This is a quick idea possibly worth a punt from here - a hairball of sorts at this point but asymmetric to the upside. One thing that happens in special sits land is that yeah sometimes turd hits the fan - maybe a takeover falls through, a merger breaks etc. - there will rampant selling, the stock chart will look like a cliff-off and a bloodbath ensues for a short period of time. Different investors operate with different mandates and sometimes for a certain kind, it’s just plain discipline - if you are there for the takeout and the takeout falls through, then the thesis is broken and you exit. However, what I’ve noticed is that if a company has a clean balance sheet (no risk of bankruptcy), a track record of earnings (no cash burn) and a low valuation post bloodbath, this often presents an opportunity - value is value and if in a point of time, an acquirer spotted value, it may be a case of wrong place wrong time but the value is there and at some point, someone will come to unlock it, hopefully imminently.

Background

TH is such an example. For background, over the last couple of months, TH has been a takeover candidate - largest shareholder (owning ~64%) TDR Cap threw a lowball $10.80 offer, returning after a failed $1.50 per share take-private attempt in late 2020. The stock traded slightly north of 11 for the most part given how cheap the company was and the market expected TDR to sweeten the bid a little - perhaps a bump up to ~13, to close the deal.

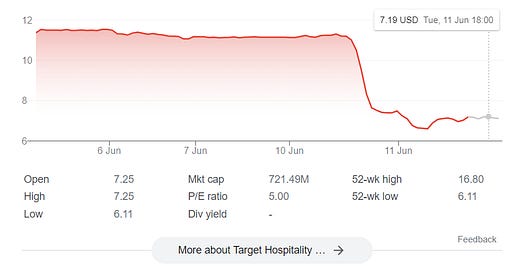

Unfortunately, the stock plunged >30% a couple nights back on report that the Biden administration is planning to close the Dilley detention center this summer as the Dilley center was more costly to operate than other Immigration and Customs Enforcement (ICE) facilities); said funds if reallocated to cheaper facilities could potentially provide an incremental 1600 detention beds and save the government up to ~$129m.

Dilly’s sports ~2500 beds and is Target’s largest facility; coupled with the fact that government contracts make up > 72% of TH’s revenues in 2023, this sent a flurry of exasperation in the stock, plummeting down like a pheasant blasted by 26 inch barrel, 16-gauge Winchester in the hands of a pompous elitist on a windy afternoon in England.

A myriad of questions cloud the stonk - “How much income is lost from the Dilley closure?”, “Which other government contracts are in jeopardy?”, “Is the TDR bid still intact?”

The stonk briefly touched the 6s before entering the low 7s so it seems like we might’ve hit a low if this is all there is to the case at hand.

What was the valuation at TDR’s bid?

First and foremost, at a $10.80 bid, TDR was assigning TH a 5.8x EBITDA multiple (based on management’s midpoint guidance). Reasonably, TDR would know the drill… sweeten a little, maybe offer $13 - which would be a ~7x EBITDA multiple, again, still extremely cheap but shareholders would be appeased.

In fact, the company lays out the valuation discrepancy for us - despite earning much higher margins, TH trades way below the average of peers. TH is also very capital light - guiding to ~30m of capex and has strong revenue visibility given its high contract renewal rates.

Management could be cherry-picking peers but at minimum, we have a mark provided by TDR. Let’s figure where TH trades now.

What’s the valuation now?

First, we’d have to triangulate how much earnings is lost with Dilley. There is a slight overhang on the stock now given the company has not quantified the financial impact yet, though it will soon, before June 30. I speculate some reasons why management has chosen to stay silent but in any case, this throws a wrench of uncertainty into the stock and so doing our own work to quantify said impact may be our first source of initial upside.

A Stifel analyst estimates Dilley contributes ~55m of TH’s annual revenue and ~35-37m of adjusted gross profit i.e. a 35-37m hit to EBITDA.

Adjusted GP would be gross profit but with add-back of depreciation of specialty rental assets. Below the gross profit line would be costs that are relatively fixed so a X hit to adjusted GP would fall cut straight into EBITDA.

Let’s do some basic math here and ballpark the estimates.

TH’s contract with CXW - whereby CXW would lease Dilley from TH, was forecasted to bring in 325m of revenues from 2021 to 2026 i.e. right on at ~55m of revenue per year.

GP margins over the last 5-6 years have ranged from 60% to as high as 82%. Just ballparking various scenarios, we could sort of triangulate a range of 35-45m hit on adjusted gross profits, midpoint being ~40m.

Another way to think about the dollar flow-through → CXW pays ~34m of annual rent to TH (source: 2023 10K F-15), not inclusive of food services which is another ~26m (44% of the total lease consideration). Assuming rent flow-through at 100% and then estimating another 20-40% margins on food service would triangulate to around 40m of impacted EBITDA, just as we speculated, with a potential worst case scenario of ~45m. Feel free to do the math.

Deducting 40m of lost EBITDA would triangulate a multiple of ~4.8x run-rate EBITDA, a valuation lower than TDR ascribed in their initial takeout bid. With Dilley being unutilized now, this would mean that a proper valuation for TH would be a multiple of EBITDA + the value of Dilley.

A 4.8x EBITDA multiple is way too low for the business - even TDR thought so throwing in their 5.8x multiple faux bid with intents to sweeten it up to 7x EBITDA. Obviously with the Biden curveball, perhaps we would have to penalize earnings by one valuation turn, but that would still put give a valuation of ~6x EBITDA.

Risk to government revenues?

The market is obviously concerned with the rest of government revenues, making up ~72% of total revenues.

Is there a risk for other facilities to be affected? Possibly, but as mentioned, this Dilley hit seems to be of peculiar fashion - a case of government budget reallocation coupled with the fact that the government could terminate the contract at any time with a 60-day notice (which is what happened). In fact, Dilley was stated as “the most expensive facility in the national detention network”, was not completely filled (~70% occupancy rate) and most of the occupants were adult women.

On the other hand, the other contracts held by TH, for e.g. the Pecos Children’s Center (PCC) just won a big long-term contract (potentially lasting a decade to 2033) - that is renewed annually and so the termination can only take place every November (a year from the contract start date) . It’s also worth noting that the Pecos facilities house children and at least legally, a child under 18 stepping foot into US has to remain in the US - i.e. detaining minors doesn’t carry the same business risks as detaining single adults.

Moreover, in thinking about multiples, I’m sure TDR, in shooting their bid, weighed in the political risks and what not. The Biden administration has not been kind to capitalistic endeavors within the capital allocation space and so I’m sure the weighed down multiples (even at 6-7x EBITDA) would have baked in some level said risks.

Would the TDR bid still be intact?

Obviously, TDR is serious about taking this private - this is the second time in the last 3-4 years - and obviously, they’re not ashamed to steal it. TDR owns ~64% of TH and would be affected in-like if the stock price remains dunked out at these levels.

One downside at this point would be that any chance of other potential bidders providing a topping bid would be practically zero. TDR is a Europe-focused PE firm and TH is their only US-based company in their portfolio which might hint that TDR would be more than happy to get rid of TH via a sale to another bidder. The way out now might then be to perhaps take this private at the original $10.80 bid (that’s at revised 7x EBITDA), do some bolt ons (?) then do a secondary sale at a more apt multiple, perhaps under the Trump administration.

How much is the Dilley Facility worth?

It is important to understand why Dilley was relatively more expensive to operate. Dilley was opened under the Obama administration to house oil-field workers and later on detain families; the property stretches 50 acres with 80 individual cottages, equipped with recreational and medical amenities - perfect for housing families. Biden, seeing such a practice as inhumane, in 2021, set the detained families free though latching them with monitoring devices such as ankle bracelets.

In other words, the Dilley facility has not been optimized for its highest and ideal use over the last 2-3 years which explains why the contract was terminated - you simply don’t need such a sprawling facility to house a bunch of adult women.

As Dilley’s is wholly owned by TH, there are opportunities for repurposing, at least to be occupied by the appropriate audience. One imminent potential would be another ICF* contract that TH is currently bidding for (TBD H2 2024) to accommodate minors and Dilley should be a good fit for that. The takeout by TDR seems to be front-running the ICF contract (so I think TDR showed their hand in the likelihood of TH winning this contract). Also a potential re-election of Trump could see this facility revert back to detention of families.

*3 ICF contracts to support ~10k unaccompanied minors - the PCC won the second contract and accommodates 6.4k individuals and so with the final contract, a 2.5k bed Dilley’s should be adequate.

CXW notes that the terminated contract will cost an annual ~40c of EPS or ~45m of net profits. Add back ~50-60m of rental payments and outsourced service expenses and this facility could generate north of a 100m to an owner-operator. How much is that worth? At least, to the market, >700m of market value was penalized, CXW losing ~330m of market value and TH losing ~400m of market value on the termination of the contract.

The private prison stocks layout how valuable real estate ownership is in terms of replacement costs and prior examples of repurposing.

From GEO’s deck:

From CXW’s deck:

Final Thoughts

Why is management waiting till end of June before disclosing the financial impact especially since it’s obviously not that big of a hit?

I think the main key reasons would be back-door discussions with TDR with regards to the extant bid (?) and potentially quickly scouring for replacement contracts.

The first TDR bid valued TH at ~7.6x EBITDA

Shortly after the bid, TH announced the Dilley 5 year contract with CXW so obviously it’s a case of TDR trying to steal TH before the EBITDA inflection from the new contract.

Again, TDR is probably quite certain that TH wins the 3rd ICF contract and they’re obviously front running that with the $10.80 bid.

The company has $500m of net growth capital opportunities in the next several years and management in the recent Q1 call has indicated it would have a similar cash flow profile as at present → IMO potentially 150-250m of EBITDA growth on just a base case.

Private prison stocks with similar business risk-profile as TH trade at a few multiple turns higher, despite sporting lower margins and more levered balance sheets i.e. CXW post the contract termination traded down from ~9x EBITDA to 7.5x EBITDA and GEO trades at ~7x EBITDA.

There are potential avenues for value creation if TDR walks away

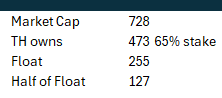

The company has room to turn up leverage (add a turn or 2 of debt) and could potentially buy back a ton of float before TDR returns again a year later (?), allowing it to foot less $ on a take private.

At the current market cap, to retire 50% of the float would require TH to pony up 125m of cash - say the entirety raised through debt - would be a mere 0.78x gross leverage (against 160m of EBITDA), not counting the cash on the b/s.

Conclusion

This is a time-sensitive post given how fast-moving the stonk is. But my conclusion is that I think the market has overreacted to the contract termination news, the stock is too cheap post-dump, TDR hasn’t (and may not) pulled out yet, there are avenues for value unlock going forward and more importantly, the panic has created an opportunity for new shareholders to make money.

https://open.spotify.com/episode/1sVVwQYE8FKCe42AlmSWeN?si=1KFxUKX0S8CUcCNGEBIL3A