Trip.com (TCOM) - is a dollar of profit from TCOM much more valuable than from EXPE?

Chinese company though...

This will be another quick idea flag and different from the typical cheapish-catalyst type situations I have often written about. This is not the highest octane idea but I do think it’s quite a nice stock to “coffee-can”.

This is a superb business that I’ve been monitoring for awhile that just saw some nasty correction. I’ve been tweeting incessantly about this business, and shares finally collapsed yesterday despite a relatively good earnings report.

Yes…the stock is Trip.com (TCOM).

Since COVID, there has been a noticeable shift in how people experience the world - notably, away from luxury goods and more towards experiences/travel. An expired passport not completely stamped out would perhaps indicate a decade wasted.

Enter Trip.com, arguably the best travel OTA out there in the market, at least based of what I’ve been hearing from friends and family all over the world. This is also supported by Google Trends - notice how TCOM laps prior years bigly whilst Booking.com (BKNG) is more or less in line. Of course, this could be partially explained by BKNG’s scale of adoption but what is clear is that TCOM is on the rise.

With BKNG and Expedia (EXPE) both beating top and bottom lines quite comfortably, it was obvious to me that TCOM would’ve had a good report. Lo and behold, TCOM came out with a double beat (top and bottom), and the stock proceeds to dump into the mid 50s (of which a couple of my buds and I managed to snipe out).. but even at ~$60, TCOM is still cheap and worth considering.

Apart from just a broad-based China pullback yesterday (which probably contributed to the sell-off), further ebullience into 2025 should reverse some of those effects to an extent.

Xi Jinping has set his mind on vigorously stimulating domestic consumption to drive GDP in 2025. For exposure to the Chinese consumer, TCOM could be considered one of the best plays.

First some background.

Background

TCOM is an OTA and has been in operations since 1999. Revenues are more or less split between transportation (think flights, trains, buses) and accommodation. TCOM being an OTA, is an agent i.e. it takes no ownership of products and services sold. Think a business that is highly cash-generative, low capital requirements and therefore high ROIC through the cycle.

The current business can be simply thought of as a Chinese business - C-trip -, with a fast-growing international arm - Trip.com.

As seen below, most of TCOM’s revenue is generated in China.

An interesting factoid, TCOM also owns 49% of MakeMyTrip (MMYT), the largest OTA in the world’s most populous nation (India). You could say TCOM basically dominates the two most populous countries in the world…

C-Trip is incredibly popular amongst the Chinese. However, there is still competition from the likes of Meituan and Fliggy. On a market share basis, C-trip along with Qunar (of which TCOM owns a stake in), sport ~50% of the market with Meituan coming in at around ~25% and the rest from Fliggy etc. There has been a few times where headlines have hit regarding Meituan taking Ctrip’s lunch and here. On that front, it is worth noting that the different customer demographics both companies target (low tier cities for Meituan i.e. the PDD strategy vs more affluence for Ctrip), the different strategies (more inbound for Meituan and outbound for Ctrip), and the fact that travel is all but just a sliver of Meituan’s all-encompassing offers whilst travel is the entire focus of Ctrip.

For the market as a whole, inbound travel bookings have grown rapidly due to China’s improved Visa policy. China has been an increasingly attractive destination for travel in recent years and this should continue to benefit the firm’s domestic arm going forward.

On the international side, Trip.com grew ~70% YoY. Enough said.

Headline numbers seem to be going the right way…why the huge sell-off then?

In this piece, I’ll cover two key fundamental reasons that I believe, caused the sell-off.

Do also note that this piece will mainly cover TCOM’s international arm which has become an increasingly larger portion of revenue. I would presume the market would value the income stream thereof a lot more than its domestic Chinese arm so it’s very important for things to go well on that front.

FWIW, I googled why TCOM fell and saw a headline “shares fall amid sequential decline” which is bonkers because Q4 is generally weaker than Q3 for OTAs by virtue of rampant traveling during the summer period.

Key Issues

Ballooning expenses

Total revenue YoY grew 23.5% in Q424 and 19.8% for FY24. Gross margins deteriorated by a few bps but remain north of 80%.

Product development grew 8.4%, G&A grew 9.1% in FY24, so there is some operating leverage on those fronts.

However, sales and marketing (S&M) grew a whopping 29.3% for FY24 and 44.5% for Q424. This huge growth, especially in Q424, affected operating margins YoY, with EBITDA margins falling from 28% in Q423 to 23% in Q424 i.e. not much EBITDA growth at all in Q424.

I think there is some element of TCOM offering “discounts” on its bookings i.e. you get the cheapest price for the same exact room vs say Agoda but that’s because TCOM absorbed a percentage of the cost i.e. marketing expense.

FWIW, I don’t particularly see TCOM’s ballooning expense as a negative thing, in light of their international expansion; notably, TCOM just entered the SEA region only a few years back or so.

A good way to think about this is growth reinvestment - the sum of TCOM’s S&M and product development (aka R&D).

For FY24, TCOM’s S&M was 22.3% of total revenue; product development was 24.6% of revenue. The all-in reinvestment costs equate to 46.9% of revenue.

This reinvestment costs grew 17.4% YoY.

For e.g. BKNG, its sales and marketing expenses tally up to 43.8% of revenue, growing 9.3% YoY.

TCOM’s margins (26.5% EBIT) are still lower than BKNG’s (31.8% EBIT) and a huge chunk of that is leveraging the G&A - 4.4% at BKNG vs 7.6% at TCOM - as well as leveraging reinvestment costs, of which BKNG has a 3% advantage (as mentioned above).

Returning back to the ballooning on S&M in FY24…

Have a look at BKNG’s P&L back when it was operating at a similar scale to TCOM:

In 2013, revenue grew 29.1% and advertising as a whole grew 47.1%. Including S&M, BKNG’s all-in reinvestment S&M grew a whopping 43.6%. As a percentage of revenue, S&M expense came in at ~31%.

One thing that BKNG did well then, was managing costs in other areas - for e.g. keeping G&A expense as a small sliver of revenue (less than half of TCOM’s despite similar revenue profile), allowing BKNG to book in a nifty 35% EBIT margin.

In sum, the point I’m trying to drive home is that TCOM’s aggressive reinvestment into its business whilst positive, in my view, has been taken as negative by the Street. Perhaps the Street would have preferred a higher EBIT margin which would give the stock a nice bump but at the expense of the business long term.

Whilst analysts are trying to pencil out margins to satisfy their thirsty spreadsheets, management is nonchalant in this regard.

Some random muses on OTAs

Just some brief thoughts on OTAs, I’ve always found it fascinating in whilst its tempting to think of OTAs as marketplaces akin to say a Shopee/Amazon, the ticket price of each purchase is so much higher that customers inevitably “platform shop - compare between different OTAs”, versus say how one may just open the Shopee app and buy XX item without thinking twice. However, the unit economics on OTAs are vastly superior, downright incredible.

There is a question of the sustainability of OTAs - e.g. a bad one but off the top of my head is “why can’t hotels form an alliance” - and apart from the million reasons why such an alliance won’t work, I thought of an imperfect analogy to reason through OTAs and their strategies.

In some ways, travel service providers, think airlines, hotels, are the “Nike” of the industry (imperfect comparison - though travel service providers especially upscale ones do have loyalty systems in place - but bear with me) and OTAs are the “Footlockers” i.e. the retailers. Unlike a traditional retail relationship outlined above, OTAs have vastly better economics as they generate a margin superior to the providers with no inventory risk - something like consignment inventory. BKNG captures ~35% EBITDA margins and even as high as 40% pre COVID. These are sizable margins being captured downstream, especially comparing to say airlines that barely generate a profit through the cycle.

And so the reason for this example above is, as we all know, NKE tried to disintermediate its wholesalers and go DTC and that backfired bigly. Customers still want to price-shop, compare…

Once the retailer has enough scale, customers, and good real estate locations, its hard for the brand to remove them, because they have a consumer touchpoint that belongs to them e.g. NKE didn’t remove JD Sports from its wholesaler list.

But OTAs themselves are captive to someone else, they sit within the shopping mall called “Google”.

Ben Thompson has written extensively on Stratechery on aggregators. Aggregators by Bens’s definition, are platforms with i) direct relationships with users, ii) zero marginal costs for serving users, iii) demand-driven multi-sided networks with decreasing acquisition costs i.e. network effects. Think businesses like Meta and Google as pure clean-cut examples of aggregators.

Whilst it’s tempting to classify OTAs as aggregators, the truth is that despite having zero marginal costs for serving users e.g. their supply “inventory” incurs zero supplier acquisition costs - suppliers join by virtue of OTA having a critical mass of users - the truth is that the users don’t actually belong to the OTA themselves.

For a typical OTA, most of its traffic is generated via Google which has been the issue for the industry over the last two decades. Google is a super aggregator - a multi-sided market whereby users, suppliers and advertisers all pay and contribute to access to this market, all at zero marginal cost to the market operator.

And the power of Google i.e. the shopping mall is such that it has managed to aggregate all the retailers (OTAs) onto its platform whilst getting paid rent (in the form of SEO to ensure they are top in search). The retailers (OTAs) on the other hand have to onboard merchandise (flights, hotels) and foot the rent for their prime shopping mall location (paying Google) whilst also competing with other prime retailers in the same mall. Yet the retailers individually don’t actually control the traffic, it is a result of what’s available in aggregate at the mall.

However, it is not impossible to have your own traffic.

That’s why TCOM has been reinvesting so much into their business, entering new markets, buffing up inventory, creating engagement, ensuring excellent customer service… TCOM wants control over the demand side and be the starting point for the traveler’s journey.

That’s where the smartphone app comes to play - the flagship store. By embedding processes within the smartphone app e.g. train booking QR code within the app etc., this entrenches TCOM within the mini computer in our pockets and further drives it as the starting point for travel, bypassing the rapacious search engines. In 2024, Trip.com was the third most downloaded OTA app, bypassing Expedia and Agoda, but lagging behind Booking and AirBnb.

Poor guidance

TCOM is guiding to 14-15% growth for FY25. Management is also guiding to margins below the street’s expectations (28% vs 28.5%). In any case, there is obviously some level of managing expectations here but the firm has a history of beating estimates nicely. Credible sources have also spoken highly of management.

The Valuation

At $59, TCOM is trading at 12x FY24 EBITDA and 11x FY25e EBITDA. Note management’s words that TCOM’s margins could be comparable to global peers i.e. BKNG doing 35-36% EBITDA, achievable imminently if they reduce their growth reinvestments, though not ideal long term.

On an FY25 EBITDA-CAPX basis, TCOM trades at ~11x. I assume 10% growth for FY25 EBITDA; with ~14-15% top line growth and aggressive marketing spend, I surmise ~10% growth to be a fair figure. CAPX has more or less stayed between 80m to 100m despite revenue growth so I’m keeping it at the top range.

Let’s compare this with Expedia (EXPE), a slow growing (revenue grew 7% in FY24 with guidance for 5% growth in FY25) , lower margin OTA business with a much, much higher CAPEX profile - EXPE has twice TCOM’s revenue but spends 8-10x more on CAPEX.

The market is implying that TCOM, a superior business qualitatively and quantitatively, is worth just 2 turn of EBITDA more than EXPE, despite sporting higher margins and a better FCF conversion ratio. Normalizing out capital requirements, on an EBITDA-CAPX measure, TCOM actually trades lower than EXPE, on FY25 numbers.

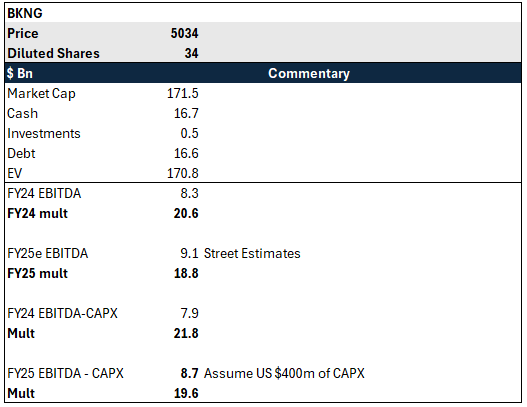

Let’s look at best in class BKNG. A top-tier operator but anecdotally losing out to TCOM and not much growth to show for as well (the Street is modeling ~7% growth in 2025).

BKNG trades at a premium multiple, 18-20x EBITDA with an EBITDA-CAPX multiple of ~22x. Given the scale and superb capital allocation, such a multiple is warranted.

But it’s not like TCOM can’t trade there as well. Shares have traded to a 52w high of $77 which would still sit at a slight discount to BKNG, albeit warranted due to a higher discount rate for China.

However, I’m estimating ~20% of revenue at TCOM is generated internationally now, up from <10% a couple of years back. A few years out and maybe we’d look at TCOM and say, that’s not exactly a China business anymore.

Note, I’ve not included Meituan’s valuation but by Street’s numbers, they are trading at ~12x 25 EBITDA and 16x EBITDA-CAPX.

Odds and ends

TCOM has also initiated capital return plans but it’s nothing to write home about.

Prosus also sold down its entire stake in TCOM last June via block sale at ~$51 - I don’t read too much into this, given that Prosus has been very focused on food delivery, as seen by the TKWY purchase last week.

Prosus’ sale of Tencent stock has not been that well-timed either with half of its cumulative sales done during the Tencent winter.

Yes, at present, TCOM is a Chinese company, yes it is a VIE.

Whether you think this is value or not is for you to decide.

Very interesting write-up. Well analyzed. Thanks. Yes the VIE structure is risk to keep in mind. I hate it not knowing what I own...

Informative post! Thank you! TCOM is an interesting one as I don't mind investing in VIE companies.