Recently, a number of subscribers have asked if I provide updates to pitched stocks. While I haven’t done so in times past, as I usually update via rants on Twitter, tweets tend to get lost in the abyss of noise and so, I think periodic blog-updates are fair and warranted.

Overall, stocks selected have not performed as well as I’ve expected though I would say it’s too early to judge, for some.

Here are a few updates for some key ideas:

SPB (Idea: closed)

This was the first situation profiled on this blog. This one worked satisfactorily - SPB and DOJ reached a settlement mid-trial and the stock performed in line with the valuation work conducted - crossing my PT of $80 a few weeks back and trading ~$78 today. Consider this idea closed.

GLOP (Idea: closed)

Not much to say here other than this was stolen from under our nose for a paltry $8.65. While no money was lost here, the opportunity cost was expensive.

Nothing of note here; incredibly cheap with intelligent shareholders holding big bags so I think both companies cease to exist in their current form in the near future.

VLRS-AAL (Idea)

I’ve been completely caught offside here. VLRS price action has been all flavors of abominable though buoyed by an 8.5% gain on AAL short which also, wasn’t a pleasant ride over the last few months. This industry just doesn’t catch a break - CAT 1 has been reinstated but more than offset by rising fuel prices and engine recalls by Pratt & Whitney.

Airlines seem to be a tough industry to trade due to general low predictability; prices seem to very much follow RASM, CASMX trends rather than vanilla valuation and of late, appear to be very negatively correlated with oil prices (based on my cursory observation).

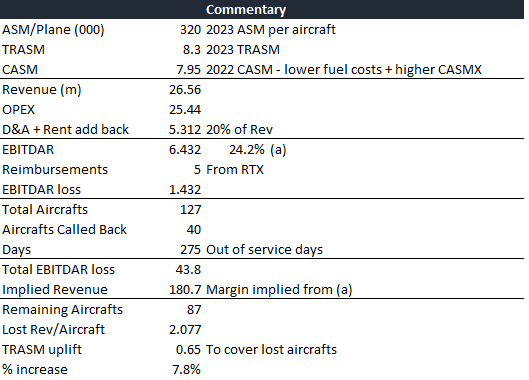

My initial quick thoughts on the engine situation - SAVE mentioned in their call that P&W will make them “whole” via reimbursements. For VLRS, IR guided to around ~5m reimbursement per aircraft and I anticipate VLRS to earn ~6.4m of EBITDAR per aircraft in 2024, thus equating to a ~1.4m loss per aircraft, requiring a 7.8% TRASM uplift on the remaining fleet to cover said losses. Admittedly, there’s a lot of up-in-the-air assumptions here and other analysts I’ve contacted with more “boots on the ground” have estimated around ~10% uplift.

In any case, the stock has sold off bigly here so there’s no point puking at the bottom; the current price implies VLRS can’t earn a dime from operations but with CAT 1 reinstated and the new consolidated market, that might be unfairly punitive. With no imminent risk of distress, the stock should do fine eventually, albeit a pedestrian return.

TBRD (Idea)

Another one that was supposedly running a strategic process but dropped like a rock for weeks on end until an update was finally released, though a rather disappointing one with a ton of fluff that basically reads as “we couldn’t sell ourselves but we’re still attractive so guess what, maybe we’ll buy back a little of ourselves if that helps.” Jokes aside, it now seems like the knotty sales process may have been leaked to some - explaining the repugnant price action.

Moreover, this shouldn’t be surprising. Hasbro selling eOne (except for key IP i.e. Peppa Pig and PJ Masks), a library of 6500 titles, for 500m to obviously...Lionsgate…, after their constant reiteration on how valuable the library is, is a clear indicator of how few natural acquirers there are and how worthless most content is. Let’s not forget, Hasbro purchased eOne for 4bn in 2019 so the delta is ~3b+ here which cannot be entirely attributed to Peppa Pig (estimated to generate 229m of revenue for Hasbro this year). Hasbro also paid ~15x fy19 EBITDA for eONE so it seems that industry mid-teen multiples thrown around for media library assets is fairly extravagant.

Nevertheless, TBRD now trades at ~5-6x EBITDA and just because something is difficult to sell doesn’t mean it doesn’t get sold eventually (e.g. ARGO); management has indicated continual pursuit of a liquidity event; the interest rate environment also dictates the probability of a buyout so I’m holding my nose here.

Theoretical exercise, where I argued that BJ’s is way too cheap relative to Costco.

Stock performance so far:

BJ return +18.73%

COST return +11.09%

CLMT (Idea)

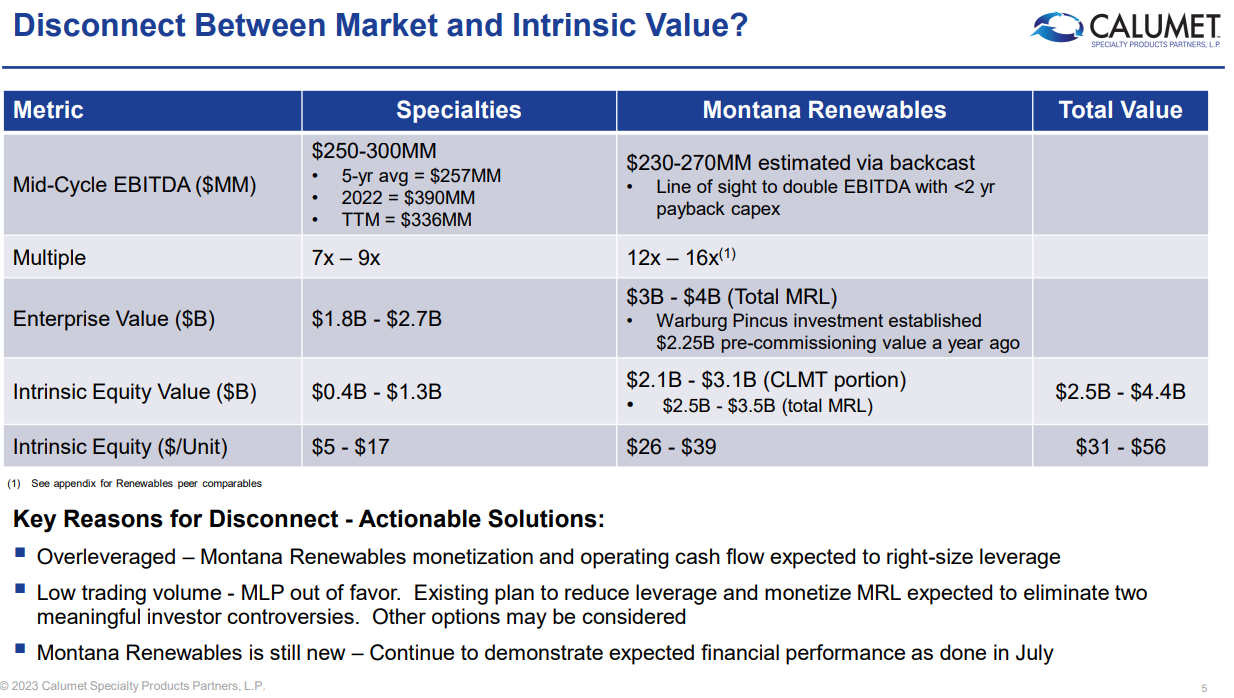

CLMT has performed very well since, reaffirming EBITDA/gallon and really making the value discrepancy clear as day in their recent Barclays conference, indicating that a “monetization event” is a near term priority; I find it hopeful that they acknowledged the liquidity issues tied to their MLP structure and there’s a possibility of a conversion with the line “Other options may be considered” *bullet point 2.

As for why the stock still trades at ~$19, it seems like the main overhang is that every potential investor has zero confidence in the corporate governance thereof. CLMT remains a show-not-tell story.

PAC.AX (Idea)

Stock dropped a fair bit today before recovering, resulting from Regal rather coquettish behavior - disappointingly pulling out of the bid whilst indicating “nothing has changed in relation to its view of the company” and that the acquisition still “could provide strategic benefits”. The firm still owns ~16% of PAC.

Assuming $8 down and $12 up (NAV = A$11.92 as of 30 June so icky price action of GQG shouldn’t be material to NAV estimate), the market seems to be mispricing this at close to 50/50 odds for a target that has more than two firms engaged in diligence (as per the recent FY 23 call), further confirmed by the wording “proposals received from a broad range of potential acquirers” in the recent strategic transaction update.

Final note

Ideas haven’t performed as I’d generally like but all part of the journey and hope to continue improving as an investor (open to all feedback). Last but not least, I would like to highlight some other interesting situations worth paying attention to:

i) SAVE merger arb - Lionel Hutz has written a nice argument for this and Andrew Walker as well; I’m currently on the fence and still poring through the documents. Nevertheless, excited to see how this pans.

ii) ALTO - This is sort of a quasi-activist position run by Jeremy Raper which I liked. I have a position here with a cost basis a fair bit lower than current trading prices.