I’ve been discussing Samsonite with a couple of friends and having run it through my mental conveyor belt quite a fair bit, thought I’d bring the discussion to the public domain.

Recently, there floated rumors of Samsonite receiving takeover interest from various suitors including private equity firms, which are interested in potentially relisting the company in another market, such as the United States, believing that it would help Samsonite garner a better valuation. The same situation is happening at L’Occitane, which I believe will cease to be public very soon.

The basic background for many of these HK listed stonks that are headquartered in Western jurisdictions is that many were looking to tap into the increasingly affluent Chinese market and the Hang Seng Index wasn’t too shabby then, hence the HKEX listings. However, as investor appetite for HK stonks has waned, the rationale to remain listed there is no longer applicable.

While many readers would have heard, and probably may use the Samsonite luggage, under the Samsonite umbrella is housed disparate brands - of key importance being the Samsonite brand itself followed by Tumi and American Tourister. For fy2023, I am annualizing the L9M sales figures - typically, H2 sales are stronger than H1.

Before diving ahead, let’s have a quick look at Samsonite’s extant valuation - price affected for buyout rumors - Samsonite is currently floating for 9.6x EBITDA. Note that EBITDA estimates already account for rent expenses.

Margins

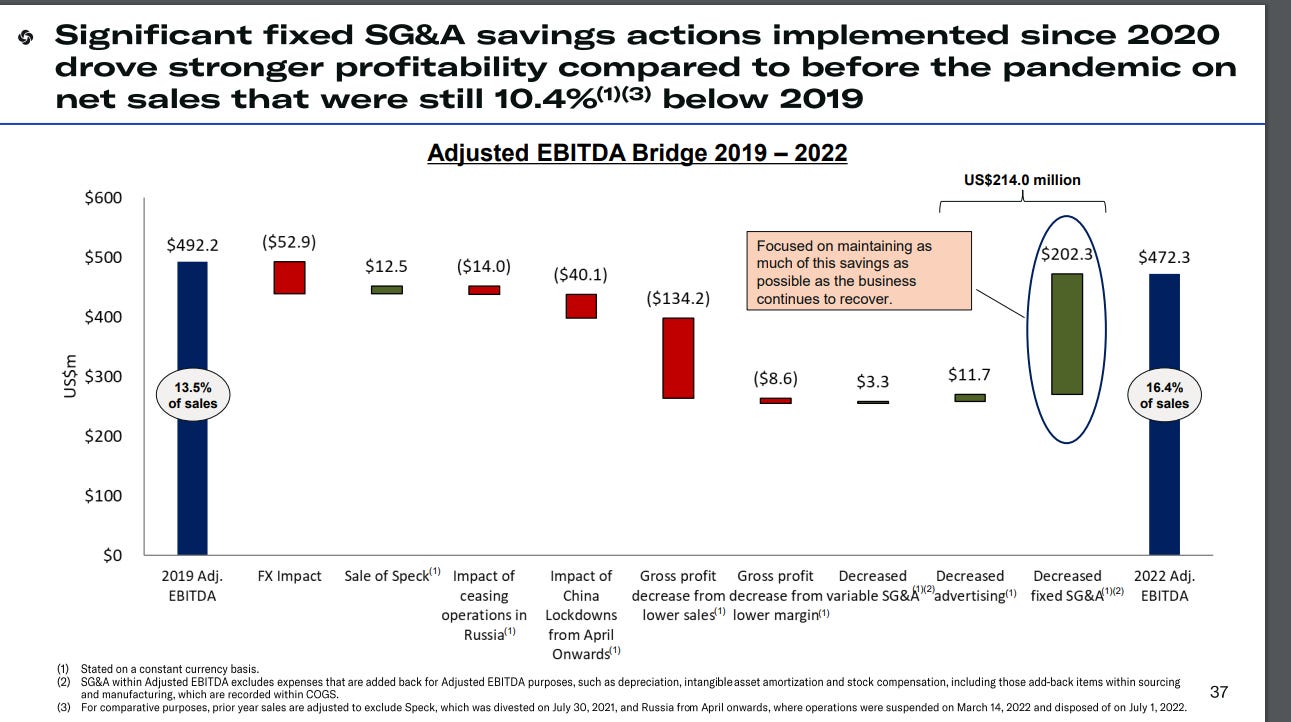

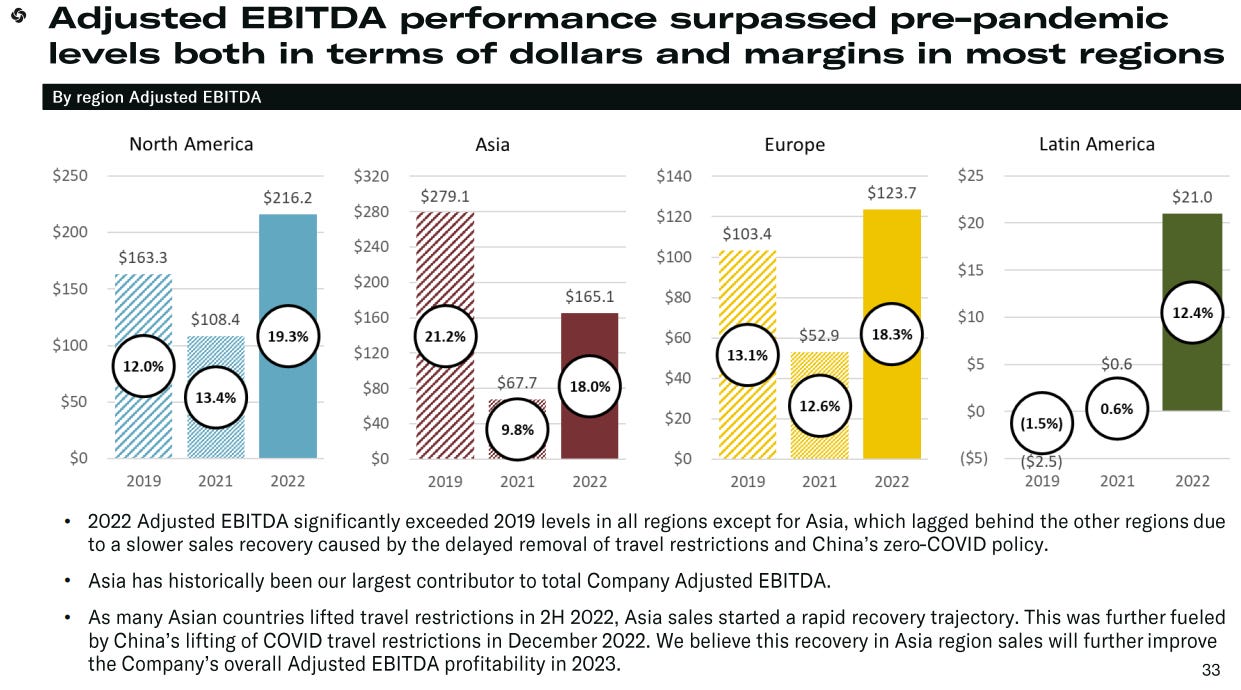

Before addressing the valuation potential - the crux of any buyout - it’s worth examining Samsonite’s margins, which has exploded above pre-Covid levels. Here’s a slide from the 2022 presentation where the margin bridge from ~13% pre Covid to ~16% in 2022 was mainly a result of management deracinating Samsonite’s fixed cost structure. Recent additional gains on the margin (+3%) have mainly come from the bounce back in the Asian market (see second diagram) - typically featuring higher margins - and a lower promotional environment.

The rationalizing of Samsonite’s cost structure was a result of the firm attempting to stem cash burn through the pandemic, when travel of all sorts was shut down. The company cleaned up its back office, closed unprofitable stores and renegotiated leases - estimating a ~200m (~5% margin uplift on ~3.7b of revenues) permanent profit improvement, which explains the gap up from 2019 to 2022 margins. Moreover, with a much better fixed expense structure, Samsonite has decided to flex up its variable advertising expense a little, to ensure continual competitiveness in its market share - taking its market share up from 13.9% to 15.9% from 2020 to 2022.

Gross margins have crept up recently due to a less promotional environment, ~59% GM. GMs for Samsonite have been historically stable, reaching and hovering mid 50s just prior to the pandemic. Even if we shave off around 3-4% (assuming the need to get promotional again), we’d get ~16% EBITDA margins i.e. ~590m EBITDA (on 3.7b of revenue), around an 11x EBITDA multiple, arguably not too expensive, as we shall discuss shortly. Note that prior to COVID, Samsonite traded at a mean EBITDA multiple of ~11-12x.

Another reason why I believe Samsonite’s go forward margins will remain structurally higher is that even the emerging LATAM business, whilst subscale and relatively de minimis - running at around ~150m of revenue, is already printing 13-15% EBITDA margins.

There has been contentions in the past regarding the accounting figures (not wrong given the rather erratic working capital flows as seen in the OCF) and management’s attempts to juice up numbers with frivolous acquisitions and what not. But on a cumulative FCF conversion basis (which is what matters), Samsonite isn’t doing too shabby - managing to convert 56% of cumulative EBITDA into FCF. In other words, a 10x EBITDA multiple would imply a normalized ~7% levered FCF yield.

Valuation Discussion

This is where things get a little interesting. I was speaking to some analysts and the concern seems to be around the inability to find appropriate comps to value Samsonite. The issue is 2-fold → 1) Forward growth and 2) comparable transactions.

Firstly, forward growth. Prior to 2018, Samsonite pursued acquisitions to buff up their numbers - there’s a short report somewhere on this. We really only have 2 clean years to determine organic growth - 8.8% growth in 2018 and a (-4.2%) growth in 2019 - but even referencing the table way up, luggage growth for the disparate brands were rather sluggish from 2017 to 19.

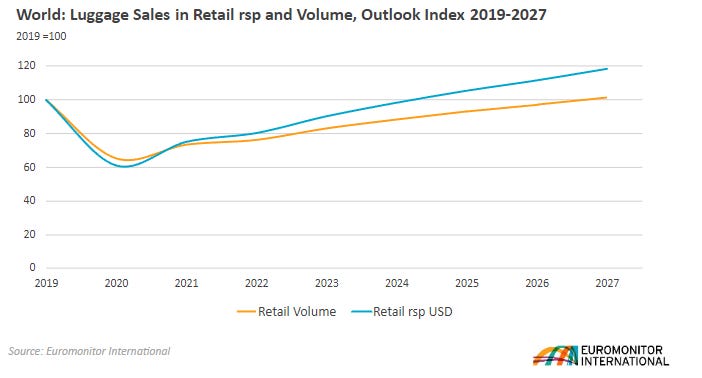

Recent supra-growth rates have merely been the recovery in luggage sales. As seen, in the image below, the complete recovery in luggage sales is forecasted to be rather drawn-out and Samsonite’s premature full recovery over 2019 sales levels is indicative of some amount of market share gains as well as price taking. One could argue that given luggage sales still remain below 2019 levels, Samsonite still has room to grow. The street definitely thinks so - estimating some pretty robust growth going forward though the credibility thereof remains to be seen.

Secondly, comparable transactions. A key competitor, Rimowa, was taken out by LVMH in 2016 valued at ~800m EUR against ~350m EUR of revenue in 2015, i.e. around ~2x sales or my estimate of ~12x EBITDA (guesstimating close to 20% EBITDA given Rimowa is more upscale). Samsonite itself, acquired Tumi in 2015 for ~3.1x sales and ~13.6x EBITDA. But that’s more or less it. Tumi is considered a “luxury” luggage brand so perhaps it is worth a premium multiple within the Samsonite umbrella and maybe there’s some way to unlock the value of that in a strategic transaction.

One way of thinking about an appropriate multiple is considering the multiple expansion across the “luxury space” over the years. Ferrari for e.g. has expanded from a mere 15x EBITDA in 2015 to 35x EBITDA today. LVMH has gone from a mere 10x EBITDA to 18x EBITDA. Hermes has climbed from 20x to 35x EBITDA. In other words, perhaps if Tumi or Rimowa had not been acquired then, what would be the appropriate trading/takeout multiple today? Would’ve it been closer to 15 or even 20x EBITDA?

The key contention then would be, is Samsonite a luxury brand and most would sort of shake their head. Apart from Tumi, I mean Samsonite is, arguably an excellent luggage brand but doesn’t qualify as luxury by any means and wouldn’t deserve a Ferrari or Hermes multiple; on the other hand, notching gross margins close to 60% is indicative of a business with some sort of brand advantage - the number of businesses with said gross margins, a rarefied few. In any case, could Samsonite float for 15x EBITDA if it were on the NYSE today?

Not so fast though - there remains a subset of companies that feature similar GMs yet trade at pretty impoverished multiples - arguably, an appropriate comp base may be Tapestry ( ~70% GMs, trading at ~8x EBITDA), Hugo Boss (60% GMs, trading at ~11x EBITDA) - we’re talking about brands like Coach, Kate Spade and Hugo Boss - more in line with Samsonite’s brand equity and these are floating in Western markets, yet don’t enjoy mouthwatering valuation premiums.

Other pointers

Timothy Parker, an advisor to CVC Capital Partners, owns 4.2% of Samsonite and began his involvement in Samsonite during the GFC when Samsonite was a portfolio company of CVC, helping to restructure operations and then list it on the HKEX in 2011. Perhaps CVC may get involved again and is one of the potential buyout candidates.

A secondary listing was in discussion in the Q3 call

Notably, management does seem to be open to ideas to address liquidity and valuation if proposed sensibly.

Is there some sort of scarcity value for what seems to be the last publicly traded luggage company?

Who’s the natural acquirer here? Given the umbrella of brands - which company wants to subsume em all? Probably not LVMH because they already own Rimowa and may not be allowed to make said acquisition, but even if they could, Arnault would probably only want Tumi and nothing else.

I’ve been burnt a few times speculating on acquisitions by financial buyers i.e. private equity; they’re sort of like stock pickers, looking to maximize IRR and may perhaps be more sensitive to macro-volatility compared to say a strategic buyer who’s more concerned with operational fit versus where rates are or what the financial outlook will be for T+1,2 etc.

Again, open to discussion here. This seems interesting in that, the downside may not necessarily be that huge - upcoming catalysts for share price appreciation includes a reinstatement of dividends, which will at least provide an additional pool of buyers i.e. the dividend hunters - but I’m not too certain of whether a full takeout will materialize.

Disc: No position yet

I linked to it in my post for today: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-march-18-2024

CMBI Research China has done a few free research reports about the stock over the past year as I do monthly posts covering those reports: https://emergingmarketskeptic.substack.com/?sort=search&search=Samsonite

thanks for the report ..how mich the takeover price do u expect in hk dollars?