The preferred way to participate (TDS)

There’s been quite a fair few interesting situations around but I thought this one was especially fascinating (and quirky enough for me) given the way everything ties in. Quick update on certain stonks are placed at the end of the article.

TDS

Telephone and Data Systems (TDS) is a stonk that most white-haired value investors should be familiar with. The company is sort of a cellular quasi-holdco with an 84% stake in publicly traded wireless provider USM (which pro-rata market cap is worth more than TDS market cap) and a core broadband, video and voice operation.

The respective industries that TDS operates in are extremely competitive - the company suffers genteel decline in its customer base, offset by slight bumps in ARPU (average revenue per user). Moreover, to maintain competitiveness, a chunk of capital expenditure is necessary - fiber expansion and wireless 5G roll outs. Moreover, the lack of scale of the respective operating businesses relative to competitors also results in TDS/USM generating poorer margins relative to peers (~20% EBITDA vs say VZ which does mid 30s).

The competitiveness thereof means that TDS does not earn its cost of capital - generating paltry returns on equity - combined with the entrenched controlling family, has led to the stock being priced at a fraction of book value (despite book value being understated). The Carlsons own slightly north of 10% of the total company but with disproportionate voting control due to the dual class share structure. Whilst USM has traded like turd for a while now, Verizon did offer $100/share for the entire company in 2007, which was turned down by the Carlsons. In fact, Mario Gabelli has been stuck in this stonk since forever and enjoyed a fleeting upbeat moment when TDS’ Chairman LeRoy Carlson Jr, agreed to attend a road show to meet hedge funds - a signal that perhaps TDS would sell USM after all. All it took however, was half way through the road show to pop Gabelli’s bubble… yet at least we have an idea of the value Gabelli felt USM was worth, ~6bn of net asset value or $71 per share (in fact, Gabelli was on CNBC recently touting that USM is still worth $65-70 per share).

The sheer persistency of the unadulterated obstinacy of the Carlsons can be primarily attributed to two reasons - 1) LeRoy Carlson pockets a nice fat 7 figure paycheck every year and 2) the rest of the family lives off the dividends. In fact, TDS is so proud of the fact they’ve increased dividends for 49 years despite the stock falling to as low as $8 early this year.

So what’s the trade here? The stock could possibly be at a point of inflection in that the company is undergoing a capital intensive fiber expansion program against a heavily levered balance sheet and would thus have to monetize their underlying assets; now would be the perfect time as the consolidated entity still has ample liquidity, any later and the firm’s heavy balance sheet would defang its bargaining claws. I will elaborate on the key points below.

Expansion and balance sheet

TDS has been undergoing a fiber expansion program (similar to under telecoms), upgrading incumbent copper line to fiber and this is necessarily, capital intensive - TDS is estimating negative free cash flow for the year, a mid point of 285m adj EBITDA and 550m of CAPEX (~2/3 dedicated to fiber work).

With the goal of doubling fiber service addresses by 2026, FCF will likely remain negative over the next few years and TDS’ balance sheet is not exactly in the best shape. EBITDA (for both TDS and USM) has more or less flattened out ~1bn and the debt covenants (doesn’t include the prefs) have been amended temporarily to provide some breathing room - a consolidated leverage ratio of 4.25 at present, easing down to 3.75 by mid 2025. Without the prefs, the current leverage ratio sits marginally below the current leverage ratio threshold. However, counting the prefs as debt, TDS would be ~5x gross levered and ~4.7x net levered, i.e. pretty heavily levered.

Remember Gabelli trying to push for a sale in 2017? Back then, TDS didn’t have the same liquidity pressures - carrying 2.4b of gross debt and 1.7b of net debt against ~1b of EBITDA (approximately 2.4x gross levered and 1.7x net levered), with capital expenditures half of what is spent presently.

The market has taken notice and the stock, earlier this year, traded as low as ~700m of market cap against a ~5.7b EV, implying imminent distress.

Strategic sale

Following the situation as laid out above, management in early August, announced the potential sale of USM and removed the CEO of USM from the BoD of TDS. The market liked the news so much that both USM and TDS shot up ~100% and more on said news. Using USM as a proxy for market implied probabilities - assuming a $60 all-in sale price and a $17 break price, the stock at ~$43, imply a 60% chance of a deal - quite an ebullient response given how bad a reputation the Carlson family has and the hairs around the situation.

Re the hairs, first and foremost, the company has been very silent over the bidding process - a few analysts tried to finesse questions re the process into the conference calls but got shut off immediately. However, not all is lost in the deafening silence -there’s been recent news that first round bids by VZ, T and TMUS, along with P.E firms have been collected.

Secondly, regulatory and timeline uncertainty. Given the consolidation of the industry, most of the market is dominated by three major nationwide carriers - T, VZ, TMUS - which are also the key bidders. Charlie Ergen has cited USM’s wireless assets as a favorable opportunity to nab areas that DISH hasn’t fully built out. But considering DISH’s current financial predicament, they’re unlikely to be buyers here.

Experts believe that whilst the current administration will induce difficulty for a merger with the big 3 - T, VZ, and TMUS - it’s still defensible depending on market definition i.e. i) re product market definition, will cable be included? ii) is the relevant market the national market (USM is merely a small rural player) or the local market (USM will have dominant share in some areas).

However, as a mitigant, structural remedies such as divestitures can be made and since prices are set at a national level, the local markets are unlikely to be affected by the merger.

It could also take a while for these transactions to finalize especially with regards to the nature of the sale. As noted in the first round bids, the PE firms were reported to be interested in the towers specifically and would likely discard the spectrum and telecom units. In other words, USM assets would most likely be sold in tandem to multiple parties.

I was recently reading the Straight Path (S.P) litigation memorandum that was an overhang on IDT and a few key points from that saga → Verizon did eventually purchase S.Ps spectrum licenses for ~3.1bn but that was after a bidding war running through 2017-18 and VZ sold to Howard the patent portfolio it didn’t need - an example of picking the key assets it wanted. However, shareholders were well compensated for waiting as when the auction process began, the first bids came in at ~$750m, a fifth of the final sale price.

Putting all these together, this could explain why the shares have jumped so much → the financial predicament facilitating a deal and the final takeout price for USM potentially finger-in-the-air, offset by regulatory and time uncertainties. Apart from Gabelli’s $60-70 NAV estimate, the sell-side has also produced some estimates right around the ballpark.

The Trade

The play here however is not in the common stock of the respective entities but in TDS preferred securities.

While both the TDS and USM common stock has reacted ebulliently to the strategic review, the TDS preferreds have been left for dead (see stock chart below) - almost like someone forgot to ring the morning alarm on the prefs.

For background, TDS, to protect their credit ratings, issued two tranches of preferred stock in 2021 ranking pari passu to each other - the PV and PU issue. The PU prefs (total 16.8m) were issued in March 2021 yielding 6.625% at par and the PV prefs (total 27.6m) were issued in August 2021 yielding 6% at par.

Both issues are cumulative redeemable perpetuals which has both positives and negatives. For positives, if dividends are not paid in any one year, they are not annulled but rather deferred and cumulated, and if the company were to call on these prefs, they would have to pay out all the missed divvies. On the other hand, given these are perpetuals, the company has zero obligation to call on these prefs. However, the saving kink here is that if the company turns off the pref divis, then zero capital can be returned to common stock holders (be it share buybacks or dividends) unless the cumulated pref dividends have been paid back in full, therefore killing the stream of income to the Carlsons.

The Carlson family takes pride in their dividends and with the unaffected share price languishing, the family simply cannot afford to turn off the prefs spigot. Furthermore, defaulting on the pref divs would also hit their credit ratings, further ratcheting their cost of capital BIGLY. Management indicated financial flexibility in the recent Q3 call given that “access to capital” remains a challenge and thus, TDS would “pace and size capital expenditure in order to remain within our funding capacity and leverage ratio thresholds”.

Given the positive attributes mentioned, there are quite a few reasons/detractors in my mind for why the prefs trade as such (apart from threats of insolvency). Firstly, interest rates - these were issued in 2021 and rates have soared bigly since then, causing a sell-off in fixed income instruments. Secondly, the general liquidity for these prefs are just plain bad. For e.g. , the PV prefs trade ~1.1-1.2m of value per day. Dan Loeb reportedly purchased ~60m of combined TDS/USM common stock which he could more or less fill in under a week or two - nigh impossible for the prefs. Thirdly, given the perpetual status of the prefs, the upside would, in my mind, not be $25 but lower - possibly 85% of par - in the event that pref holders revolt and demand the firm to repurchase the prefs, I would reckon a redemption at 85% of par value a base case. In other words, there is more upside in the common equity especially if we’re talking about a “Straight Path” type of bidding war and the fixed income instruments have no dip in that “option”.

In any case, trading a limited upside for limited downside (remember the prefs have basically been asleep to the event-news) the play here would be to own the PV prefs due to similar yields but with much higher upside on capital appreciation. The PU prefs however, would be more favorable if TDS sells itself (and only at fire-sale prices) as the prefs have slightly better common share conversion rights than the PVs.

Just to recap: what we have here is a situation where the controlling family is caught at crossroads → they are undergoing capital intensive growth expansion against a heavily levered balance sheet, but they also make dough from their dividends, even so much as taking pride in their continual dividend bumps. An apt solution to this would be simple actually: conduct an auction for the subscale/uncompetitive USM and wipe the balance sheet clean, with excess cash to spare for both fiber expansion and dividends and there is a preferred way to profit from this.

Valuation

There are quite a few moving parts within USM - cell towers, spectrum licenses, wireless subscriber base, wireless partnerships (which are undervalued on USM’s B/S) - each of which are valuable to different entities. For e.g. unlike other network operators such as T-Mobile and AT&T (who lease cell towers), USM owns 2/3 of its towers and the former two are unlikely to be interested in the towers (they would be pining for the spectrum licenses). The towers would be an attractive bolt on for say, American Tower - who likely wouldn’t be interested in the spectrum licenses.

Assuming USM gets sold all-in, close to current market prices - $45, what would the proforma balance sheet of TDS look? At the current $3.8 bn market cap, TDS stake would be worth $3.2 bn with TDS receiving a cash infusion of $2.5 bn post tax - more than enough to wipe out all debt and prefs with $500m net cash left for common equity dividends and fiber expansion.

In other words, it’s quite likely that the prefs trade up to a more reasonable yield (say $20) - with the added kicker that rates may soften as well given the slowdown in inflation (? as per WMT/BJ earnings calls).

What’s the downside on the prefs?

Apart from the price action being in our favor, quantitatively, owning the prefs at extant prices essentially creates the firm at ~3.5 - 4x EBITDA → 3.84b of debt and assume prefs marked at 60% of face value ~640m against ~1.2b 23 EBITDA. Another way of thinking about this is against book value. For the prefs to be marked at 60% of face value would imply a ~5.9bn impairment on equity (marking common equity and minority interest at zero) which is way too drastic - either taking a full mark down on net PPE (approximating 5.9bn on TDS books) or a full mark down of TDS spectrum license (4.9b) and then some PPE; even excluding ~550m of goodwill, the resulting number would still be way too punitive, in my view*. Also TDS built fiber service addresses certainly have value - currently at 709k (as per Q3) - TCX earlier this year managed to raise 239m of debt collateralized by 96k serviceable addresses - implying ~2.5k/address - so TDS addresses should be worth ~1.7b of value. FYBR also managed to raise 1.6b of debt backed by a portion of its fiber network. In addition, USM investments in unconsolidated entities (consolidated into TDS), are marked at ~500m against ~160m of pretax earnings → 3x earnings. Say marked at fair value of 5-6x earnings, that should more or less offset the goodwill stated above.

*For e.g. the 4356 owned towers should be worth ~2.5b to 3b using AMT EV/tower as a comp and the spectrum licenses are sell-side estimates point to USM’s unused** spectrum licenses to be worth ~2.5bn.

Final pointers

The 300m senior secured debt raised in Sept is worth cogitating about - it matures in 3 years (Sept 2026) with a pretty onerous collateralization package - 26.5m shares of USM, shares in other subsidiaries and basically all of TDS’ personal property. While bridge loans tend to mature within 6-18 months tops, this one would be a quasi bridge loan (also worth noting that telecom companies typically raise debt with longgg maturities), perhaps due to the potential bidding timeline and regulatory hurdles - remember Straight Path and it also took around 2 years for T-Mobile to acquire Sprint.

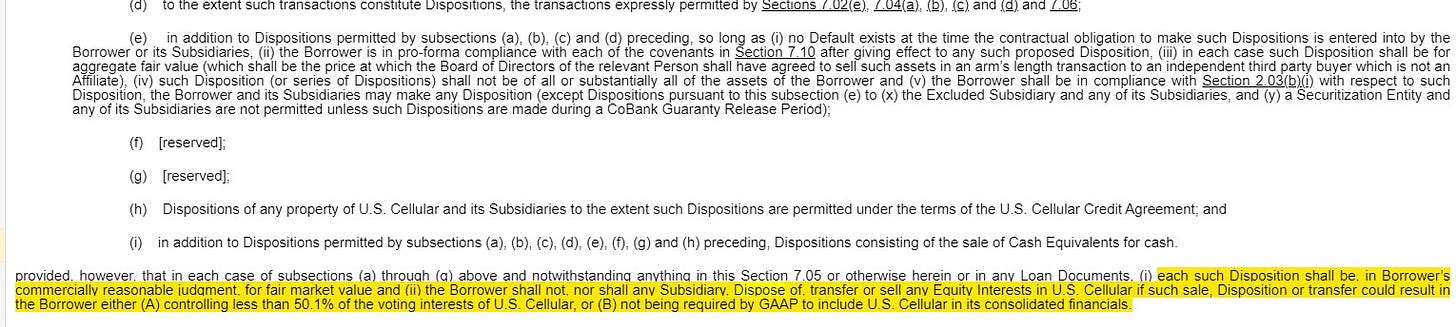

The bond indenture had an interesting proviso barring TDS from disposing USM past a limit of dipping below the majority ownership threshold/deconsolidation of financial statement (~50% ownership). I’ve asked around and initially presumed this meant that there wouldn’t be a sale though that would be quite iffy given first bids were submitted in November and in the recent earnings call, management cited ongoing process. In other words, this proviso makes sense perhaps as a protection for the borrower in that creditors cannot steal majority control from TDS - the 26.5m shares (which is all the creditor is entitled to) brings their ownership to just a hair above the 50.1% ownership threshold, not accounting for dilution etc., over the next 3 years.

Regardless of the break price, just from an NAV basis which we can establish is oodles higher, the fact that TDS is willingly pledging a third of that NAV for a 300m loan, not to mention other secondary assets, really seems to drive home an intention for a sale here.

Lead liability

The telecom companies were hit in July over a report of a potential liability resulting from a sprawling network of cables covered in toxic lead stretching across the US. The share prices of VZ, FYBR etc, reacted badly that day, falling ~20% if I remember correctly. But most have recovered (and then some more) from the correction already and so the market has moved past that

Also, the carriers, including TDS, have all clarified that lead was just a small % of their network

Updates

PAC.AX → that didn’t go as panned but the company has not been shy to reaffirm intentions to crystallize latent value and a couple board members have stepped down; there is also the possibility of a board spill (forced by River and Regal) next year given the recent AGM turnout. So the final outcome still TBD.

VLRS → Some good clarifications on capacity, post CAT 1 operations and the new government funded Mexicana operations in the recent Q3 call. The stock has bounced pretty hard off the lows and so far at least in the short-mid term, in my mind, this remains a quasi inverse oil trade for the most part - jet fuel prices have moderated.

Great call. What do you think of the preferred shares today? Less potential for capital appreciation but there’s a 8.4% yield