SLA.AX update

Wesfarmer has returned with a higher bid ($3.35 vs initial $3.15), which I laid out the potential of in post 1. When Wes indicated that it would not match EC’s bid, the market was spooked (up till last week where shares closed at $2.84 - implying a 56% acquisition probability, assuming a $3.35 takeout and $2.20 break price), especially on the backdrop of noise-events i.e. WAM dumping shares (admittedly I was spooked as well), Wes’ CEO prognosticating bearishly on the economy and EC issuing a profit warning; yet the acquisition rationale made sense as laid out in post 2, with Wes explicitly stating there they weren’t walking away, creating an interesting r/r (a quasi-can’t lose situation) and so, here we are and congratulations to all arbs that were buying <$3 - as a friend once told me, “fortune favors the foolish”.

CLMT

This isn’t a novel idea and a number of subscribers would have seen this idea passed around in the event-driven space. Nevertheless Calumet (CLMT), despite a well-told story hasn’t been able to catch much of a bid over the last year or so. To be fair, the stock breached $20 temporarily but retraced as the market soured on all things energy and commodities - oil, refining etc. Whilst the tape for oil has been rather abysmal, refining cracks have remained stable and elevated - in some sense, one could argue that the market is pricing a recession but then again, looking at how the major ad players, online retail giants and major industrials trade YTD, it just doesn’t seem like it.

Anyway, basic background on CLMT - this is basically a goodco/badco story with the badco being CLMT’s core business, an integrated specialties operation (specialty products, performance brands and refining) facilitating the sale of waxes, fuels, asphalts, lubricating oils and packaged specialty products (e.g. synthetic oils) under the Royal Purple, Bel-Ray and TruFuel brands. The goodco on the other hand is CLMT’s majority stake in Montana Renewables (MRL), a valuable top quintile renewable diesel (R.D) /sustainable aviation fuel (SAF) facility in Montana, which is where most of the value realization for this stock is encapsulated. But we’ll get into that later.

How CLMT stumbled onto MRL is fortuitous to say the least. CLMT purchased the Great Falls refinery in 2011, with a production capacity of 10k bpd of niche fuels and specialty asphalts. In 2016, CLMT decided to expand the refinery and purchased an oversized hydrocracker - frankly, too much for its needs (25k bpd); then in 2020, COVID struck and CLMT, facing an imminent maturity of its 2022 notes, put the Great Falls up for sale for liquidity management and simplification of the company’s operating structure (management argued that the volatile refining profits masked the earnings stability of the specialty co) though the idea was eventually shelved and supplanted by a partial conversion to a RD facility due to a number of idiosyncratic asset advantages and the market’s increasing fondness for all things green.

After a sequence of transactions and installations, operations at MRL commenced late last year and as of Q1 23, production capacity of 15k bpd has been fully activated. MRL also initiated its pre-treater in April this year, expanding the potential feedstock base with concomitant cost advantages - management estimates $0.80/gallon cost advantage relative to treated feed - to be realized on the P&L starting Q3 23. Normalized effective throughput will range around ~80%, approximately 12k bpd and management just reaffirmed $1.25-$1.45 EBITDA/gal (bear this in mind). Going forward, management has outlined a “Max SAF” plan which, upon installation of an already purchased reactor, could expand plant capacity to 18k bpd with 80% SAF throughput (up from current ~30%) - to take advantage of the rapidly growing SAF market. This will take place somewhere late 2024.

With the background out of the way, let’s delve deeper into the key markets.

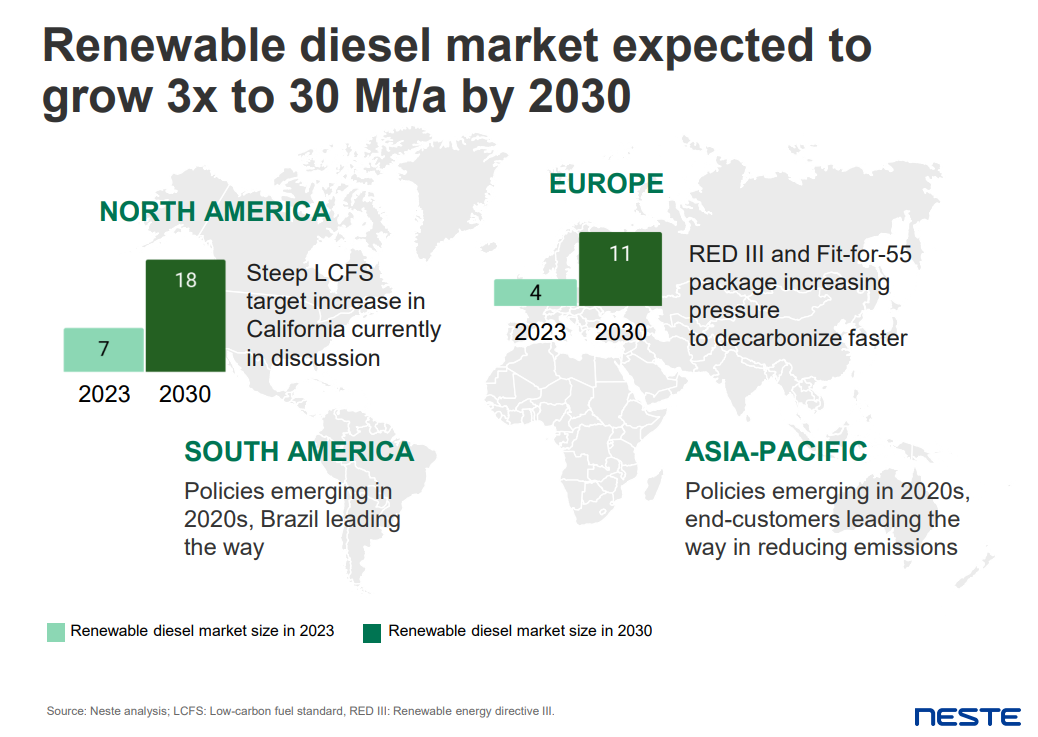

I think the Neste slides are instructive with regards to both the RD and SAF market; the long-term trends point to increasing demand and even if there exists near term global surplus, it’ll flip into a deficit eventually.

Moreover, local supply-demand dynamics is what drives the price of credits which determines CLMT’s profitability. Accordingly, CLMT has guided to existing RD capacity shortfalls locally and with inflationary cost pressures stifling new build economics, saturation fears may prove to be unfounded. The proof is in the pudding re demand → MRL’s initial renewable products was 3x oversubscribed and have all been contractually placed with three major offtakers with solid credit ratings.

Montana Renewables

There are a few key aspects that make MRL a top quintile asset and it’s mainly a result of where MRL is located. There are two key risks when kickstarting said projects - 1) input/raw materials availability and costs (this determines where one sits on the cost curve) and 2) competition (determines sale price) → marrying the two provides us a rough idea of where margins sit.

As mentioned, recent cost overruns have reduced the attractiveness of local nascent projects and so 2) shouldn’t be a problem in the near to medium term.

Regarding 1), MRL has a backyard of abundant supply (~150k bpd of feedstock supply), especially with canola oil recently approved by the EPA as a feedstock for R.D and Camelina oil - a nonfood low CI feedstock gaining traction in the R.D space - both available at large in Montana; given the short supply chain and low cost to suppliers, MRL would naturally be the offtaker of choice for many of these suppliers. This accords MRL a cost advantage relative to Gulf Coast (GC) RD producers (around $0.25-$0.35/gal of transportation cost).

Another geographic advantage MRL enjoys is that it is located near current mandated markets of Canada and Pacific Northwest again, providing further cost advantages relative to GC peers should they wish to access the same markets.

Margins

The graph can be a little misleading in that the column length for every $2 of gross margin/gal is rather narrow. However, we can safely estimate that there is a stable gross margin range - between $1.50 to $2.

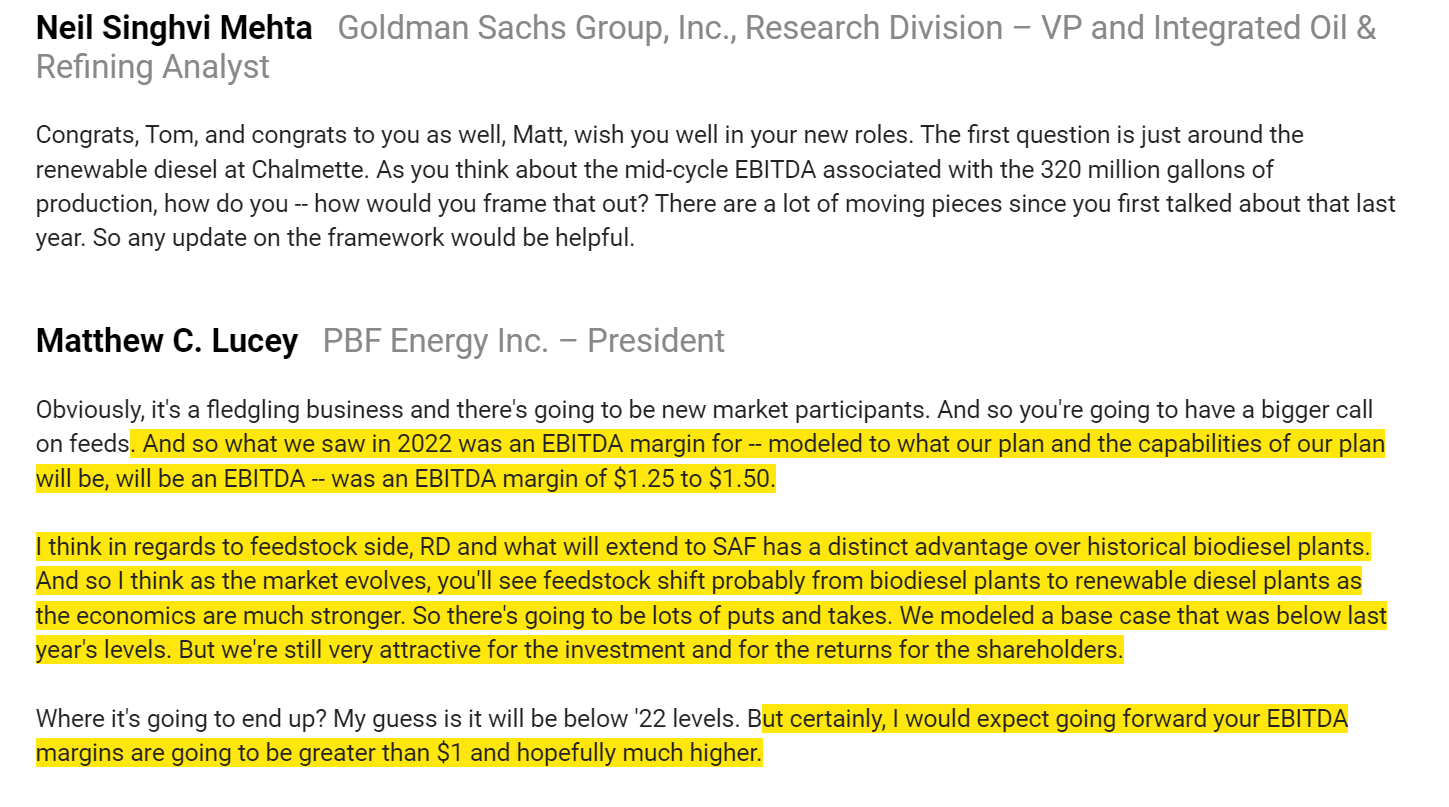

PBF recently affirmed on their Q1 23 call that their Chalmette RD facility would have done around $1.25 to $1.50 of EBITDA margin with go forward base case of ~$1/gal. Again, PBF’s facility is located in the GC region and so I don’t find CLMT’s $1.25-$1.45 EBITDA/gal guidance that out of pocket (remember geographical cost advantages).

The slide below from Valero illustrates how to think about margins - having access to cheaper and lower CI feedstock provides higher LCFS credit value - of which, as we have discussed earlier, bodes advantageous for CLMT.

Valuation

How much is MRL worth? This is where it gets interesting. Management has guided to 250m normalized EBITDA at around 80% utilization rate on 15k bpd production capacity. I threw a bunch of figures into the blender and a 12k bpd output with ~$1.3 EBITDA/gal gets us there. Note that management’s margin guide is fully loaded for SG&A etc.

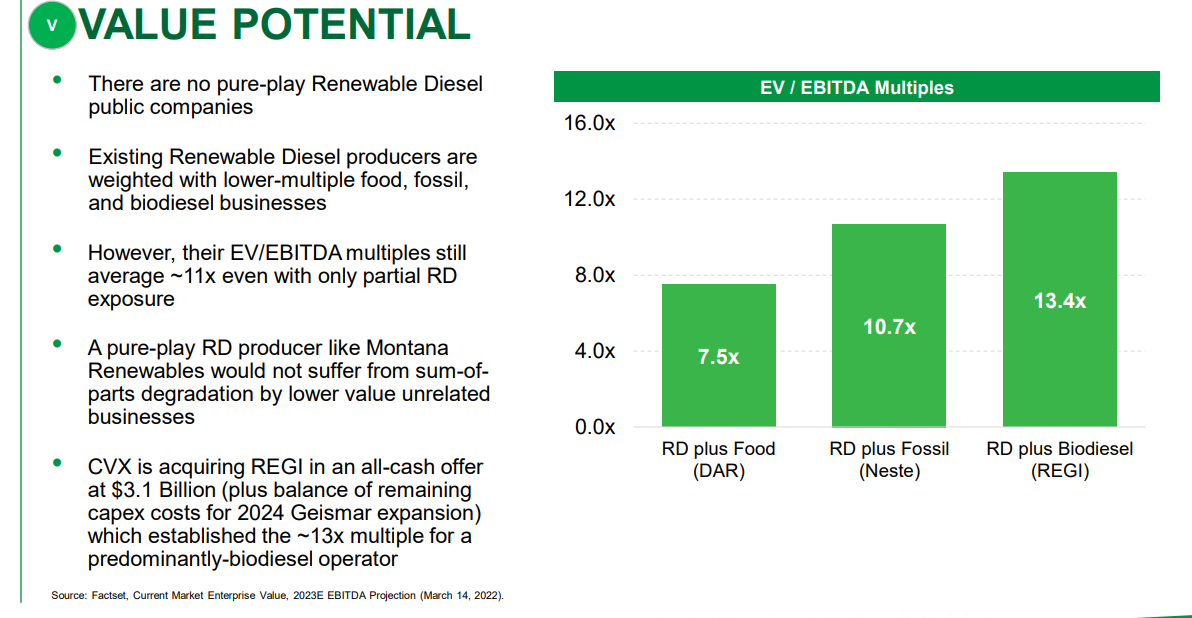

Precedent transactions for mixed assets have gone for low teens multiples; the data is indeed a little stale (i.e. March 2022) but it’s not hard to envision a pure-play RD producer garnering a 10x EBITDA multiple at minimum, if listed - a scarcity premium for a rare asset - most RD facilities sit inside oil/refining majors and are necessary for carbon offsets.

Valuation has been further validated by Warburg Pincus (WP) investing $250m of preferred equity at a pre-commissioning EV of 2.25b granting them a proforma ~14% equity stake in MRL. The terms of the agreement is rather interesting in that Warburg is entitled to a minimum return requirement (10K pg 115) of 8% IRR over 5 years or an MOIC that begins at 1.35 from the closing of the equity infusion date, increasing at 0.01/annum to a maximum of 1.4 by the fifth year. In other words, WP is pinning MRL at an exit value of >3b.

How then does WP realize said value? If in 5 years, MRL has not had an IPO or a change of control transaction, WP is able to force an IPO or shop for a buyer which will immediately crystallize value. This brings me to the next point, covering a key risk factor - obviously, a lot of the economics of RD is driven by government incentives and any retraction of said goodies could really turn the economics upside down. But WP is clearly playing the medium-long game here - this article states that WP was monitoring the space for 2 years, liked the low capital requirements inherent in MRL (see slide below) and envisions tremendous upside in the SAF and RD market. Moreover, MRL’s then close to commissioning state provided it a relative advantage in that WP didn’t have to undertake construction lead-time risks. This means that WP, having done extensive due diligence on the space, including a deep understanding of the regulatory landscape, saw fit to make said investment (and I’m sure these majors and P.E firms will have some spare $ for lobbying).

Assuming MRL is worth 2.5b - a 10x multiple on 250m of EBITDA and CLMT’s stake is worth ~2.15b (net of WP), we have CLMT’s core business trading for 1.1x LTM EBITDA and 2x normalized EBITDA, assuming the core business also generates ~250m of EBITDA, a step down from LTM EBITDA.

A simple SOTP with the core business capitalized at 5x (arguably too low given the income stability), gets us to a $25 stock price, and this is base case - core business margins may stay elevated longer than expected, comps trade at higher multiples than ascribed and there is also upside to MRL as per WP’s MOIC requirements and the fact that MRL will eventually shift from ~30% SAF to ~80% SAF production; SAF enjoys a better economics/higher margin than RD (~$0.50 - $1 higher gross margin/gal) and so frankly, it’s not hard to see north of $30 in SOTP value.

Catalyst

In the same way that WP aims to unlock value for itself, unitholders will also benefit likewise. While there doesn’t seem to be a process running of late, due to the prevalence of insider buying up till mid-May, management has stated unequivocally that a monetization event is nigh which could very well be happening post Q3 23, maybe in Q4 or early 2024 - post pre-treater installation with normalized EBITDA on print - a proof to the market.

Based on the municipal bond (that fell-through unfortunately) roadshow presentation, MRL was projected to generate 242m in 2024, rising to $299m in 2027 with low capital expenses - ~5-10m → tremendous FCF generation. LFCF could easily come in at around $150m in the near term, creating an equity value of ~2-3b at a 15-20x FCF multiple. This is not accounting for the MAX SAF expansion which could take EBITDA north of 500m, but that’s all cherry on the cake.

Moreover, a monetization event provides liquidity to cleanse the balance sheet and improve CLMT’s cost of capital which as a corollary, improves the valuation on its core business.

In any case, management has been very clear about the event path, as outlined below.

What’s the catch?

Lack of patience re monetization event. A souring market (seems to have recovered especially with the market debut of CAVA) and the intent to maximize potential value (through perhaps more SAF throughput) creates timeline uncertainty.

A clear example of time-delay risk would be the recent disappointing update of the EPA’s mandated volumes (which led to a temporal (more or less recovered) drop in the futures and share prices of soybean oil and peers such as DAR and ADM respectively) leading to a potential crash in tradable credit values e.g. RIN (which underpin profitability of RD) if production surges (partially offset by cost-push supply pullbacks, as discussed earlier).

The commentary outlined by P66 in the recent conference call is instructive and perhaps the market has internalized that maybe this isn’t so big of a problem yet** (hence the recovery of DAR, ADM etc.).

The key takeaways in my mind is the

balancing/self-hedging mechanism of the various credits (discrete individually but collectively autocorrelated) - this was outlined in the municipal bond roadshow presentation as well (which also hinted at lobbying be a key factor which may prompt RVO revisions) → e.g. say D4 RIN halves, the production cut response (typically by marginal biodiesel producers) leads to an increase in value of LCFS which offsets the D4 RIN loss. It is worth noting that since Jan 2016, D4 RINS have ranged from $0.43 to $2.04, LCFS from $0.41 to $1.12 etc, and RD margins have more or less averaged around $1.70.

The urgency for MAX SAF at MRL. The SAF market is a much more attractive market with less risks of substitution (hard for long-haul aircrafts to run on batteries and even hydrogen lacks energy density). A consequence of this may be a slight inevitable push-out of the timeline re monetization.

On the other hand, the street is arguing that the local market won’t plummet into a glut as surplus production could be exported abroad.

As a corollary, even if normalized EBITDA cannot be ascertained (so we can’t slap a multiple), on a value/gallon basis, I firmly believe MRL is worth a min. 2b conservative. Just off the recent JV sale at PBF, the Chalmette facility was worth around $5.80/gallon (note: Gulf Coast player). Using similar figures but providing some value uplift given Montana’s geographical/cost curve advantages gets us an easy range from ~$2.15b to $2.4b. Again, PBF is guiding to a buck and change of EBITDA/gallon this year and CLMT just reaffirmed a midpoint $1.35/gal and a top range of $1.45/gal. Do note that MRL’s actual nameplate capacity is 25k bpd (remember oversized hydrocracker?) but I’m conservatively limiting to just viable production capacity. Also, there doesn’t seem to be much commentary on SAF production over at PBF’s whilst it’s clear as day at MRL and so there’s another ding on that front.

Yes spreads have tightened but still, gross debt has increased despite leverage ratios coming down, the insane EBITDA showing largely offset by heavy capital requirements in the last year.

Busted MLP structure, illiquidity and K1 Taxes.

For starters, CLMT doesn’t pay distributions, rendering it an unattractive MLP for yield seekers. On top of that, MLPs as an asset class tend to suffer poor corporate governance (CLMT’s management track record is flimsy at best), making them unownable under certain mandates - they’ve not been accorded their rightful cost of capital and thus many have been subsumed by their parent co over the last year or 2. A potential remedy for CLMT would be to convert into a C-Corp post the MRL monetization event to expand its potential shareholder base.

Illiquidity - CLMT sports a 55m float yet the stock hopscotches on an average trading volume of ~80k units - or approx ~1.2m of transacted $.

MRL has yet to be proven. CLMT recently partially refinanced with pretty expensive senior notes (increasing gross debt) compared to peer set - obviously due to margins yet to be proven, MLP structure, subsidies risks and an existing balance sheet that would implode if specialty margins collapse into a recession.

Another note on margins, another comp would be P66’s facility up in San Francisco, guiding to 700m of EBITDA on ~766m gallons → approximately ~0.90c/gal. Again, whilst SF is located smack in mandated Cali, it doesn’t quite have the same geog advantages as MRL.

Debt raising. The municipal bond offering earlier this year fell through and there hasn’t been any news on CLMT’s $600m DOE financing.

As covered earlier - ambiguity on subsidies. This article highlights the necessity for subsidies to make R.D and specifically SAF, economical.

Conclusion

Risks notwithstanding, I think the next year or so would be interesting for CLMT; key events to take note of, in my mind, include the unmasking of the margins on the P&L (barring any operational hiccups) and hopefully, shortly after, we should be getting more clarity on the monetization event. Do note that CLMT has continued to retain the service of Lazard (even after the deal with WP, which Lazard facilitated) and they’ve been on this for a while now and thus, when the time of monetization is ripe, the process should take place rather smoothly.

Disc: Long CLMT

very good write up. Great research. Thanks!

Thanks, will be nice to provide an update to CLMT after one year :)