Cab Payments (CABP) - placing a premium on good relationships

How valuable is two centuries of partnership?

“Time is a revealer of all things. All mysteries, secrets and the matters of the heart, are all revealed in time”..

It’s been awhile since I last wrote up an idea. Recent ideas have generally been bottom picking executed relatively well, partly weighed down by idiosyncratic factors that make them generally unfavorable to the market. The market seems to be spitting out interesting opportunities again - stocks are being sold off perhaps due to fear of Trump tariffs, indiscriminate selling after being booted out of the index (e.g. DLTR for both this and tariffs), M&A deals could roar back again etc..

Today, I have another bottom-picking idea, one I’ve been quite reluctant to write to be fair but just thought I’d put it out there. I’ve successfully traded around this stock early this year but my general track record with the UK is abysmal to say the least. Not excluding the expensive steaks and wasteful pub crawls, the UK stock market has not rewarded me that well and thus, I think my relationship with London hangs on a net negative, to put it simply. But yet here I am with yet another UK idea… if anyone knows a therapist specializing in such a condition, drop me a line...

Before moving on, my previous UK idea - WOSG - is up ~30% from when I last wrote about it, you can check it out here.

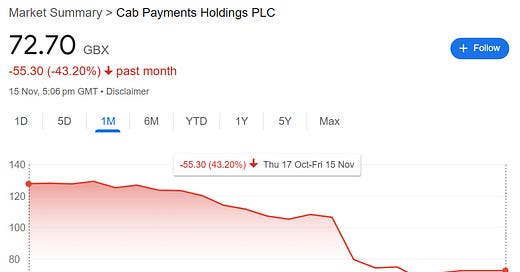

What happens when a complex emerging markets focused company, trading on the LSE, with low liquidity (~ US $1m a day), volatile earnings and subpar management, gets an unsolicited bid pulled by the bidder? Refer to gruesome image below.

Cab Payments (CABP) sports a fascinating history with a stock that has consistently disappointed investors. From the failed IPO in July last year at 335p to the constant earnings misses, the stock is down ~80% since. I will not be going into full details of the business as it has been covered extensively on here, here and here. What interests me is the setup and the extreme pessimism baked into the stock, setting up a potential positive r/r going forward.

The situation as is

Crown Agents Bank (CABP) sports a tarried history, dating back to the 18th century when the British Crown appointed agents to manage money transfers to colonies. In 1833, these agents were consolidated into Crown agents, a government entity supporting colonies with loans and investments. Following the colonies' independence, Crown Agents maintained close ties with their central banks and financial systems, continuing to distribute UK funds for purposes such as aid and pensions, while also offering technical advice and support.

CABP was eventually privatized and by 2016, was a small, loss-making bank operating an outdated system. Helios Investment Partners however, spotted a valuable asset nestled within this dated firm - a network of local banking relationships across Africa and the Caribbean, harnessed over two centuries. Following that, Helios acquired CABP for ~£40m and proceeded to revitalize the firm into the profitable machine today (see “Last 5 years ‘BUILD’ ”).

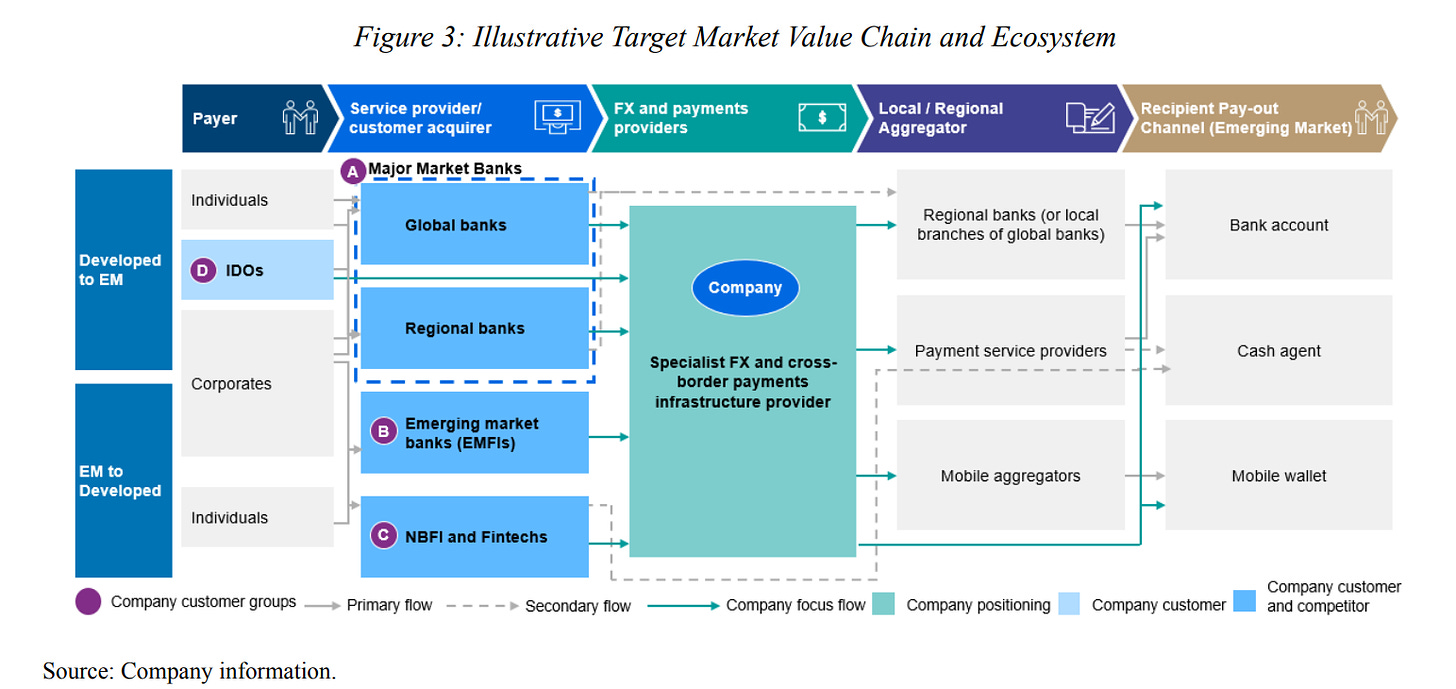

Today, as per the firm, CABP specializes in B2B cross-border payments and foreign exchange, focusing on emerging markets in over 150 countries. Leveraging its proprietary network, technology, and UK banking license, it serves blue-chip clients, including major banks, fintechs (e.g. WISE), and governments, with high-value transactions averaging over $100,000.

Where CABP sits in the value chain is as follows:

Key issues over the past year that led to volatile trading

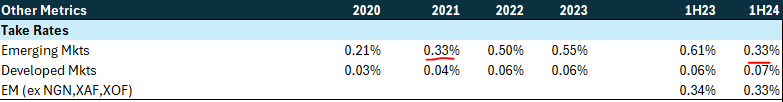

*note Central African Franc (XAF), West African Franc (XOF), Nigerian Nara (NGN)

Over-promotional management missed their IPO guidance (IPO was probably opportunistic to take advantage of the temporary liquidity crunch and hence profitable trading in its key currency blocs - NGN, XAF, XOF)

Subsequent central bank interventions in the NGN, XAF and XOF currency blocs led to volumes and take rates collapsing

Fall in IDO volumes (~30% of revenue) as charity organizations cut back on aid flows

This was offset by some positive developments at the firm

European payment license enabling the firm to onboard European clients

Partnership with Visa for last mile payment network integration (significant revenue expected in H2 25)

Change in management - new CEO etc

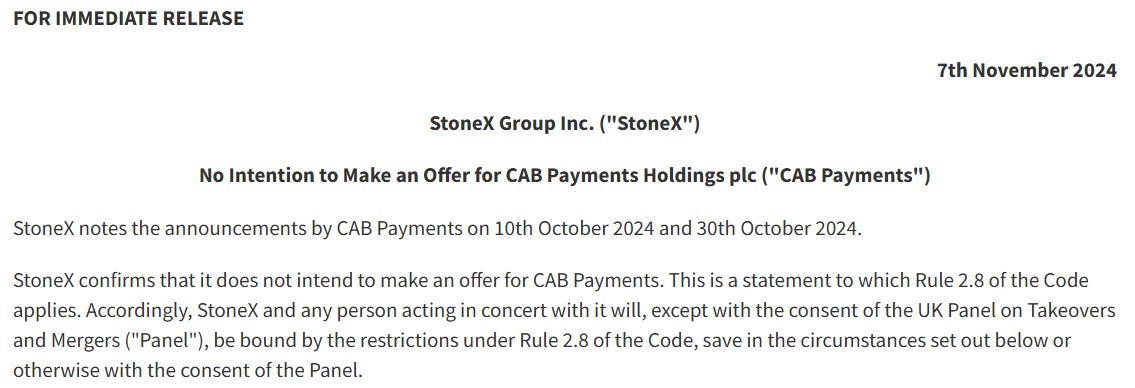

Amidst the volatile trading, on 23 Sept 2024, CABP announced that after a series of approaches starting 30 July, StoneX had increased its nonbinding offer for the firm from £1.15 to £1.45. StoneX is a key competitor of the firm but specializes in Latin America as opposed to Africa, which makes CABP an apt bolt-on. StoneX is also a serial acquirer and mentioned in their latest earnings call that they were looking to do smart deals when possible.

Unfortunately, on Nov 7, StoneX decided to pull the bid. The market responded abruptly with shares collapsing. The bid pull could be chalked up to these two reasons:

They could not agree to a proper deal price with management/Helios - perhaps the latter feels CABP should be worth £2 and more.

They discovered some “ick” in the company and decided to walk.

An issue that market participants are contending with is that if they could not agree to a proper deal price, management could have mentioned it as so, rather than be obscure about it, merely stating that “StoneX does not intend to make an offer”.

With my more optimistic tin-foil hat on and my experience with corporate governance in the UK, my train of thoughts are along the lines of - management has every reason to tank the stock so they could hop on with LTIP (which they did, as we shall see) at a favorable price and get rich when the business recovers.

After all, what’s incredibly valuable at CABP are its banking license and relationships with central banks and nostro accounts across Africa and the Caribbean. This relationship is not easily replicable which is why modern fintech companies e.g. WISE integrate with CABP for frontier markets - they aren’t banks and will never have the extensive network/relationship and nostro accounts across geographies, like CABP.

With this understanding, it is very unlikely that Helios/management would be willing to give the company away to StoneX for a mere £1.45. Not when the stock IPOed at £3.35 and reached a high of >£1.60 mid of this year; not when we earnings just hit rock bottom; and not when there are imminent catalysts at hand, as we shall see.

Regardless, at the current price of ~£0.73, the stock trades at exactly half of StoneX’s £1.45 bid and 40% below the £1.15 bid.

Follow the insiders

Right at this current price, management took advantage of the dislocation and awarded themselves LTIP stock grants, conditional on

EPS (67% of LTIP) to be 14.2p in 2026 for threshold vesting or 21.2c for max vesting

Shareholder returns (33% of LTIP) relative to peer group starting 1 Jan 2024 - the stock currently trades around the range it did then

Shares must be held for 2 years after vesting (so it can’t just be dumped)

Obviously, to bag-holders especially, such an opportunistic award is grotesque to say the least but removing the lens of corporate governance justice, it is quite clear what the conditions above signal.

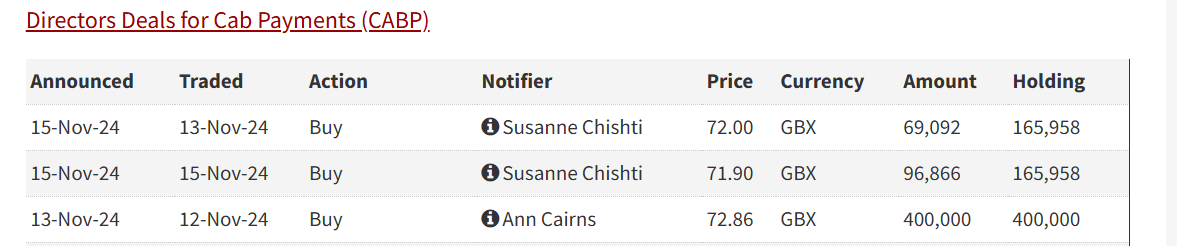

Moreover, if that’s not convincing enough, Chairman Ann Cairns scooped up 400k shares and non-executive director Susanne scooped up slightly north of ~150k shares for herself.

Notably, these are the first shares both of them own.

Fundamental Picture

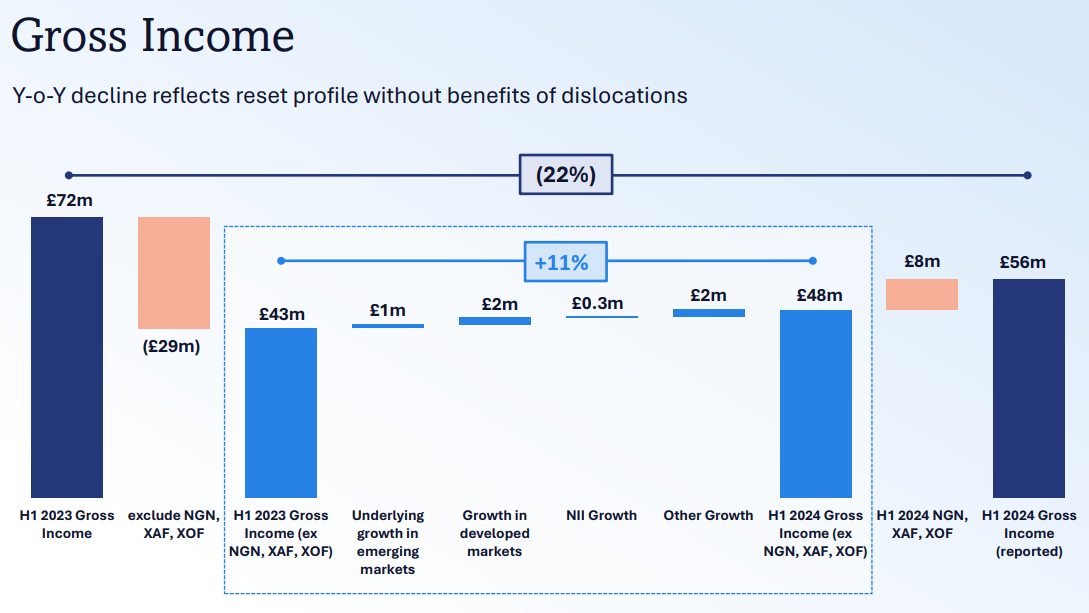

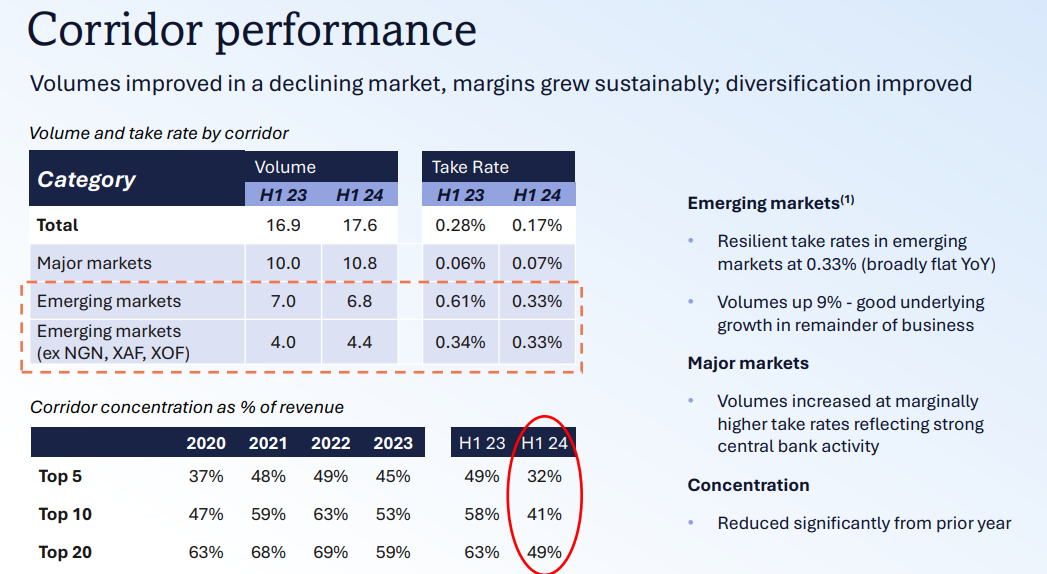

Excluding the three problematic currency blocs - NGN, XOF and XAF - CABP has actually grown revenue north of 10%, along with expanding its clientele.

Volumes have also grown in both developed markets and emerging markets with take rates in its major markets expanding 1bps. Revenue concentration has also reduced significantly from the prior year.

In the firm’s latest update, as of the 9 months ending 30 September 2024, payment volumes in emerging markets increased 10% when excluding NGN, XAF and XOF corridors and developed markets saw 15% growth - indicating market share gain as global cross border payment volumes fell 6%.

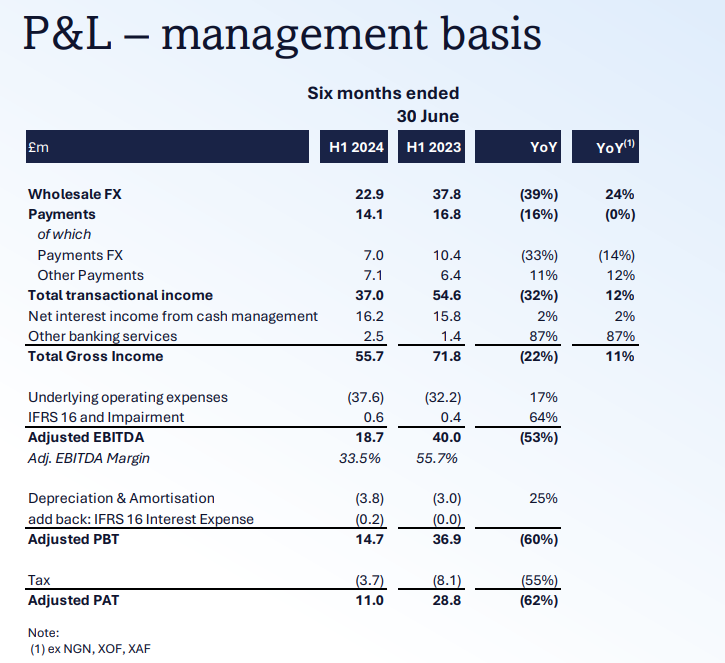

On such a disastrous year, CABP generated a 33.5% EBITDA margin and a PBT of ~15m in 1H 24, with the stock trading at a £184m market cap at present.

Moreover, the firm holds no debt and holds excess capital with a CET1 ratio of ~22.5%, i.e. the firm is overcapitalized. The street has revised estimates down yet again, guiding to 8p of EPS for 2024 on 56p of shareholder equity/per share i.e. a 14.2% ROE - not too shabby for an overcapitalized balance sheet on a terrible fiscal year. The firm’s deposits are also from emerging market financial institutions (non-retail) so there’s no risk of a retail bank run and its lending portfolio don’t carry duration risk.

Valuation

The street considers this year a trough year with estimates at 8p for 2024, inflecting up to 10p and 14p for 2025 and 2026, respectively.

Depending on how one views this orphaned institution, if from a bank perspective, then at £0.73, CABP trades at 1.3x book value - undemanding, considering trough ROE of 14.2%.

Using street estimates, CABP trades at 9x 2024 P/E, 7x 2025 P/E and 5x 2026 P/E.

As mentioned, management received LTIPs with 14p of EPS required for base vesting and 21p for max vesting. Should CABP earn 21p in 2026, the firm is priced at a mere 3.4x 2026 P/E.

Potential Catalysts

Post central bank intervention for the key trading blocs i.e. NGN, XAF, XOF, take rates have more or less troughed to 2021 levels. Should a liquidity crunch in hard currencies (USD, EUR, GBP) occur again for said key trading blocs, take rates will soar and be a boon to earnings, on top of the consistent 8-10% growth exhibited in the other currencies CABP handles.

Management has also guided to a US license in H2 24 though they’ve been absolute crickets about it so far. CABP stock reacted extremely positively on the heels of obtaining the EU license early this year; should the US license be granted, appetite for this downtrodden stock will return.

Added comments

A reader commented below: “Why is Wise not going to eat into its market share?”

Thought I’d include my full response here in case people don’t read the comments.

In sum, the answer is three-fold.

CABP's target market TAM was 2.3T in 2022 and 6.6b in revenue terms, poised to outpace global cross border payment growth of 3% p.a. with a 4.2% p.a. growth; accordingly, regulated specialist players like CABP only have a mere sliver i.e. 1-2% of this growing market.

CABP, as per the prospectus, is known as a regulated EM specialist versus e.g. WISE, a regular specialist, the difference being the banking license providing credibility. Traditional banks and regulators trust regulated specialists more. Typically B2B players like CABP work with B2C players like Wise (which falls under non-banking financial institutions (NBFI) comprising 30-35% of CABP's revenue). It also helps that CABP specializes in its regions entailing a high network density - multiple nostro accounts and direct banking relationships with local banks across this region which a B2C NBFI focusing more on what its consumer needs/wants would not necessarily have.

Not only does CABP benefit from the ~4% TAM growth but traditional banks are gradually exiting correspondent banking relationships in EMs due to high regulatory/compliance costs and unfavorable risk profiles. Hence, specialists like CABP stand to take incremental market share with satisfactory growth even if its TAM doesn’t expand.

Grabbed some shares at 69 pence. Looking for more UK tax loss murder victims if anyone has a list.

thank you for this. Seems to me like a no brainer? Did some work on this before, their intangibles are very hard to replicate. The aggressive insider buy and stock grants says there's prob no financial shenanigans. Trough earnings, no debt, single digit pe. Crazy how forsaken UK is atm.