Amentum (AMTM) - Well telegraphed secondary sale provides a dislocation opportunity

Taking stock from a non-economic seller

This is a potentially fast moving idea so I’m trying to push this out as quick as possible, before the market opens.

AMTM was a recent spinoff from Jacobs. There are a few writeups out there laying out the underlying thesis in depth:

For my piece, I’d just like to lay out the set up I see right now.

Background

In a nutshell, Jacobs, last year, conducted a reverse morris trust transaction to combine its Critical Missions Solutions and Cyber & Intelligence government services business with Amentum, to form a publicly traded government service sector player. Post transaction, Jacobs retained an ~8% stake, but indicated intentions to sell-down, in the spin prospectus.

Amentum’s shares have not done well since the spin, falling from ~$30 post spin to a mere $17 today. This is not surprising as the entire sector has puked on news of DOGE spending cuts and how the industry has more or less been milking the government for years.

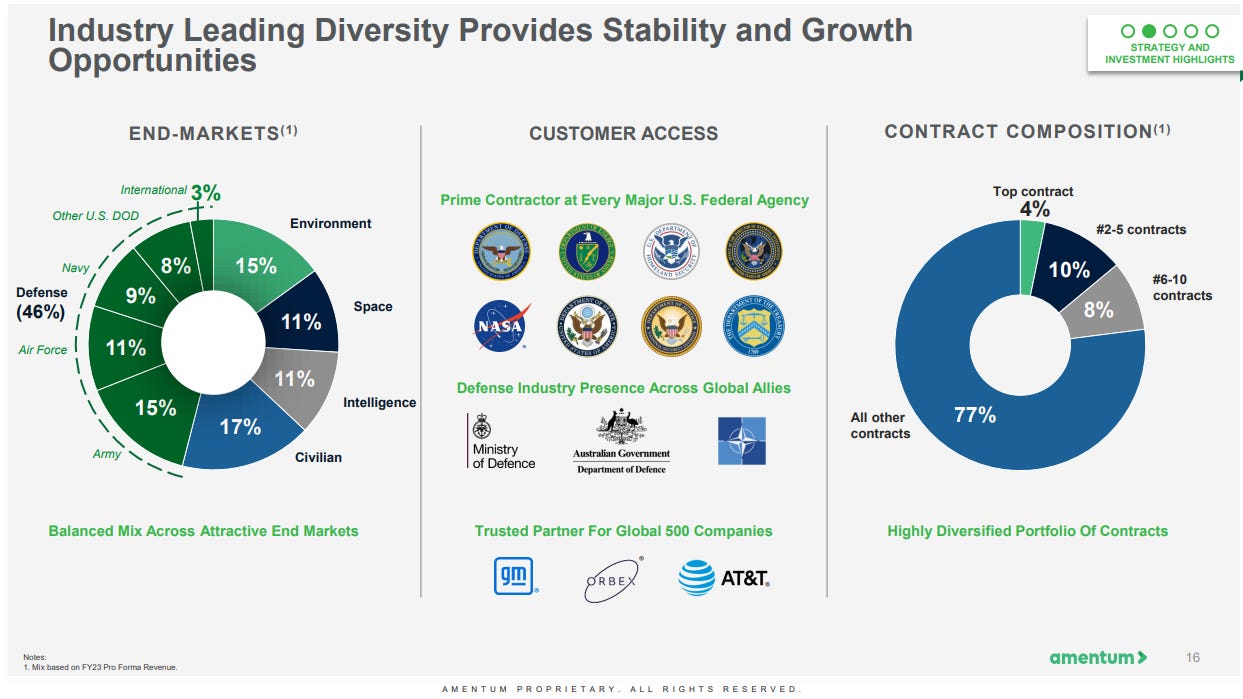

Notably, Amentum’s portfolio is rather diversified with most of its end-markets coming from defense and space, purportedly more insulated from spending cuts. Moreover, its contract composition is highly diversified with the largest contract encompassing 4% of total revenue.

Events

Two days ago, Jacobs announced a secondary offering of its entire stake in Amentum, but not in the typical block-sale fashion or open-market sale. For tax-efficiency (hint: tax-free), Jacobs proposed a debt-for-equity exchange, whereby its 19.4m shares will be swapped with its BofA issued debt.

Post transaction, BofA’s lending department will be the ones unloading the shares and in a price indiscriminate way, as shown in the $16.50 secondary sale pricing announcement (huge discount to last unaffected price), just a couple hours back. The pre-market is whipsawing around, green, as the pricing uncertainty overhang is removed. FWIW, $16.50 is a ludicrous price, as we shall see in a bit.

Using figures from yesterday’s closing, AMTM dumped out at a ~12% drawdown, whilst peers performed relatively tight over the last 5 days. I use the 5 day chart to eliminate the slaughtering of Parsons (PSN), which tumbled bigly after a sell-side downgrade. Nevertheless, even on a 1 month basis or 3 month basis, AMTM is the worst of the lot, excluding Parsons. Note, space and defense spending only form 13% of PSN’s end markets so its contract portfolio is a lot more susceptible to terminations.

Volume yesterday was high but the indiscriminate dumping is quite obvious with shares trading at a high of 18.77 and a low of 16.95, a 10% difference intraday. However, whilst these large intraday moves are quite pervasive e.g. you can calculate high single digit intraday moves on the other high volume days, it’s only yesterday that shares closed down 8% lower - and note, the news of the secondary sale was announced on March 10th so it’s really very odd when you tie everything in together.

Where AMTM stands now

As of the time of writing, AMTM trades at the lowest of its peer group, along with V2X, on an FY25 EV/EBITDA basis.

On an FY25 P/FCF basis, AMTM is the cheapest of the lot, the only one to be trading below 10x FCF.

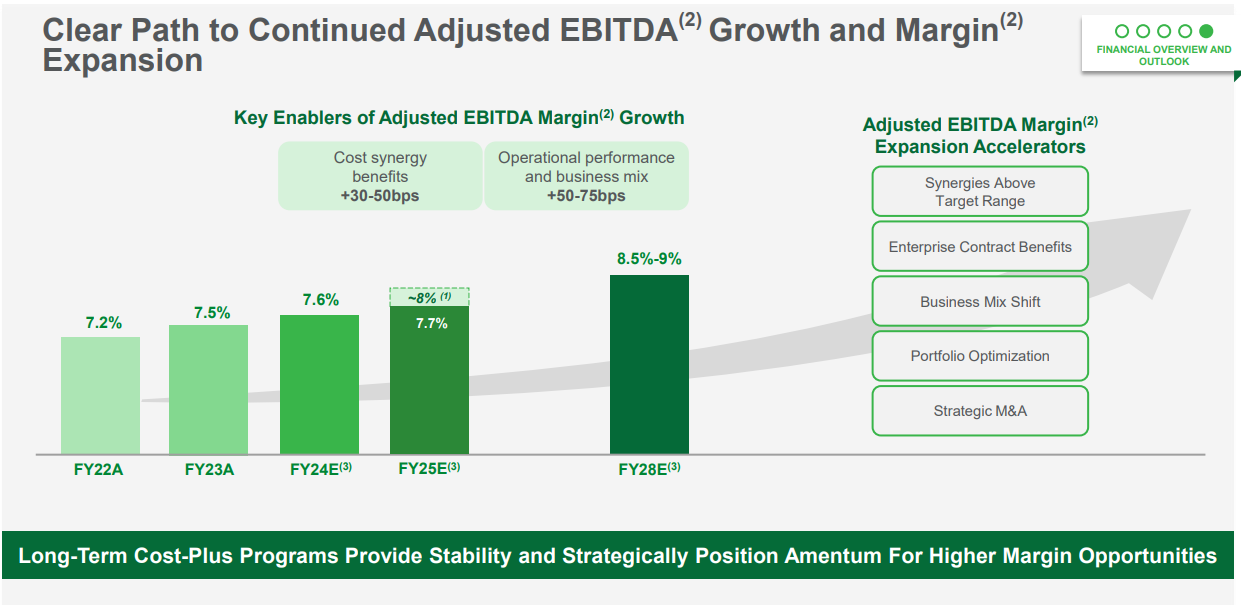

There’s a lot to quibble on whether it deserves to be this cheap; their EBITDA margins for FY25 is forecasted to be 7.8%, the absolute worst of the lot, barring V2X’s 7% margins. The rest generate ~10-12% EBITDA margins so obviously, AMTM’s contracts aren’t of the highest quality.

The company is also the most levered of them all, with a 4x leverage ratio vs peers with 2-3x leverage. Management has however indicated intentions to bring its net leverage ratio down over the next two years, which should be easily done with its ample free cash flow.

Moreover, bringing leverage down acts as a catalyst in itself. Assuming a 500m EBITDA firm worth 5b but with 3b in debt and 2b in equity. Even if EBITDA remains constant but the firm manages to pay down 1b in debt over 2 years, keeping the firm value constant at 5b will bring equity up to 3b, net of 2b in debt i.e. shareholders will have generated a 50% return, ceteris paribus.

Figures are a tad dated but AMTM is also a scaled player among its peers with a high backlog coverage ratio so revenue visibility is not an issue in the near term. 2/3 of contracts are cost plus so any inflationary pressures should not cause deleterious impact on margins.

With regards to margins, management has indicated plans to expand its margins into the high 8s to 9% region in the coming years.

Insider buying

CEO Steven Demetriou was a recent buyer of ~$2m worth of shares. Another director bought another ~$100k worth of shares right after Steve. Post this transaction, Steve will own ~800k shares which should equate to about ~$13.6m at current prices.

At current prices, we are buying below Steven’s. A pushback would be Steve is paid a base salary of $1.25m so this is a basic 2 year salary for him. Whilst that is true, the fact that he is shelling out a couple 7 figure dollars for an open market purchase is a signal of confidence in the LT prospects of AMTM, in my view.

Notably, Steve Demetriou was CEO of Jacobs for 9 years up till 2023 and created tremendous shareholder value.

Great write up

Great write-up and summary of the situation. The secondary dislocation seems like a real gift for building the position. Also, I really appreciate the shout out on my article!