will approve anything lower than reported NAV (especially for a partial cash/stock offering); buyers have precedent here and as mentioned, there are some cross-management dynamics around here so bidders should more or less know what management is gunning for at the end of the day.

Any reasonable explanation of PAC getting hammered a full week after CEO basically says SOLD?

https://twitter.com/TheRealDavey2/status/1714501518840508822