Weekend muses - cult factor and valuation discrepancies

I just arrived in Jakarta for a quick weekend vacation and so I really wanted to get this piece out ASAP (it’s almost 3am here), so pardon the brevity.

Lately, I’ve been contemplating the earnings results of a number of companies, along with their subsequent price action. Two companies that recently reported, seized my attention and saddled me with perplexity; throughout today, they’ve been living rent-free in my head and I can’t help but write about them. In this piece, I will lay out some quick thoughts, hopefully enough to give readers something to think about this weekend.

For the sake of intellectual exercise, I will not disclose both companies just yet but present their latest numbers so readers can come to an unbiased judgment. These two companies are consumer-facing, operating fairly simple, identical business models; I shall label them as business A and B.

Business A is a large cap operator, well-loved by the investing community, has historically delivered great consistent results though performance has been rather lackluster of late. Business B on the other hand is a midcap entity, sports a checkered history but in recent years, has delivered excellent performance leaving a sweet aftertaste for its investors. Both businesses have a membership component and enjoy renewal rates of 90% and above.

In the table below, I layout the aforementioned businesses’ growth and key operating metrics.

Note: Quarterly differences due to dissimilar fiscal calendar

Quite clearly, on almost all unconventional metrics, Business B stands as the undisputed winner. Drawing attention to the underlying earnings power, Business B outperforms, with EBIT growing in absolute terms and margins trending upwards despite an inflationary environment, indicating successful cost controls and price taking. On the other hand, Business A has seen a reduction in EBIT with margins compressing sequentially, to the extent that Business A earns a full 25% less operating income per dollar of revenue (in the latest Q) than Business B, despite having more scale, by nature of being a large cap stock.

Perhaps the argument may be that Business A is sacrificing some margins (in this case, some 10% on average) for greater inventory turns. While this is true, the incremental benefit is half the margin difference, a meagre 5% advantage in inventory turns. With that said, despite Business A withholding price hikes to offset inflation, it has surprisingly, barely managed to scrap a positive SSS growth in the recent quarter.

On top of these facts, Business A trades at >30x P/E whilst Business B sports a mid-teens P/E with a relatively clean capital structure - <1x leverage ratio.

Say in the recent quarter, Business A misses revenues and EPS, this quarter being the third consecutive quarterly revenue miss, while Business B, despite missing revenues with a similar magnitude, managed to claw out an EPS beat, which stock would you reckon the market pukes?

All else equal, one would theoretically argue that Business A will see the puke given the greater embedded expectations (as exhibited by the premium multiples) → the poor underlying trend of late coupled with top and bottom line misses should theoretically spell a big “F” for the stock.

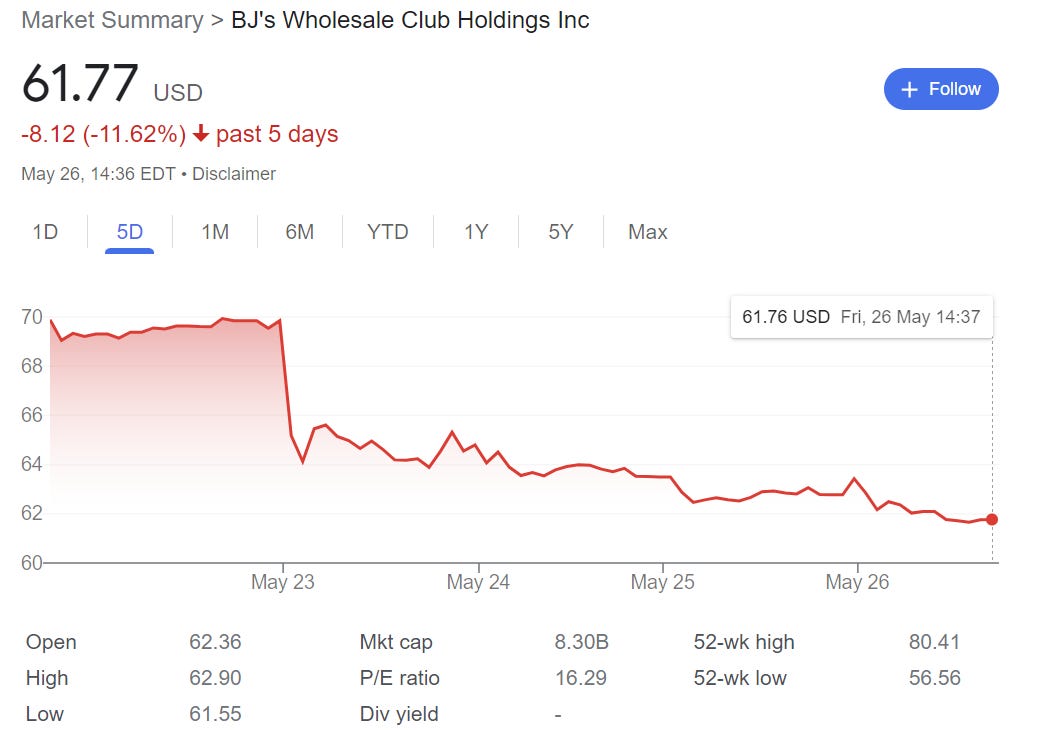

On the contrary, Business B saw a huge drawdown (despite reaffirming its FY guidance) whilst Business A was comfortably in the green.

Business A is Costco and Business B is BJ’s Wholesale Club.

There are obviously other factors that affect stock prices but surely a case could be made that the reaction at BJ’s seems rather excessive, when placed beside Costco’s. The jump in Costco’s stock price is rather perplexing as well since, as mentioned, Costco has basically missed revenue estimates in the last 3 quarters. Costco did clarify that EPS in the latest quarter was affected by the discontinuation of charter shipping activities, which was strategically faulty, timed badly and cost $0.50 per share in EPS - whether one should completely write this off is up for question as Costco clearly made a strategic blunder, paying charter rates at the peak of shipping demand. Quite clearly, investors are very lenient with Costco and whether that is warranted is a whole other debate. Regardless, the results in aggregate ain’t pretty and in my view, doesn’t warrant such a rich multiple.

Delving a little more into some unconventional metrics - both business are membership-driven warehouse clubs. Would it make sense then to determine how much each member spends at each club, how much profits each club makes per member and lastly, how much value the market imputes to each member? Just to reiterate, both clubs enjoy renewal rates 90% and above so churn is not an issue here.

On average, each BJ’s member spends a gross ~50% more annually and BJ’s earns a net (EBIT) 65% more per member than Costco.

BJ’s sports a 9.2b enterprise value equating to $1350 per member. Costco sports a 220b enterprise value, equating to $1860 per member, a 37% premium per member despite the figures laid out above. Why does this large premium exist? BJs has also grown membership fee income at a relatively faster rate so growth isn’t an issue.

As mentioned, there are obviously many other inputs to determine intrinsic value - i.e. terminal value holding a lot of a stock’s value. There are also operating differences - BJ’s expands via leases while Costco prefers to own the land underneath each club. But in some ways, there is a case to be made that the valuation discrepancy makes no sense.

One retort would be that Costco is growing its unit store base at a quicker rate than BJs. However, on a % basis, assuming BJs plans to grow 10 units per year on average (as per management) from a current base of 235 units, that nets out to slightly north of 4% unit growth in the near-term. Costco on the other hand expects 25-30 units from a base of 848 stores, ~3% unit growth.

Overall, these are some quick weekend thoughts that’ve been percolating at the back of my mind; obviously there are a lot more smarter folks out there who are much more in the weeds with regards to the aforementioned businesses and perhaps would disagree with the entire premise of the article. All fine with me and all pushbacks are welcomed.