Gaslog Partners (GLOP) - one of the worst MLP takeout offers

With a chance for a substantial bump..

Speculating on MLP takeouts was one of the more profitable and low risk trade themes of 2022; I was personally involved in DCP and SIRE, though I must say, the final takeout prices for these two were rather disappointing. Nevertheless, here’s a new one for 2023.

I’ve been following Gaslog Partners for a number of weeks now and have finally taken a position given the recent selloff. Just to recap, on January 25 this year, Gaslog Ltd (GLOG), the parent/GP who owns approximately a third of GLOP, offered to acquire all remaining units for $7.70 in cash, a 10% premium to the previous day’s closing price, consisting of $5.37 of out-of-pocket cash and a $2.33 special distribution by the target, GLOP (bear this in mind).

This transaction is slightly different from previous transactions but before that, let’s first establish why MLPs are getting taken out in droves. MLPs were formed in the first half of the last decade and enjoyed multiple benefits:

They paid no corporate taxes (only taxes at the individual level so no double taxation)

They generated predictable streams of income as they owned midstream/pipeline assets which locked in contractual fee-based revenue streams that were insulated from the caprice of commodity prices.

They offered a nifty dividend which was very attractive in a zero interest rate environment.

Putting it all together, MLPs enjoyed a low cost of equity - in 2014, GLOP distributed around $1 of dividends and traded close to $30 which is a 3% yield. Hence, the game plan was simple - MLPs would capitalize on their low cost of equity by tapping equity markets to finance more acquisitions of midstream assets to grow their asset base and dividend streams which should further improve/maintain their cost of equity allowing for more acquisitions, ad infinitum.

Alas, in the later half of the decade, Trump’s tax cuts nullified the MLP tax advantage and as the commodities market imploded mid-decade, most MLPs began a slow downward drift as cost of capital increased, rendering the existence of MLPs pointless. Thus, it makes rational sense for the respective GPs to subsume them, wring out synergies and eradicate unnecessary listing fees.

Traditionally, the way to steal MLPs from minorities would be to kill the stock by slashing dividends to naught, before swooping in with a low-ball zero premium bid. Following that, a 3 to 6 months discussion with an independent conflicts committee ensues before a final revised offer is made. In the interim, the stock will trade at a premium to the initial bid as speculators anticipate a better offer; the final offer in my experience has usually been a 10% + premium to the extant stock price though in this case, I believe it could be substantially more.

For starters, we have a rather unique situation at hand.

1) Rather than a zero premium bid, GLOP was offered a 10% premium to the prior closing price.

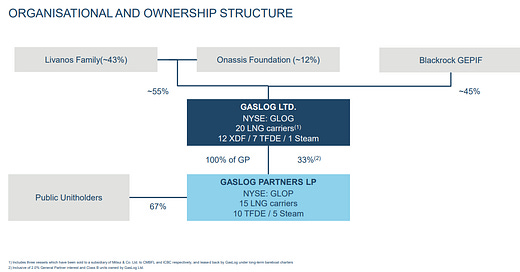

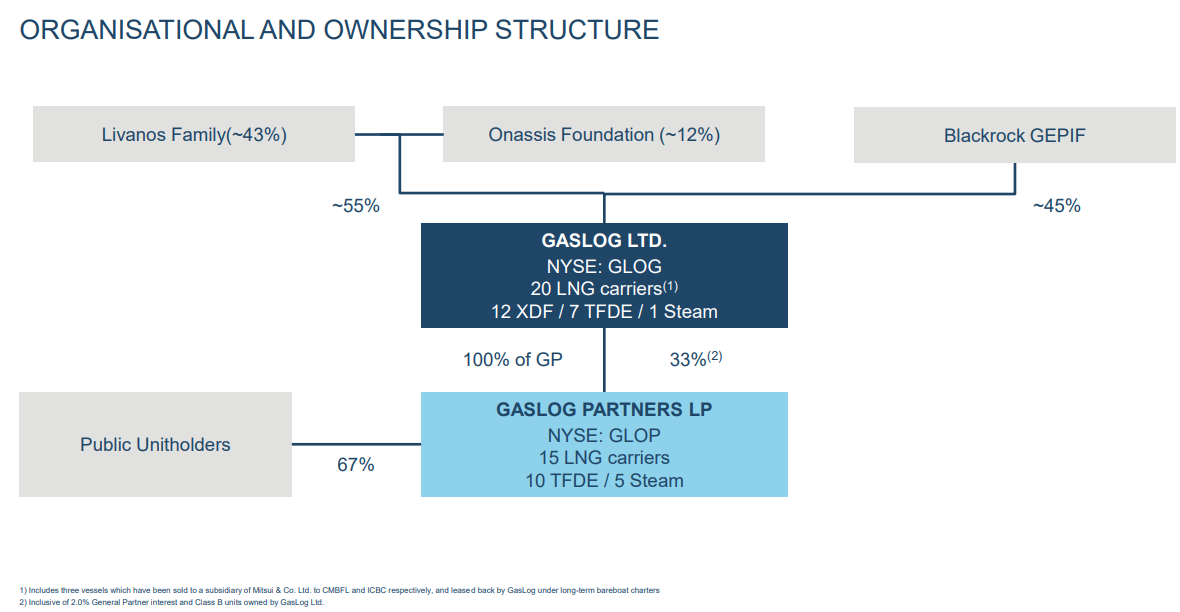

2) The GP only owns a third of GLOP.

The second point is key here as under US takeover laws, a majority owner (50% < ) could squeeze-out minority holders i.e. force a sale of shares as long as it is signed off by the independent committee. In other words, if the independent committee triangulates a fair value that is below one’s estimates (which happened in the case of DCP and SIRE), there is really nothing a minority holder can do.

In the case of GLOP, unit holders will be able to vote on the revised deal offer (albeit at a capped 4.9% voting rights regardless of equity stake) which reduces the risk of sloppy valuation from the independent committee. Additionally, BlackRock owns 45% of the GP, is long term oriented, has deep pockets and has demonstrated flexibility with price negotiations. For example, in early 2021, when BlackRock acquired the GP, GLOG, the initial offer proposed in late 2020 was $3.18 to $3.45 which was eventually bumped to $5.80, 68% - 82% higher than the initial range.

Strategic Rationale

GLOP is an operator of 14 LNG carriers - 12 owned and 2 leased. 5 vessels are currently operating under long-term charters ( > 3 years) and 9 are operating <3 years terms. Margins are pretty neat as GLOP earns EBITDA margins in the 60-70% range with voyage expenses borne by the charterer and the firm only footing for ship maintenance. Revenues are quite predictable, range bound between 300-400m over the last few years; the business also enjoys low capital intensity with scarcely any working capital needs (no inventory) and de minimis capital expenditure requirements.

Industry dynamics are quite favorable for LNG carriers but before moving on, where does GLOP fit in the LNG value chain? When natural gas is extracted, it is processed and transported to a liquefaction plant where it cools to -162 degrees before loading up for transport to export. GLOP provides these specialized LNG carriers to transport the gas to import regasification terminals where it is regasified before distribution through a pipeline to consumers.

Russia’s invasion of Ukraine altered the dynamics of global energy markets, leading to extremely volatile natural gas prices. Given the severance of energy imports from Russia, there was a massive “grab” for natural gas, in anticipation of a freezing winter, sending natural gas prices skyrocketing; shipping rates also skyrocketed to >$400k/day (before plummeting >50%) due to tightening of the freight market as many ships were used as floating storages due to congestions in Europe and contango in gas prices (there was uncertainty in how the winter would play out).

While the volatility of spot markets might seem precarious, shipping firms like GLOP tend to fix most of their days in the term market (which is a lot less volatile), leaving a few open days for spot market capture - typically in Q4 where spot markets tend to seasonally shoot higher. The term market for most of 2022 actually traded above the spot market as the spot volatility encouraged charterers to lock in term charters rather than gamble on spot fixtures.

Accordingly, GLOP has fixed 87% of days in 2023 at attractive rates in the term market, providing predictiability of income. As shown below, GLOP’s contracted EBITDA for 2023 is already >250m, not accounting for potential spot capture on open days.

Let’s zoom out for a second to examine the industry dynamics.

As mentioned, the whole Russia-Ukraine debacle really emphasised the importance of energy security; to replace Russian pipeline gas imports, Europe resorted to importing as much LNG as possible, sending NG prices skyrocketing. Fortunately, a warmer winter and a delayed reopening in China led to a decline in imports to the East, balancing out the supply deficit, bringing NG prices back to earth. However, now that China has reopened and there’s no guarantee that the next European winter will be similarly warm, various governments are green-lighting new infrastructure projects to facilitate the exporting/importing of LNG and obviate the risk of tight-market volatility.

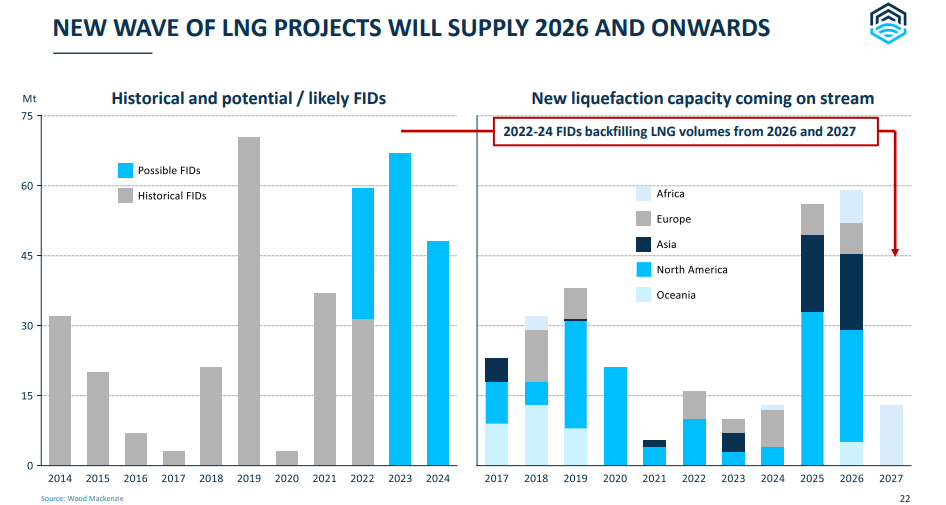

New LNG liquefaction capacity will ramp up beginning 2025/26 with the majority in North America and Asia.

Orders for LNG carriers have also been placed with the earliest delivery date coming end 2026/2027 (shipping rates should remain tight, up till the first delivery), not accounting for unforeseen delays. With the pending new infrastructure facilitating future global demand, it is unlikely that the influx of carriers will decimate shipping rates post 2026. It is worth noting that many NG suppliers are forcing buyers such as Europe to lock in long-term commitments, essentially locking-in demand, to ensure that they are able to recoup their investments in new LNG capacity infrastructure.

The economics of new ship building also blows a term-rate tailwind for incumbents like GLOP. New ships coming online in 2026/27 would require a 10-12 years term charter payback period; with higher interest rates, term rates would have to remain elevated to offset the higher cost of capital, which unwittingly benefits incumbents. New builds currently cost 250m, up 35% from a couple years back and prolonged inflation could push costs up further, leaking into term rate pricing. Concomitant to the current favorable term rates, LNG shipping firms are locking in long-term commitments pre-build and so the number of free, available ships should remain scarce post-delivery.

Thus far, we have established that term rates should remain elevated in the near term and the influx of ships should be balanced out by more demand-facilitating infrastructure, buffering term rates in the medium term. Still, there are other near-term tailwinds for LNG carriers which I won’t elaborate on too much but just to list them out:

Going forward, the reopening of China, coupled with lower NG prices in Asia (which actually benefits the freight market as it bolsters demand from emerging markets reverting back to NG from coal) increases transportation to the East, further tightening the freight market due to longer delivery distance.

FRSU conversions. Some existing ships may be converted into FRSU to serve as import capacity, further reducing available fleet.

In sum, I believe GLOP will be a cash gusher over the next few years; the acquirers likewise understand the shifting industry dynamics and would much rather have the full economics for themselves. In some sense, this reminds me a little of SIRE; on the backdrop of a global soda ash shortage, the firm owned the lowest cost soda ash mine in the world which made it a highly attractive asset to the parent firm, Sisecam.

Valuation

At the previous closing price of $8.57, GLOP trades at a mere 5.2x EBITDA!

When BlackRock acquired the GP GLOG in 2021, Evercore released a presentation showing precedent transaction multiples and industry multiples going for at least 8x EBITDA. Evercore also valued GLOP separately with a few stale assumptions: 1) charter rates were projected to hover around $60k+/day, way below the current >$100k+/day 2) 2022E EBITDA was projected to be 210m versus the actual $275m GLOP raked in. Using similar assumptions - 9% WACC and 9x EBITDA exit multiple, whilst taking street estimates up to 2025 and further tapering the numbers down in later years, still gets us to $16 of equity value.

A lot of the extra juice comes from deleveraging. At the time of the GP acquisition, GLOP was burdened by $1.5b of debt compared to <$1b today. There is still more deleveraging juice to squeeze (as majority of EV is still comprised of debt) and obviously, the GP wants all the oranges for themselves.

A direct peer would be FLNG, which trades at north of 10x EBITDA and 2x book value. GLOP on the other hand trades at 2/3 of book value and that book equity is growing rapidly given the debt amortises faster than ship depreciation. Yes, FLNG has a younger fleet and so a premium is deserved but surely that large a gap is unwarranted. Even relative to its trading history, say pre-COVID, GLOP traded around 9-10x EBITDA and at a 20% premium to book value whilst sporting more leverage and without the “energy security” structural tailwinds we are seeing right now.

Final thoughts

One of my gripes with this transaction is that, excluding the GP stake, the dividend of $2.33 per unit amounts to $88m of dividends paid out to remaining unitholders. Given the high EBITDA to FCF conversion rate, GLOP could probably earn a cumulative 88m of FCF by end April covering the entire dividend. In other words, the GP essentially takes the company for $5.40 (deal will probably close H2 23 so the cumulative FCF more than covers the dividend) and enjoys massive equity upside (multiples of their purchase price) from simply deleveraging the capital structure. Not to mention, prior to COVID, GLOP was paying out approximately $2 of annual dividends and so, labeling this $2.33 dividend as a “special dividend” and latching it with the offer price is pure misrepresentation and coercion at its finest. At a $2 normalized dividend yield, the GP is attempting a takeout at an astounding 25% yield!

Again, given the large amount of leverage through the enterprise value, the stock is extremely sensitive to additional turns on EBITDA. A 6x EBITDA multiple will equate to a $12 stock price; net of $2.33 dividend, it would equate to $9.67 cash out of GP’s pocket.

While this might seem risky as it entails the GP bumping up their offer by an approximate double, it has happened before. Again, same thing, an FRSU owned by Hoegh LNG Partners (HMLP - a comparable peer, according to the GLOG merger documents) ran into trouble in the summer of 2021 leading to some liquidity issues; HMLP proceeded to cut its quarterly dividends from $0.44 to $0.01, sending the stock plunging 64%. Fast forward to year end, Larus Holdings, which owned 50% of HLNG (the GP of HMLP), offered an 8% premium of $4.25 per unit for the remaining 55% of HMLP. The bid was rejected but after negotiations, was revised upwards by more than a double, to $9.25 (still a steal for the acquirers).

Last but not least, Kristin H Holth, who is part of the conflicts committee for GLOP, was also involved in negotiating the acquisition of the GP by BlackRock and so she should be experienced in proper valuation and negotiation.

In any case, assuming the deal breaks, the stock probably returns to around $7 (pre deal price) and change (given peers have rallied a little since), a 15-20% downside. If we do indeed get, say a $12 revised offer, that would be a nifty 40% upside from the current stock price.

Disclosure: Long GLOP

Very well laid out.

I agree with everything, except perhaps stock going to $7 if deal is cancelled.

It may rally - to $10+ (where it belongs) - as everyone is now more versed on its value.

I'd rather it doesn't get bought out, and they start distributing their wind-fall of cash-flow.

What are the 2nd and 3rd closest peers of GLOP (in addition to the peer that you mentioned is the 1st most similar to GLOP...i.e., FLNG)? Thank you