On a prefatory note, thanks to a few of you folks sharing my content, the Substack has recently gained a more sophisticated subscriber base and so I’ve been tinkering with the idea of extending this blog from a pure “stock pitch-esque” type platform to one that also includes “idea-exploration”. To put it simply, I believe the collective mind works better than any one individual and it would be a shame not to tap into that - many of y’all have expertise in various industries and situations that I could glean from and vice versa. With that said, Theravance is something that I’ve been looking into intermittently over the last couple of weeks so let’s discuss that today.

How did I stumble across this idea? Approximately 2 weeks ago, on February 27, Irenic Capital penned an open letter to TBPH outlining a plethora of corporate governance issues that are stymying the shares from reaching intrinsic value, of which Irenic estimates to be slightly north of $20. The stock was, as it is now, trading around $10 and so that piqued my interest.

So just backtracking for a moment, a couple of years back, TBPH was essentially a hodgepodge of assets with a slew of pipeline drugs, a profit-sharing JV for a commercialized drug (Yupelri) and an economic interest in GSK’s Trelegy. In mid 2021, the company raised $116m in equity at $15 per share and a few months after, simplified its pipeline to a few key respiratory programs, slashed headcount by 270 people/approximately 75% of its workforce, leading to an estimated $170m of OPEX savings. Going into 2022, TBPH sold its royalty rights on Trelegy to Royalty Pharma, receiving upfront cash of $1.1b, a CVR and entitlement to outer-year royalties. TBPH proceeded to retire 420m of 9.5% 2035 non-recourse notes and 230m of 2023 3.25% convertible senior notes, wiping the balance sheet clean, before initiating a sizeable 250m share repurchase program with the residual cash. In the recent quarter, TBPH announced an upward revision of their share repurchase program by 100m to 350m, and further slimmed their operations - discontinuing research in their Janus kinase (JAK) inhibitor program, reducing headcount by another 17% (to be completed by this month).

Post the series of events, the firm’s operations have been simplified and the value is essentially comprised of its economic interest in Yupelri, retained value in Trelegy (through the CVR and royalties) and one surviving pipeline drug, Ampreloxetine, which is currently in the stage 3 phase, making it an extremely attractive acquisition target, in my view.

The crux of the investment thesis is that these assets, conservatively estimated, are worth in excess of the stock price. Most small-cap biotech companies eventually get acquired by bigger firms and I believe that Irenic Capital’s letter wasn’t so much to admonish management per se (management said Irenic rejected private NDA discussions) but rather to sound out to potential acquirers the embedded value. Unfortunately, Andy Dodge wasn’t accepted onto the board and so Irenic had to blow the trumpet some other way.

The latest closing price is $10.25 and I conservatively estimate around $17-$18 of fair value. Logically speaking, why can’t a pharma major offer say a 30%+ premium to the extant stock price, take it up at $13.50 (covering all liquid, commercialized assets, which I will go into later) and then milk the additional $4 per share for themselves?

I will delve into the individual constituents of value below.

Cash

As of Dec 31, 2022, TBPH had 327.5m of net cash on the balance sheet. The firm repurchased 2.5m shares for $11 in the months after, up till the reporting date and so accordingly, we subtract 27m from cash and 2.5m of shares from total diluted shares. Proforma cash equates to $4.50/share.

Yupelri

Yupelri is the first and only once-daily nebulized long-acting muscarinic antagonist (LAMA), that provides asthma control for a full 24 hours. TBPH is a co-promoter of the drug with Viatris and owns 35% of the total profit share.

TBPH markets Yupelri in hospitals and pulmonologist clinics. Growth in sales was relatively muted through the 2020-2021 years due to COVID-19 impacting patient visits, diagnoses and new starts. As COVID rolled over, growth started to accelerate again in 2022, with Q4 22 sales growing 27% y-o-y.

TBPH handles sales inside the hospital whilst Viatris handles sales after the patient is discharged. 90% of patients receiving Yupelri in a hospital, would be discharged with a prescription to continue treatment i.e. maintenance therapy post hospitalization. As seen below, Yupelri is seeing increasing uptake both in and outside the hospital.

One recent concern analysts raised was the fall in hospital market share which management explained to be due to the expansion of the long-acting nebulizer market. Management then assured that thus far in early 2023, Yupelri’s share has returned to record levels.

There is some accounting complications with regard to how TBPH recognizes its revenues in Yupelri. While Yupelri has economic rights for 35% of net sales, the revenue recorded on the P&L is the amount receivables from Viatris, net of the proportionate shared costs incurred by both companies, which wholly considered, is typically lower than headline net sales.

The way I valued Yupelri is to value the entire drug venture and proportionally allocate TBPH’s stake. Assuming a 15% growth in 2023, EBITDA margins of 35% (which is conservative given drug margins could go as high as 50-60%) and slapping on a 15x multiple (pretty fair for a mid teens grower), would get us to $6.38 of per share value.

Again, I’m no expert in the intricacies of Yupelri, but it seems to me that once a drug works well with a patient, especially when it’s the only (no direct substitutes) once-daily nebulized LAMA, then there should be a relatively high switching cost which essentially explains why many of the major pharma firms garner a pretty solid multiple. Even for me, something as mundane as wearing contact lenses, once I find a model that suits my cornea, it’s unlikely I’d be shopping for other alternatives. It is also inconvenient for doctors to change what has worked and most would adhere to the “don’t fix what isn’t broken” adage.

What I did not include in my valuation is the potential for market expansion. Yupelri in its current form is poised to generate US peak sales of 400m (read: doesn’t account for global sales). The firm is also running a Phase IV PIFR-2 study, of which it is responsible for 35% of the costs, which could double the number of eligible patients and as a corollary, the sales potential of the drug. The basic crux of the study is to measure the performance of Yupelri compared to Spiriva, in patients with low peak inspiratory flow (PIFR) - who suffer from ineffective inhalation of medications which could result in ineffective treatment. If Yupelri is effective, then it becomes a direct competitor of Spiriva - though Spiriva only requires a dose a day so it would be more competitive on that front.

I estimate Yupelri to be worth $6.38 per share.

Milestones

Upon selling the economic rights of Trelegy, TBPH received a mid-term CVR and outer-year royalties rights from Royalty Pharma. GSK raked in £1.7b ($2.1b) from Trelegy in 2022, up 42% from 2021. It seems very unlikely that Trelegy hits the 2023 net sales of $2.86b and so I ascribe zero value for the first $50m milestone payment. I believe the $2.86b of net sales is possible for 2024 and I think for 2025, 26 the respective low net sales thresholds are feasible.

My assumptions are as follows:

15% discount rate for midterm milestones

For the long term royalties, management’s NPV is discounted by 7% at a blended (between ex US and US royalties) 8 years out (my assumption).

I work backwards and then discount that figure by 15%

Again, I think I’m being super conservative with my discount rates; another way to think of WACC is determining GSK’s WACC given the cash flows for payments originate from GSK. As per the 2022 annual report, GSK estimated their WACC to be 7%, which is probably where TBPH’s management got their estimates from. Slap on some additional percentage points for personal risk premia and what not and you’re still a far cry from my 15% input.

In sum, the milestones are worth $2.60 per share.

Ampreloxetine

Last but not least, Ampreloxetine - the only pipeline asset TBPH owns and currently in Phase 3.

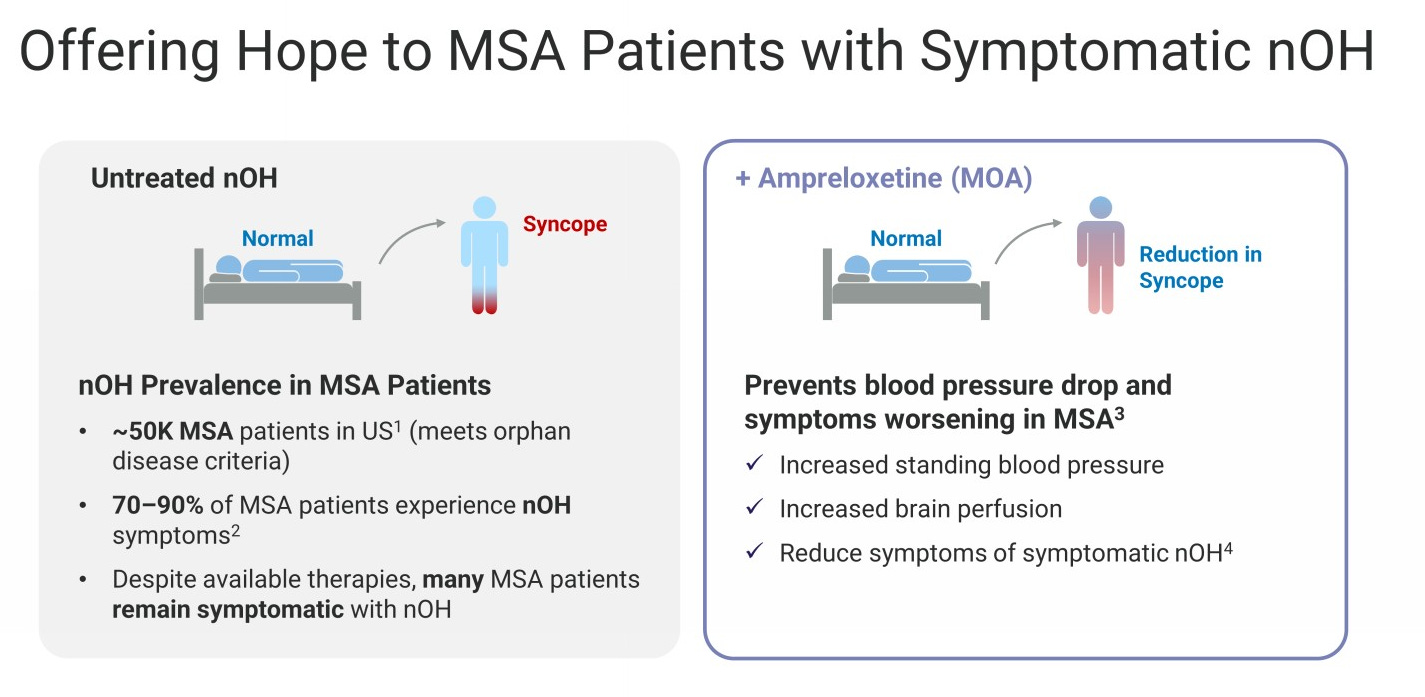

Ampreloxetine is an investigational, once-daily norepinephrine reuptake inhibitor (NRI) which TBPH is developing for treating patients with Multiple System Atrophy (MSA) and symptomatic neurogenic orthostatic hypotension (nOH).

Again, a lot of technical terms thrown around here but a few key pointers to take note of:

Despite the current therapies available, many patients still suffer from nOH syncope.

Ampre, not dissimilar to Yupelri, only requires a dose per day compared to 3x per day for current therapies

Current FDA-approved therapies have black box warnings on their label cautioning supine hypertension risk, which was not observed in over 800 patients who tested Ampre.

A common retort would then be, wouldn’t management be biased to elucidate on the grandiose quality of their pipeline, providing us a contorted view of reality?

That’s definitely a concern given the prior Phase 3 failures.

With that said, Royalty Pharma provided validation for the drug; in conjunction with the purchase of the economic rights to Trelegy, Royalty agreed to invest up to $40m in Ampre’s development, of which $25m was in upfront cash (funding for the majority of Phase 3 study costs) and the additional $15m, upon first regulatory approval. With this investment, Royalty is entitled to 2.5% of annual global net sales up to $500m and 4.5% of global net sales over $500m. While this investment might seem small, I think there is some validation from Royalty that global net sales should be pretty meaningful.

Here’s a snippet from their Q2 call:

Some key points:

while the first comment by Pablo is in reference to Trelegy, it is worth noting that Royalty takes pride in doing “deep dives” on products they invest in. That should be a foregone conclusion but it’s worth mentioning.

The undertone of Marshall’s comment is rather muted but he notes interesting upside should Ampre succeed. Again, everyone’s going to say their investments have “interesting upside” but Royalty is a specialized shop with 2 decades + of experience in this field so their words carry way more weight than your typical generalist investor. In addition, I do think involvement of an established and experienced firm like Royalty may increase the chances of success just via the cross-pollination of network and knowledge resource.

Another way to think about it would be say Ampre is a total flop and sales sort of jumps in at 200m, grows nicely for a year or two and then stalls out at MSD growth; the NPV for the initial 5 years, at a 15% WACC is a mere 17m of value. In other words, the PV-adjusted payback period is pretty long and so obviously, Royalty is thinking of numbers wayyy higher than what I’m postulating below. A retort would be that Royalty’s own cost of capital is mid-single digits and so one should apply that WACC on the stream of cash flows from Ampre - even so, at ~6%, that would still net to 26m of value.

Note that I begin counting from year 3 on the assumption that commercialization begins post mid 2024 (with a non-zero chance of delay).

Moreover, the $40m investment doesn’t account for the fact that they would definitely want a margin of safety to their in-house NPV estimates and that they have the bargaining chip in their pockets because it is TBPH that required capital (note this transaction took place in conjunction with the Trelegy sale, when TBPH was still heavily-levered).

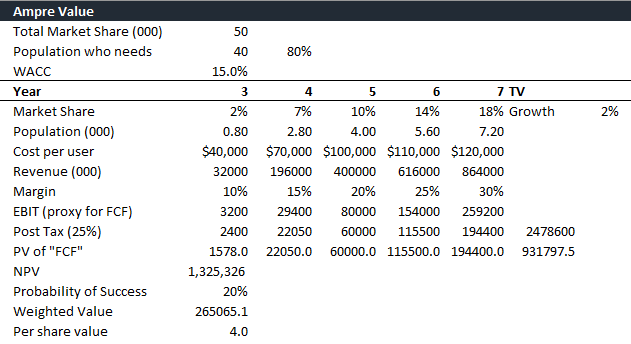

To value Ampre, I make a few assumptions (figures here are in $000s) :

50,000 patients with MSA, 90% with nOH symptoms, so addressable market is 40,000 patients

Modeled a reasonable market penetration rate growth similar to Yupelri

Cost per patient - Northera’s droxi, a peer drug, is priced $130-200k per annum so I think my pricing escalations are reasonable; a low price to kickstart usage and then raising it every year

15% WACC

Reasonable EBIT margin expansion

20% probability of approval with commercialization beginning mid to end 2024 (think the average failure rate at stage 3 is around 60%)

This gets us to around $4 of per share value.

The key point to bear in mind is that even if Ampre fails, the more certain and liquid assets - cash, milestones and Yupelri stake - add up to ~$13.50 of value, exceeding the current stock price.

Potential endogenous catalysts

One of the ways management could unlock value on their own, is to just carry out the remaining $170m of capital return they have left, of which they expect to complete by end 2023. Assuming 15.4m shares are repurchased at $11 per pop, this would accrete an additional 11% upside to the SOTP.

Other comments

On Sept 28 last year, the company proposed a modified dutch tender to acquire up to $95m of stock at prices up to $10.50 per share - so around 9m shares or around 13-15% of their total shares outstanding. Prices subsequently traded range bound between $9.90 and $10.20. The funny thing was that the tender offer was so undersubscribed, management had to extend the offer date by an additional week or so to 17 November; eventually, only a pathetic 116k stock was tendered i.e. $1.2m of the $95m offer.

I looked through recent tender offers and I don’t think I’ve seen one that was so ridiculously undersubscribed. For example, Trinet recently conducted a modified dutch auction tender for around 3.5m shares and only tendered 1.5m shares. The CFO then stated,

"We view the undersubscribed Tender Offer as clear evidence that stockholders share our belief that there is upside to our current valuation. We plan to continue to maintain appropriate capital levels, while deploying excess capital to our stockholders over time," said Kelly Tuminelli, chief financial officer at TriNet.

If a ridiculously undersubscribed tender off is even a remotely viable signal of undervaluation, what does that say about TBPH? Not to mention TBPH’s shareholder base is extremely sophisticated - 42.8% is owned by Baupost Group, Weiss Asset Mgmt and Madison Avenue Partners, this isn’t some retail AMC-esque shareholder base that won’t/can’t “vote”.

Apart from Baupost, who’s been a bag-holder since the spin off of TBPH 10 years ago; Weiss Asset Mgmt, Madison Avenue and Irenic are all quasi-activist and seasoned event-driven guys. Post the additional 170m share repurchase program, assuming pf share count of 51m, these 4 funds will own a cumulative ~50% of the company - how will they exit their positions together except for a change in control transaction? A status-quo trading stock would suffer an ownership overhang because potential investors would fear the bid being hit by Seth Klarman or Andrew Weiss every time the stock rises a little; this could be a bear case argument if one presumes TBPH still exists in current form a year or 2 out.

The board will also likely be declassified by this year which would allow activists to initiate a proxy contest if need be. Susannah Gray, executive VP and CFO for more than a decade at Royalty Pharma was also appointed to the board of directors, “bringing extensive transactional, operational and value creation expertise…”

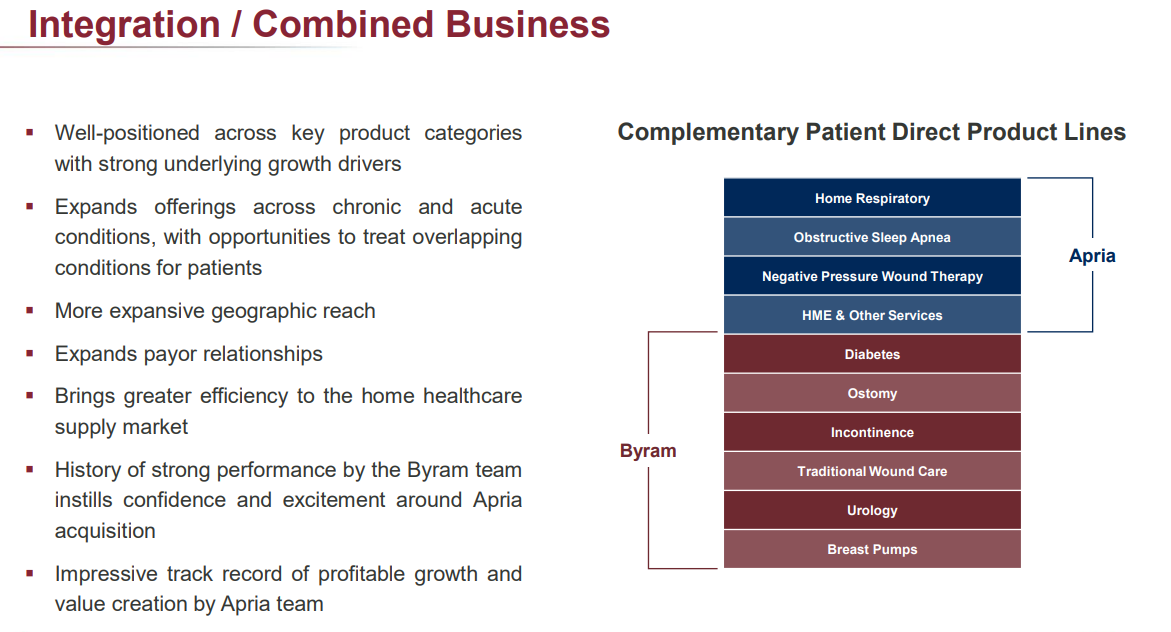

Previously, Susannah was appointed onto the board of Apria in May 2021, 10 months before it was sold to Owens and Minor. Here’s a slide from the transaction presentation, highlighting the integration value:

The way I’m thinking about this, TBPH’s sales team is really small and despite the success of marketing Yupelri, it would probably be more efficient if the firm was part of a larger firm whereby distributional advantages could be easily tapped into and complementary products could be bundled and marketed.

A concern would be continual cash burn. TBPH did previously guide to being cash flow positive in H2 22, which has been pushed out to H2 23. With continued growth of Yupelri and the massive workforce downsizing, I can see a path whereby FCF comes in positive by year end - you can fiddle with the numbers and their costs guidance; 40m midpoint R&D for 2023 But of course, SBC is an expense and so you could either just assume the compensation is paid in cash (maybe haircut net cash by ~25m) or increase the shares outstanding to account for incremental RSUs. These adjustments shouldn’t change the total value by much especially on the presumption that TBPH wouldn’t be a listed entity by year end.

On a final note, in my estimations, I have left out other assets such as milestone payments TBPH is entitled to if Viatris successfully markets Yupelri globally. So there’s another few $ of per share value that hasn’t been accounted for.

Before I conclude this lengthy piece, perhaps one might wonder, why is TBPH mispriced? Potential reasons include:

We are in a risk-off environment and the biotech index hasn’t performed too well of late

P&L still looks like a pile of excrement though that should change meaningfully this year

Staggered board that has yet to be declassified i.e. poor corporate governance

Update (18/3/2023):

A new initiative, as per the 2023 preliminary proxy, was for CEO Mr Winningham to receive a portion of equity compensation in the form on PSUs (165,000 units), tied to appreciating stock price, over 4 years from grant date. The tranches are as follows:

While this isn’t Mr Winningham owning 1.7m shares, or $17.5m worth of stock so there should be some incentive to engineer value creation.

Disclosure: Long TBPH