Regular readers of this blog may know that I love tinkering with setups. Recent profitable ideas of late have come from identifying mispriced situations primed for profit e.g. TDS-PV and FF. Whilst a lot of focus in investing is on deep diving the fundamentals, the first easy pennies are often acquired via identification of a profitable set-up and thus, being able to identify profitable patterns is an important skill to hone.

This trading framework has been percolating in my mind over the last few weeks; but given the way the strategy has played out (hint: amazing), I think the blog deserves an article on what I’ve been tinkering with over the last few months.

This would be a rather quick “think-piece” and might ruffle the feathers of fundamental purists but in the short term, markets are governed by trading dynamics - one can get the fundamental picture wrong but if the technical dynamics are nailed, even a wrong investment could turn into a profitable trade. An exaggerated example of a recent ludicrously x2 profitable trade would be Roaring Kitty just absolutely milking every last juice from GameStop (GME) in spite of the fundamentals.

This trading framework would be termed as “calling the recoil”. Others may just call it “BTFD” but it’s best to not be so vulgar on the blog. The basic idea is that when the stock of a good business gets sent to the doghouse, there is an overshooting mechanism driven by investor psychology i.e. investors getting overly negative - and like a compressed spring trapping a tremendous amount of elastic energy, a potential to shoot quickly upon even the slightest change in sentiment. To trade this, one would purchase one year OTM vanilla calls - to provide breathing room for the trade to pan.

I will list out a few examples later but there are three stools to this trading strategy:

Fundamentally good company missing quarterly expectations

Accounting hiccups

Random aggressive sell-off on zero endogenous news (could be exogenous i.e. interest rates etc)

There’s still some cake for fundamentalists; ideally, for downside protection, you’d want to ensure the company’s balance sheet is clean and that the business is a “good” one - so there is some art > science involved here.

To be fair, one could gamble on absolutely dumpster levered busted shitcos that trade at a miniscule fraction of tangible book value - assemble 150 of them and it could be profitable - but that’s a strategy for another time.

Below, I will narrate a few examples I was involved in YTD.

Case 1: ADM (Accounting hiccup)

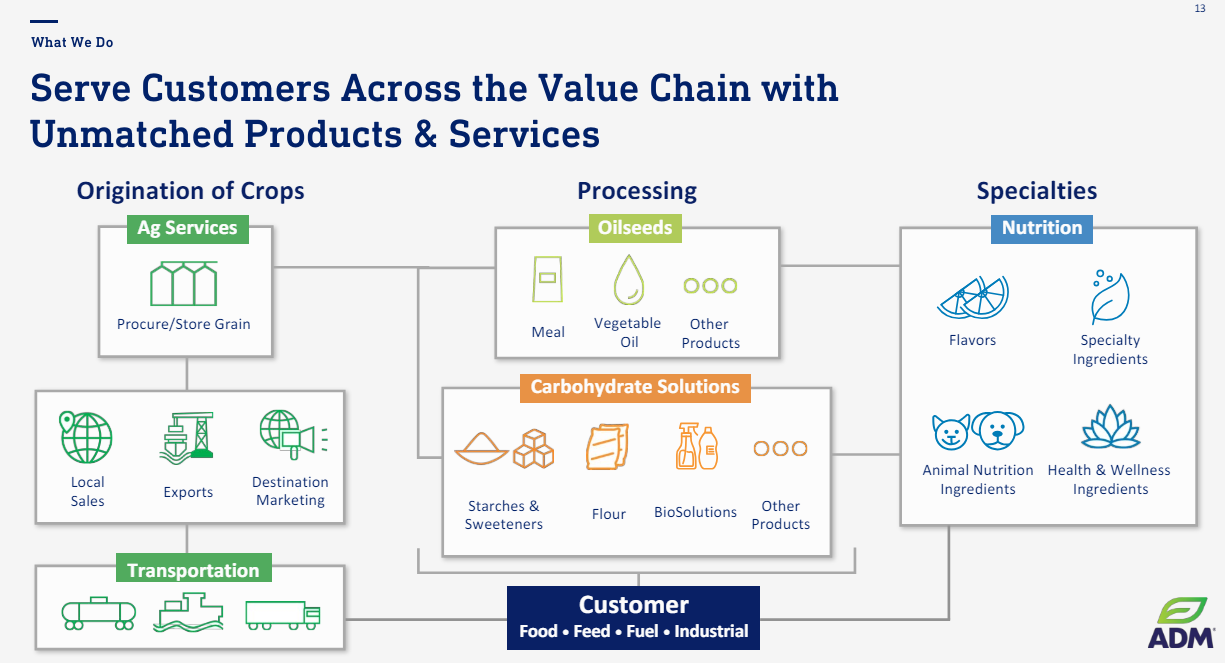

In late January, ADM saw its share price plummet due to confluence of accounting issues followed by the departure of the CFO - a nasty sight. Given how sudden the situation was, it would’ve been difficult to have thoroughly grasped ADM’s business model (“What we do” according to the firm); fans of Buffett would recall him mentioning ADM as a company he would acquire, so at least we got one cheeky stamp of approval.

But, it wasn’t as important to understand the core drivers of ADM as it was to triangulate the issues quickly and figure if the risk/reward is good.

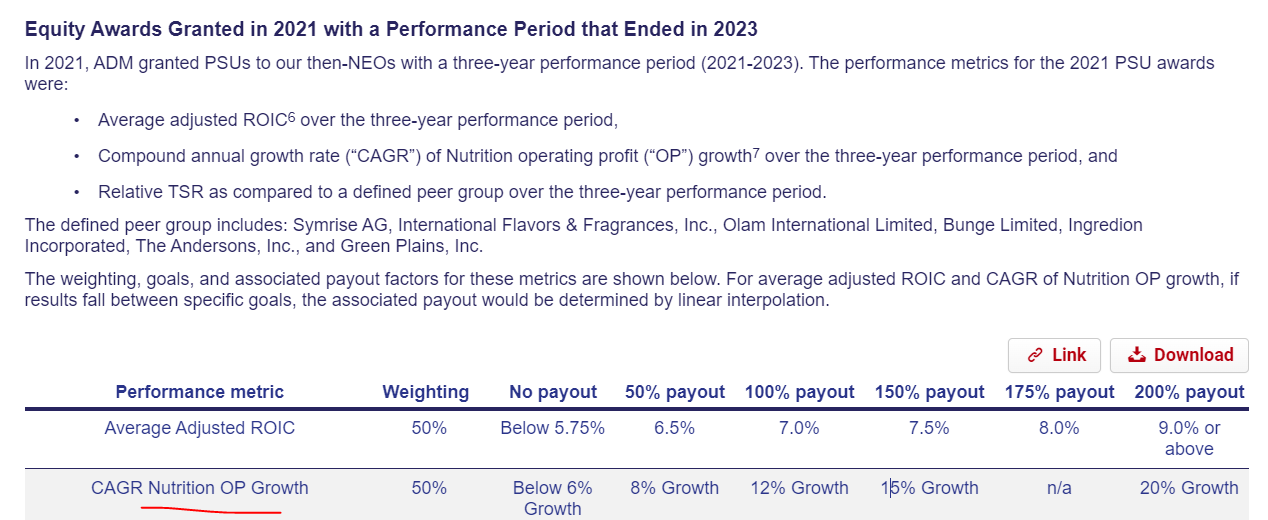

First up, the accounting issues seem to have been an intersegment sales issue i.e. the allocation of expenses between business segments or more specifically, a juicing of ADM’s nutrition segment, of which management’s compensations were partially tied to - the outcome, dictated by the incentives.

In other words, the firm’s consolidated profitability was not the issue as reiterated in this letter by the CEO - affirming $6.90 of EPS i.e. a 7x P/E for a firm that typically trades in the mid-teens.

Secondly, despite Nutrition being a big part of performance evaluation, Nutrition really was just ~10% tops of the firm’s EBIT and so the intersegment misallocation would’ve been a single digit % of total EBIT i.e. not enough to warrant a >20% + drop in the share price.

Thirdly, ADM’s balance sheet was in fine form - with around ~10b of net debt and 5-6b of EBITDA i.e. 2x levered. Moreover, ADM was also FCF positive so there was no risk of insolvency.

Last but not least, ADM was sporting a 3.5-4% dividend yield so an investor would’ve been paid a nice yield to wait.

Turns out, ADM’s issues turned out to be a nothing burger, and the stock has recovered some ground since.

In sum, you had a situation where irrational sellers may have oversold out of panic, a solidly profitable company with a healthy balance sheet, creating a situation whereby holding your nose and perhaps purchasing some OTM LEAPS would have worked out quickly and profitably.

Case 2: HHH (Random aggressive selloff)

This example might get some flak but hear me out. HHH isn’t in my wheelhouse but there’s a lot of work done online pinpointing to NAV being oodles higher. The setup was simple - HHH saw its stock get hammered to as low as $59 recently, reminiscent of late 2022 when the stock went below 60 before promptly recovering to 80. In fact, throughout its trading history, HHH has rarely gone below 60 except for left tail exogenous shocks (i.e. COVID). The stock is a hairball to an extent, management has not been great but if you’d ask any seasoned real estate investors, they would tell you that HHH below $60 warrants a position, even if small.

From another angle, just the simple fact that despite Bill Ackman stepping away from being chairman, he has constantly demonstrated his belief that HHH is below intrinsic value - not only purchasing open market shares at >$70 but also conducting a modified Dutch auction for shares at $70 in late 2022.

Valuation wise, HHH sports a tangible book value of ~$58 per share so at $59 you were purchasing it a smidge above TBV, a valuation that when purchased at, historically, yielded a profitable result.

Readers may scoff that I’m building a thesis around Ackman here… but the fact is the trade worked - I did not purchase calls on this but my buddy did and is probably enjoying some good wine somewhere now.

A Few Valuation Cases

These are the ones I missed due to my stringent valuation criterion. But one thing I’ve realized is that most of us value guys are way too hard-up on valuation; hear me out and this might sound like garbage but my working bro-science theory is that at a certain valuation spectrum, it doesn’t matter.

Now I’m not going to speculate on why that is i.e. fund flows, market structure, algos etc. But often, when a high quality company gets killed, the valuation comes down but not really - by that I mean, a high quality company often trades at some nose-bleed valuation already, say 35x P/E, and maybe trades down to 25x P/E. Value fundamentalists may find a 25x P/E too rich still, but the market doesn’t care whether something should be 20x P/E or 30x P/E. Valuation matters most when the discrepancy is wide - like my recent writeup on WOSG (trading at ~6x EBIT when it could arguably be worth mid-teens EBIT) or the cash-box ideas (decent companies going for low single digit multiples - laughably cheap). However, with “quality” companies - the quality itself is subjective and esoteric and the stock is priced in a range where the market simply doesn’t care if it’s worth +/- 5 turns of EBITDA.

Still, as I will show you in the examples below, there are ways to profit from this.

Example 1: Adyen

Adyen, late last year, suffered a sell-off resulting from disappointing earnings and a stretched valuation. Management explained that the OPEX bloating was due to staffing scale-up, the benefits not yet apparent, hence temporal operating deleveraging. A salient and obvious point (as learned from META’s rebound) is that yes, companies over-hire in the harvest years but they could also fire in the lean years.

Nevertheless, Adyen remains best in class - the lowest cost producer in the payment space, growing organically compared to peers which are often acquiring to grow and laden with accounting fraud problems (numerous to name…).

A key issue (at least for me) post sell-off was, well the valuation was still too rich for my liking. But for a best in class payment processor, the market overlooked that and determined that Adyen was still the prettiest girl in the room or a collectible (gentler parlance), and like the recoiling of a spring, the share price recovered quickly and swiftly.

Example 2: Starbucks

Starbucks is facing immense amounts of competition but the esoteric quality (ugh I hate this phrase) of the company came to me in an interesting way.

My neighbor upstairs is undergoing some renovations and so my home is frequently, deafeningly noisy - I found myself finding respite in a Starbucks nearby rather than other coffeehouses.

I don’t remember what’s the term for it but there was a social experiment done whereby 2 people, with no contact, were to meet each other in New York within an arbitrary time frame. The way the duo went about it was to meet at a key landmark at 12 noon - or at least that’s what they believe the other party would’ve done - and they nailed it. In a sense, Starbucks is that “quasi focal point” for many local communities.

I was hanging out with a Vietnamese friend a few months back and she comes from a region producing rich Arabica coffee. Inspired by the Kopi Kenangan story, I had a dream one night that I ran a Vietnamese coffee chain in Singapore, with beans sourced from said region.

However, realistically, the difficulty of such an endeavor could be boiled down to two things - 1) I would have to deal with sky-high rents and 2) I would have to compete with Starbucks

Maybe Starbucks isn’t so popular anymore but can I compete with the cost advantages of a global vertically integrated coffee company?

Shopping malls see Starbucks as an anchor tenant whilst my “Viet coffee chain” is dispensable, and I would have to foot relatively higher rents (feeding into 1)).

In sum, on a fixed cost basis, I’m fighting with one arm behind my back, not to mention the myriads of other wantrepreneurs with a similar idea.

Maybe this problem is very specific to the tiny island I live in but is Starbucks quality or not? Should it trade at 15x earnings rather than 20x or 25x earnings? I don’t know and frankly, the market doesn’t either.

Post an internal family discussion, my dad intelligently took a position post sell-off and so far, the market has deemed that the sell-off was far too aggressive with a ~12-13% gain in a month so far. If he had used calls instead, the position could be up a nifty 50% (;p)… as quick as a shot of espresso.

Final Thoughts

Not to let this short think-piece drag on too far but other notable mentions that may fit into one of the three buckets I mentioned above would be LULU and XPOF (I own calls here). Both have bounced a fair bit in recent days which triggered me; I actually had this article drafted for awhile given how ridiculous I thought it was to write about something so “unscientific” but the recent performance of LULU and XPOF validated my hypothesis and spurred me to get this up.

As all things, there is no exact science here. I would classify this as a short-term trading strategy that may help bring a few % to the P&L. There is no iron-clad law that stocks will rebound immediately post sell-off; stocks that go down can keep going down and all good trading/investing requires some level of artistic discernment. But nevertheless, open to discussing this concept with readers if interested.