“The realization that life is absurd cannot be an end, but only a beginning.”

Happy New Year!

Hope everyone’s had an amazing holiday season. This is usually my favorite time of the year - everyone’s chill and it’s real fun to ponder about the year we’ve had and what we’d like to experience/achieve in the coming year.

I’ve more or less spent my December in Phuket, Thailand, and yes, whilst it was a vacation, as the saying goes… you snooze you lose. This year has been rather fascinating as a few events transpired through the month, creating fascinating profitable setups into the new year. I’m writing this just in time before everyone returns to their desks in a couple days!

Admittingly, I’m quite late in recommending them to an extent - I apologize. I attempted to push this note out a week back or so but was repeatedly, completely drained by the time I returned to the resort at night.

Nevertheless, I think it’s still worth dropping the ideas here for interested readers to dive further, or to keep on the watchlist and then snag a position in the event of a price dislocation.

a) TripAdvisor (TRIP) - event: corporate structure cleanup

TripAdvisor is a fascinating hodge-podge of assets - you have a sort of “melting” legacy business and two pretty relevant businesses, all bundled into one sketchy structure (or was..at least). Anyway, early this year, TRIP received bids from various private equity firms at stock prices much higher than where we’re trading today. The bids fell through partly due to shareholder structure overhang i.e. major shareholder Liberty TripAdvisor (LTRPA, which owned 57% voting rights via a dual class structure) was on the hook for a near maturity of a large chunk of preferred stock, making it perceptibly difficult to negotiate for a fair value takeout price with acquirers (i.e. dealmakers would assume LTRPA was desperate and would try to squeeze’em and Greg Maffei was probably not having any of that). Having a major shareholder i.e. LTRPA, with maturing debt, negative tangible book value and trading on the pink sheets, also makes TRIP unpalatable to most investors as LTRPA may be motivated to act in their own interest as opposed to shareholders.

Well, just a few weeks back, a transaction was done whereby a funky reverse acquisition of sorts occurred - TRIP acquired LTRPA’s stake, eliminating the dual class structure and cleaning up the entire corporate structure mess. The entire deal was done at an implied purchase price of ~$16 per share and effectively cancelled ~19% of TRIP’s stock i.e. a quasi buyback.

With this, TRIP’s corporate structure is simplified and the equity, much more investable. There’s an argument that this was done in the expense of TRIP and that the ~$16 was a “bailout price” for LTRPA. I disagree for various reasons as we shall see shortly.

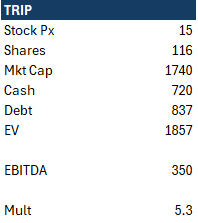

Most of EBITDA is generated at TripAdvisor, which some may argue is a melting ice-cube, especially with Google reviews and the advent of Tik-Tok food blogs etc. To be fair, I found Google Reviews to not always be reliable (especially in Europe) and Trip Advisor would be my double-confirmation. In any case, I’m not here to debate on Trip Advisor, it’s probably a pretty zombie platform and monetization efforts have consistently failed to yield fruit through the years. I think a 5x EBITDA for TripAdvisor would be fair.

At present, the entire firm trades at ~5x EBITDA and given that both Viator and TheFork generate de minimis EBITDA, those two aren’t exactly priced in and deciphering the values of the aforementioned pair will determine our upside.

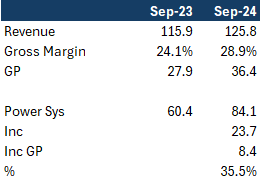

As seen below, both Viator and TheFork recently experienced an EBITDA inflection, both earning ~10% + EBITDA margins in the recent quarter with mid-teens YoY revenue growth.

Viator peers include Expedia and GetYourGuide. Expedia trades at ~1.8x EV/Sales and GetYourGuide just was valued at ~2b early last year. If Viator is worth ~1.3-1.5x sales, that pins it at ~1-1.2b.

Even ascribing zero value to TheFork, gets us to ~$22 per share value.

Another way to think about this is being ridiculously stringent - ascribing TRIP a 4x EBITDA multiple, 1x Revenue for Viator and 1x Revenue for TheFork. With that, we still obtain a ballpark of ~$18 stock price.

How is value unlocked here?

TRIP gets sold entirely; maybe Apollo returns to the table and this gets done and dusted in the low 20s?

Spinoff of Viator/TheFork. TRIP did attempt to spinoff Viator a couple of years back but held back as the public markets were experiencing major turmoil then.

b) Power Solutions (PSIX) - event: uplisting

This one is a volatile dog and a trader’s dream. I initiated my position a week or two ago when the stock puked into the high teens for seemingly no apparent reason. Perhaps someone got margin called… a desperate seller?? Our absolute favorite :P

Well, despite the surge in the stock price, the reason I’m pitching this stock is due to the interesting dynamics still at play here - appealing to my toxic habits, in simple terms.

First, the steamy piles of shit one has to deal with: you have a pretty sketchy shareholder structure here - a 51% ownership by a Chinese SoE (Weichai Enterprises) and despite being cash flow positive, the company is facing going concerns issues. Both issues are nicely laid out in their recent 10Q:

Simple math, we have 95m of net debt against a 736m market cap at the $30 stock price, pricing PSIX at ~11x LTM EBITDA and 12x UFCF. Not as cheap as it was a week or two ago and readers are not pressured to buy here, but it’s worth keeping on the watchlist in case a dip-buying opportunity presents itself.

Why do I say, keep watch of this?

Firstly, PSIX is a growth company masqueraded as a stalwart duckling. The firm is guiding to a more or less flat growth in net sales for the year but under the hood, is a fast-growing Power Systems business growing ~40% YoY, taking an increasingly larger revenue-share.

Secondly, as Power Systems explode in growth, this has noticeably inflected profit margins, making the firm solidly profitable. A quick back of the envelope math on Power Systems recent quarter earnings indicate a unit economic gross profit of ~35.5%, which is in line with the gross profit of peers i.e. GNRC and VRT. Margins have yet to be exhibited on the P&L but will eventually do so as this segment grows as a % of revenue in subsequent quarters.

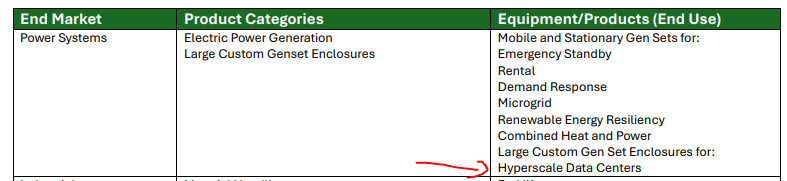

So what does Power Systems do? Power generation for data centers i.e. an AI play.

The DoE recently estimated a double to tripling of data center loads by 2028 which calls for tremendous electricity demand; PSIX will be a key beneficiary of this huge growth.

In sum, we have a fast growing power generation business, that is still early in its maturity curve (as seen in margins), trading at ~11-12x EBITDA/UFCF, despite peers (not apples-to-apples) i.e. GNRC (much slower growth, mature margins, more capital intensity) and VRT (slower growth, mature margins), trading at similar to higher multiples.

Last but not least, PSIX just uplisted on the NASDAQ. Whoever couldn’t own pink-sheet stocks can finally participate in the growth thereof. Fingers crossed to further recognition and multiple expansion (not that this isn’t a popular pick already) in the subsequent weeks/months. Ideally, we also get a debt refinancing soon which will alleviate the going concern issue.

Conclusion

So there it is, two ideas in this quick New Year’s trading note - both with events that took place during the holiday season… I had another one I wanted to include but might save that for a later piece.

Here’s to wishing all readers a prosperous New Year, full of love, happiness and peace.

Thanks, and happy new year, I like the Trip idea looks quite asymmetrical limited downside with a nice upside potential.

PSIX sounds v interesting. The earnings multiples in this tweet seem high, any thoughts?

https://x.com/UncleAlpha007/status/1873805153519731109