Update included at bottom of piece (9/5/2023)

All figures in USD unless indicated otherwise: 1 AUD = 0.7 USD

Stock Price: A$ 0.195

Sierra Rutile is one of the world’s largest natural rutile producers, controlling about ~25% of total global supply through a single mine named Area 1. The company was demerged from Iluka last year and has seen its share price collapse due to insensitive selling resulting from institutional mandates, jurisdictional ownership limitations etc. Area 1 is running on limited life, with 3-4 years of reserves left and SRX is currently undergoing feasibility studies for an adjacent mine named Sembehun (~13 year mine-life) with results set to be out year-end, enabling a definitive go-ahead investment decision to be made.

The current situation is as follows - SRX is debt free and as of Q1 23, has its entire market cap (~58m) covered by net cash (~57m), despite Area 1’s profitability (58m EBITDA in 2022). Accordingly, the stock could be viewed in 2 ways - 1) market is valuing the net cash at zero and Area 1 at 1x EBITDA or 2) net of cash, the market is valuing the core business at zero.

Slide from FY22 presentation: SRX is the only firm with a stock price below net working capital

I believe the 1) is the apt way to view the stock, at least up till recently.

Firstly, relevant filings have stated explicitly that Sembehun (Sem) would require additional equity/debt financing for development in spite of excess balance sheet cash and Area 1 already generating a solid amount of FCF - phase 1 development would require cash investments north of $200m. In other words, the market is correctly implying that extant cash is worth zero since it won’t be distributed to shareholders i.e. capital allocation risk.

Secondly, whilst the global outlook for rutile is bullish in the medium term resulting from dwindling supplies, Area 1 has a limited life and NPVing projected FCF over the next 3 years would triangulate values close to SRX’s market capitalization today.

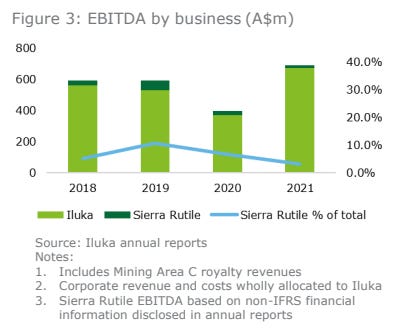

Moreover, on May 4th, the company released an announcement (sending the stock falling >15%) stating that terms of the Third Amendment Agreement between SRX and the Govt of Sierra Leone (GoSL) are up for renegotiations. The background of the agreement was that Iluka (previous owner of SRX), in the depths of COVID, faced operational issues with its Sierra mines and attempted to divest said assets in 2021, but to no avail. Instead, the company issued a notice of temporary suspension to the GoSL; the GoSL, to deter this potential hit on the economy, revised and ratified fiscal arrangements providing reductions in duties, taxes and royalties. For example, the minimum tax, charged as a % of revenues, was reduced from 3.5% to 0.5%. In the end, on the backdrop of rising prices, cost cutting through a turnaround operation orchestrated by a new CEO, has led to the waterfall profits as per the latest P&L.

In any case, should renegotiations lead to the minimum tax reverting back to 3.5% of revenues, assuming sales of 240-250m per year over the next 3 years, net of NOLs (of which SRX has >100m), SRX will pay ~8m of taxes p.a. (up from ~1m), equating to a cumulative incremental ~21m of taxes, or an undiscounted ~4-5c per share of value - which could partly explain shares falling from ~24c to ~20c.

In my view, the share price collapse is an overreaction given the involvement of Samuel Terry Asset Management (STAM). STAM is a prolific deep-value event-driven shop and they took an ~11% stake in the company a couple weeks back with a, I believe to be, potential playbook similar to past investments - a deep-value purchase below liquid assets followed by a liquidation of sorts.

In other words, the share price collapse is now irrational given the implicit stock embedded expectations have transitioned from “cash is worth zero due to development & capital allocation risk” to “cash is now worth par (therefore covering the entire market cap) and the business is valued at zero” → changes to tax laws should have zero impact on the stock price given Area 1’s future profitability is no longer a component of the stock.

Again, the only way for the market to come to this view would be for STAM to employ strategies of times past e.g. bidding for the company to attract other activist eyeballs e.g. FAR.AX or personally publicly demanding a strategic review of operations - a special dividend/tender offer for shares coupled with running-off Area 1, milking a cumulative ~50-60m of FCF over the remaining 3 years, conservatively estimated, capped off by selling rights to Sem.

What is Sem worth?

With an 8% discount rate, management estimates $318m of NPV for Sem. Adjusting the discount rate upwards to 20%, accounting for political, geographical, operational risks etc. would slash NPV by 2/3 to ~$100m, which is still accretive to current EV.

I don’t have particular insights to the funds involved but while optically, SRX is only 0.15% of the largest shareholder’s fund, Perpetual, it is likely that SRX would be a much more sizeable portion in one of their disparate portfolios and so I believe the incentive to maximize shareholder value is aligned.

With regards to the previously mentioned institutional selling pressure - Tribeca and Yarra have been smashing the bid, reducing their stake by >80%.

Miningnut owns 2% of stock and if HotCopper’s Miningnut is the same entity, then it’s likely 2% of votes will be against the sale of Sem (as he/she has stated support for Sem development). In any case, if STAM were to go public with this, we will see more like-minded arbs/shareholders joining the register.

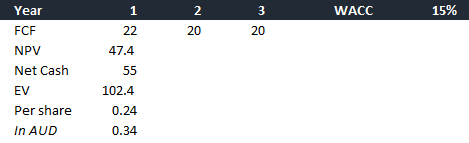

While boutique research has estimated blue-sky values for an operational Sem, I believe estimates should be taken with a grain of salt, as underpinned by historical precedents. In 2019 (note: pre-Covid), SRX was already seeing operational issues with Area 1 and recorded a 290m impairment as acquisition synergies predicted by Iluka was deemed unattainable. While an ideal outcome would be to offload operational risks at a price, simply deciding to wind-down the firm and halting Sem developments would be net accretive to the stock → 34 cents against 19.5 cents today: assumptions are, balance sheet cash + residual cash flow from Area 1 + cash savings from Sem development CAPEX.

~2.5m of cash is earmarked for the rehabilitation trust (hence reduction from ~57.5m of net cash), of which Iluka contributed a lump sum 45m for its entirety last year.

Risks

Rehabilitation costs are higher than expected

SRX is another junior miner fraud

the mitigating argument is that the entity was spun out of a large cap, Iluka (~4b + market cap), isn’t cash burning and has a stamp of approval from smart hedge funds

STAM wants to develop Sem similar to their rights participation for development at Kiland.

In any case, I think the rational thing to do here is a winding-up of the firm given where the stock sits. In fact, just listing the entity on the ASX costs ~$5m p.a. which is ~10% of the current market cap, a sizeable drain on value.

Updates: 9/5/2023

Spoke to mining/resource experts and was informed that a key risk to the “wind-down” thesis was the importance of Sembehun to Sierra Leone’s economy and is therefore a “non-option” : note: SRX is one of the largest private employers in Sierra Leone.

STAM, as per a filing yesterday, just increased its stake in the company by another 4%. SRX has historically faced difficulties, as mentioned in the piece above - impairment (2019), temporal suspension (2021) - so I can’t see why STAM would be playing the long game here, undertaking the multitude of project/political risks.

Additionally, whilst Iluka may have faced difficulty divesting operations a couple years back, there is currently, 1) less market uncertainty 2) positive outlook regarding supply i.e market will be tight 3) even Area 1 itself has improved i.e. cash costs per unit has improved bigly since.

Also, another question would be, why wouldn’t Iluka just try to monetize the assets themselves again rather than simply demerging it? My view is that SRX formed way too small a % of Iluka’s operations and simply not worth the headache.

Do note that as per the recent annual report, ~98% of cash is held in ANZ Bank Australia so there is no credit risk of GoSL locking up cash to combat management pulling the plug - if that happens.

Readers are advised to size this appropriately given the risks involved.

We’ll see how this pans.

Disclosure: Long SRX

Any thoughts on last quarter? Surely not as appealing as before. I was expecting the inventory build-up from the previous quarters ahead of the wet season to start converting to cash this quarter. At least all this cash is mostly tied in inventory and they are profitable on a per ton basis. Central to the thesis is that STAM will push for some liquidity event in Sembehun (i.e., selling a stake of it) and the stock will price accordingly. Specially given STAM holds 20% but could have much more power as a fraction of shares were voted in the last AGM. This all is still on the table but industry conditions tightening is not good.

Any mention of a dividend or buyback being started?